- The futures trading platform also saw its highest trading volume for a single day, trading about $400 million in assets on 14 January 2020.

- There has been a staggering 85% month-on-month increase in trading volume for Binance Futures.

- BTCUSDT is the most invested in a perpetual market contract as per the report showing a 75% share of its total open interest relative to the rest of the market.

The January edition of the Binance Research reports $56 billion traded on Binance Futures across its perpetual contract markets. There has also been a staggering 85% month-on-month increase in trading volume for Binance Futures.

The futures trading platform also saw its highest trading volume for a single day, trading about $400 million in assets on 14 January 2020.

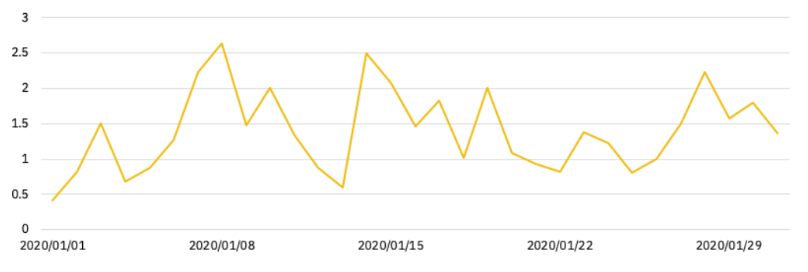

The report also mentions that an average of $1.7 billion in contracts traded per day. Total open interest in perpetual markets also saw a gradual increase over the first month of the decade, reaching $200 million and steadily climbing to $300 million currently just short of $280 million.

An increase of 98% in the total open interest in perpetual markets observed according to the report. BTCUSDT is the most invested in a perpetual market contract as per the report showing a 75% share of its total open interest relative to the rest of the market.

And following the previous trend, the volume on perpetual contract markets continues to dominate over the spot markets by 80%.

A new indicator added to the research called Bitcoin Open Interest Dominance that shows the relative share of Bitcoin’s open interest compared to the open interest in the derivatives market measured daily. Bitcoin’s public interest dominance dropped 15% over the month as eight new futures contracts added to the market.

The past year has generally bought in several positive developments in the derivates trading market. The growth of crypto-based derivatives has only been more and more beneficial to the market as it brings more accessible assets.

This increase in the Bitcoin futures trading volume can also be attributed to the fact that the Bitcoin halving event is getting closer and closer with less than 100 days remaining now.

The prices of Bitcoin usually have shown strong surges after halvings in the past, and therefore the current jump onto the Bitcoin bandwagon might be traders trying to make a profit from the halving.

Home

Home News

News