- VanEck, the US-based global investment management firm, published a report titled “The Investment Case For Bitcoin.”

- The report explains the value theory of Bitcoin concerning its Intrinsic Value and Monetary Value.

- A significant issue often spoken about in the crypto community is the lack of traditional capital market players dealing in the Bitcoin market.

VanEck, the US-based global investment management firm, published a report titled “The Investment Case For Bitcoin,” analyzing the concept, setbacks, and future potential for Bitcoin Investment. Dated January 2020, the report explains the value theory of Bitcoin concerning its Intrinsic Value and Monetary Value.

Gold, Silver, or diamonds are examples of items that carry a value that exists without economic benefit, i.e., the intrinsic value. Bitcoin, on the other hand, does not have intrinsic value, states the report. Its value as an asset is based on distinct utility and cash flow and is thus monetary.

This Monetary Value (MV) of Bitcoin is based on its durability, strong privacy characteristic, and decentralized nature. Though it presently has some drawbacks, it arguably has the potential to become digital gold.

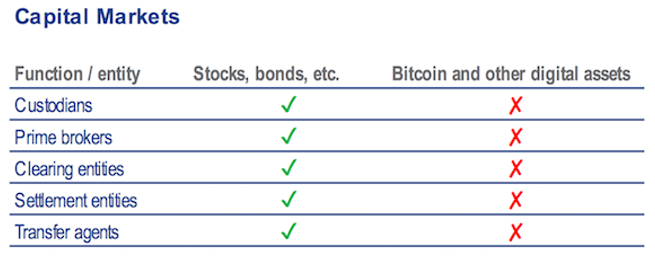

The report then addressed five major barriers to entry faced by Institutional investors. A significant issue often spoken about in the crypto community is the lack of traditional capital market players dealing in the Bitcoin market.

The report attributes this phenomenon to the limited connection between bitcoin and traditional financial markets. This lack of integration between the crypto world and the real world explained through 5 points that are lacking in the digital assets but present in the traditional ones.

The Bitcoin industry lacks Custodians to manage securities or assets. There is no presence of a Prime broker to provide fund management services — the lack of a set mechanism to ensure clearance and settlement of financial entities.

Further, there is no clear-cut securities agency business. Even though some of these institutions are gradually emerging since 2018, they are not prevalent.

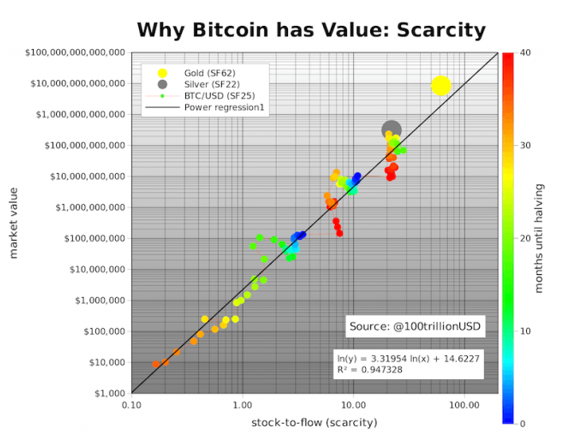

The report then addresses the future potential for bitcoin investment. The report addresses how bitcoin will work as an investment if it used as an MV asset on the chain and off-chain considering scarcity and transferability as growth factors.

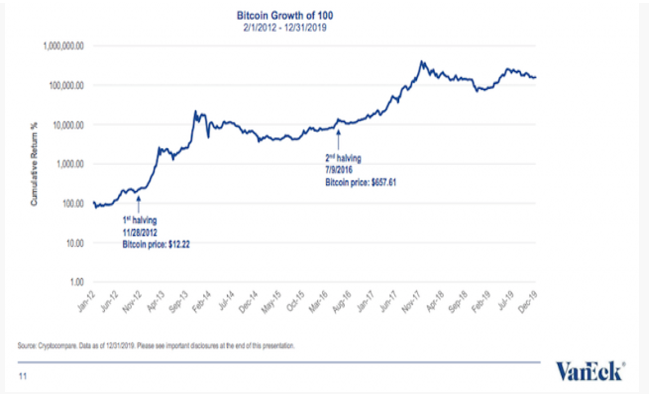

The graph represents the growth potential of bitcoin from a stock-flow ratio perspective. The ratio is the “amount of assets in stock divided by the number of assets produced during the period.” The report then focuses on bitcoin half-life. It shows that, based on the past trend, the next half-life is expected in May this year.

The analysis proves that not only does Bitcoin have a better investment performance than conventional assets, but it also produces higher profits than gold in the long term. It is not the most suitable for short term investment.

But one thing to note is that Bitcoin has a low correlation with traditional assets. The report further suggests that Bitcoin is a great option to diversify an investment portfolio.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News