- BitMEX, in 2019, customers and users have continued to trust the platform with their funds through last year.

- The CFTC launched the investigation last July to see whether BitMEX deliberately let US citizens trade unregulated on the platform.

- The major drop seen in the exchange’s cold wallet storage during the course of the last year was in July after it was reported that the firm was facing a probe by the US CFTC.

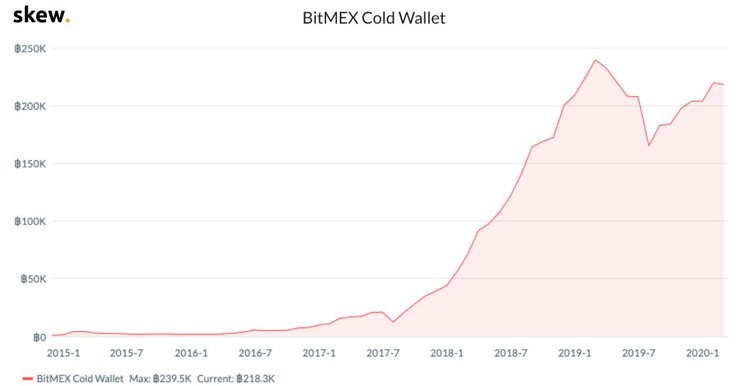

Data has revealed that despite the various fiascos of the cryptocurrency exchange and derivatives trading platform, BitMEX, in 2019, customers and users have continued to trust the platform with their funds through last year.

This is particularly surprising because BitMEX was in the news for all the wrong reasons in 2019. First, the platform faced a probe by the US Commodity Futures Trading Commission (CFTC), The CFTC launched the investigation last July to see whether BitMEX deliberately let US citizens trade unregulated on the platform.

In November, the crypto exchange platform accidentally leaked sensitive user data. The fiasco was caused by an error while applying the Bcc protocol to its mass e-mail servers.

If this was not enough for the platform to handle, it also faced increasing competition in the area of perpetual swaps products and was called out for “systematic illegal activity.”

Irrespective of all these mishaps, it looks like the trading platform has managed to keep its investors happy. Data collected from the blockchain data analytics firm Skew Market is represented in the graph below.

Source: Skew

The major drop seen in the exchange’s cold wallet storage during the course of the last year was in July after it was reported that the firm was facing a probe by the US CFTC. However, the platform has since seen an increase of up to 100,000 BTC in its cold wallet holdings.

Not only was this rise consistent, but BitMEX also achieved the milestone in just six months. Analytics firm Skew also stated that the platform probably runs “the most capitalized crypto-native clearinghouse in the industry.”

The comment was made about the BitMEX’s insurance fund containing up to 34,000 BTC. The exchange reportedly consists of more than 1.5 billion USD in total Open Interest across contracts.

An area where the negative PR seems to have hit the platform is the number of daily active users. Skew reported that the crypto platform had seen a decreasing trend in terms of the number of active users over the years.

As can be viewed in the graph below, Before the July incident, 20,000 active users were reported on the website on a relatively slow day. However, post-August, anything above 20,000 users per day, was seen as an optimistic sign.

Source: Skew

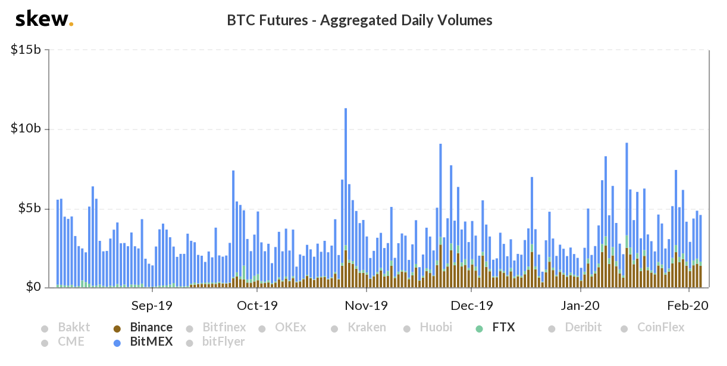

BitMEX’s XVTUSD contract possesses the best liquidity in the crypto industry, but Binance has seen great progress in this aspect since the beginning of the new year.

Even after trading billions of dollars’ worth contracts every day, BitMEX continues to be trampled by Binance’s rapid growth and dominance. Though the recent XRP perpetual swap contract is a ray of hope for the platform, Influential people like Arthur Hayes publicly criticizing BitMEX is not helping.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News