- The overall bearish momentum in the market forced BTC to come below $10,000 mark.

- However, the downfall in volume traded and the market cap of BTC has somehow increased market dominance from 61% to 64%.

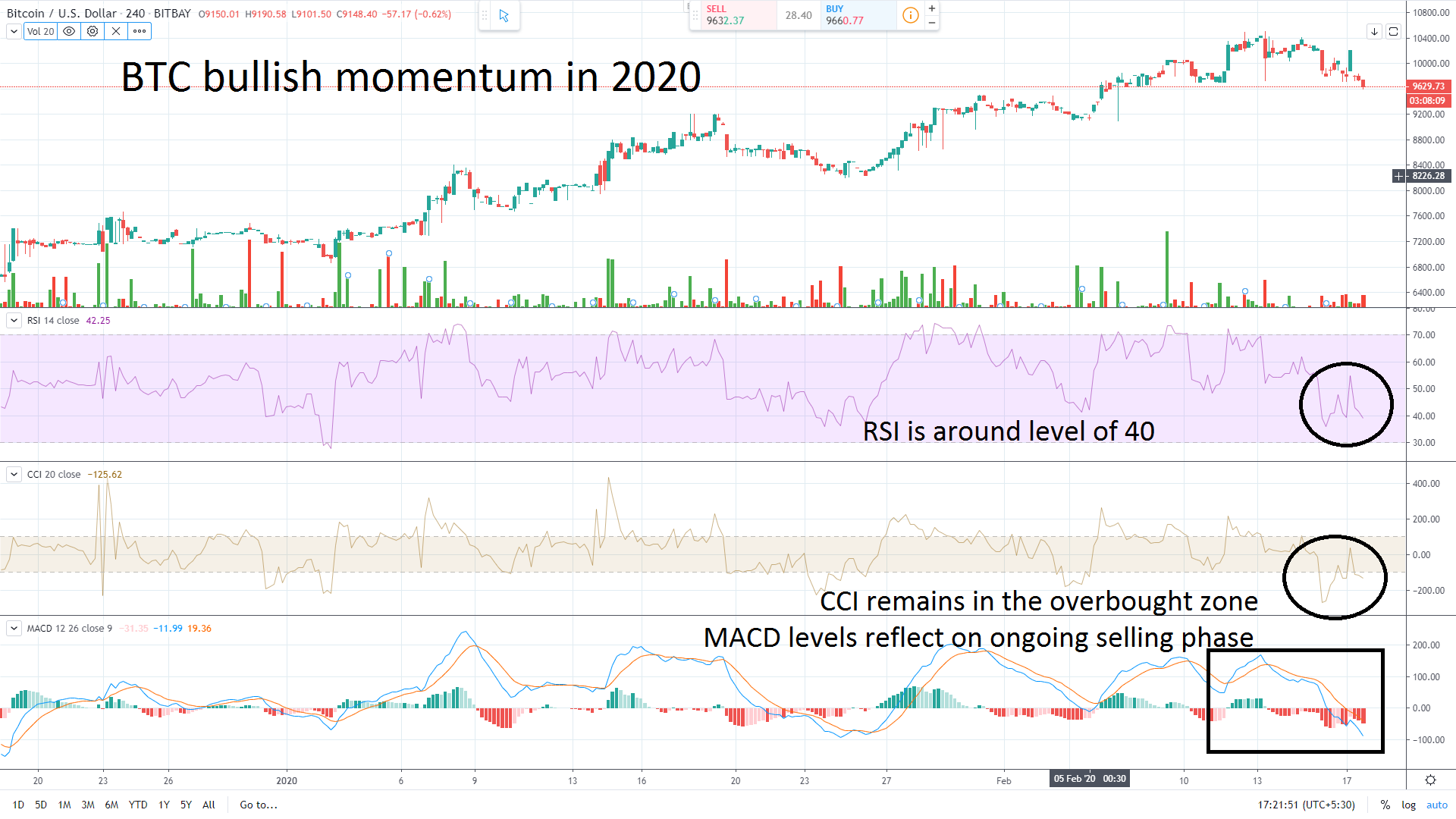

The chart focuses on the bullish momentum built by BTC from the starting of the year and the ongoing bearish movement in the market. Bitcoin rejected major resistance of $10,500 and dropped below $10,000 mark.

It also broke the major support level of $9750 bringing the current price to $9657.73. The market capitalization is of $175,984,035,831 and the 24H volume traded of $23,230,264,604,422.

Bitcoin started the market with a support level of $9,800 and with the hope to cross $10,000. But, the crypto market witnessed somewhat opposite of that. BTC broke the major support level of $9750 also. Other major crypto-assets like ethereum and ripple are also facing downtrend of -5.34% and -8.43% respectively.

The technical chart indicates that BTC can see more of price corrections activities in upcoming days but the aim for breaking $10,500 is still on the map. The RSI is around the level of 40 which is comparatively low meaning more downtrend can be observed.

However, CCI remains to be in the positive zone which favors BTC bulls. MACD levels reflect on strong ongoing negative movement for the largest cryptocurrency in the world.

BTC has been majorly supported by the support level of $9,600 currently. Any downfall from here will indicate that BTC bears have planning to stay in the market for a while.

However, any positive movement about $9,800 will bring back BTC bulls into the play. If BTC gains positive movement from here, it is likely to break the multi-resistance of $10,500.

Major resistance level: $10,200 and $10,500

Major Support Level: $9,600 and $9,750

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News