- Jack Purdy, a researcher at cryptocurrency analysis firm, Messari, predicts Bitcoin to begin a bull run due to 2020 being a leap year.

- The Bitcoin protocol is set to control the mining difficulty at a precise level such that a new block is added to the chain every 10 minutes.

- Bitcoin is no exception to this as it lost over $20 billion in its market cap over the past weeks, with its price dropping from a high of $10,000 to $8,700 as of current.

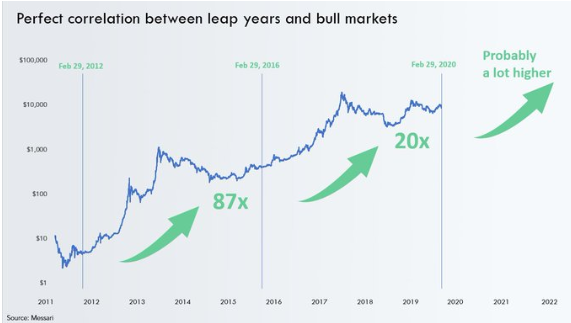

Jack Purdy, a researcher at cryptocurrency analysis firm, Messari, predicts Bitcoin to begin a bull run due to 2020 being a leap year. Purdy states in a Twitter post that Bitcoin prices have shown a strong affinity for price surges during a leap year.

This correlation between Bitcoin and the leap year can be attributed to the fact that Bitcoin halvings occur every four years, which is also when leap years occur. The Bitcoin halving is an event that is set to occur in May this year when the mining reward on the network is cut in half, essentially reducing the number of Bitcoin released into circulation with every block added onto the blockchain.

The Bitcoin protocol is set to control the mining difficulty at a precise level such that a new block is added to the chain every 10 minutes. And every 210,000 blocks (~4 years), the Bitcoin reward is cut to half.

This year marks the cut from 12.5 BTC to 6.25 BTC, and this normally brings forth higher competition in mining, lesser circulating supply, and, therefore, a strong spike in prices.

In the past, during the two halvings that Bitcoin has experienced in the past since its inception, the most famous cryptocurrency has seen its prices shoot 341% by $12 during the first halving in 2012, and then the second halving in 2016, seeing prices surge 119% with the prices rising to $650 per coin.

This leap year will stand out to be a little more of a mixed bag given the financial crises that the world is currently facing due to the coronavirus outbreak. Wall Street sees numbers never seen before since then 2008 financial crises, and all financial markets, including the stock markets and cryptocurrency markets, are seeing huge losses.

Bitcoin is no exception to this as it lost over $20 billion in its market cap over the past weeks, with its price dropping from a high of $10,000 to $8,700 as of current. It is yet to see whether Bitcoin will follow its past patterns and see significant price surgest regardless of the market crises.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News