- Over the last few years, staking has been a popular trend in the digital currency market. With the launch of the aristocrats, Cosmos and Tezos, increase of staking services and propaganda by the long-awaited Ethereum upgrade made to the conclusion that proof-of-stake (PoS) can be the next development of consensus mechanisms.

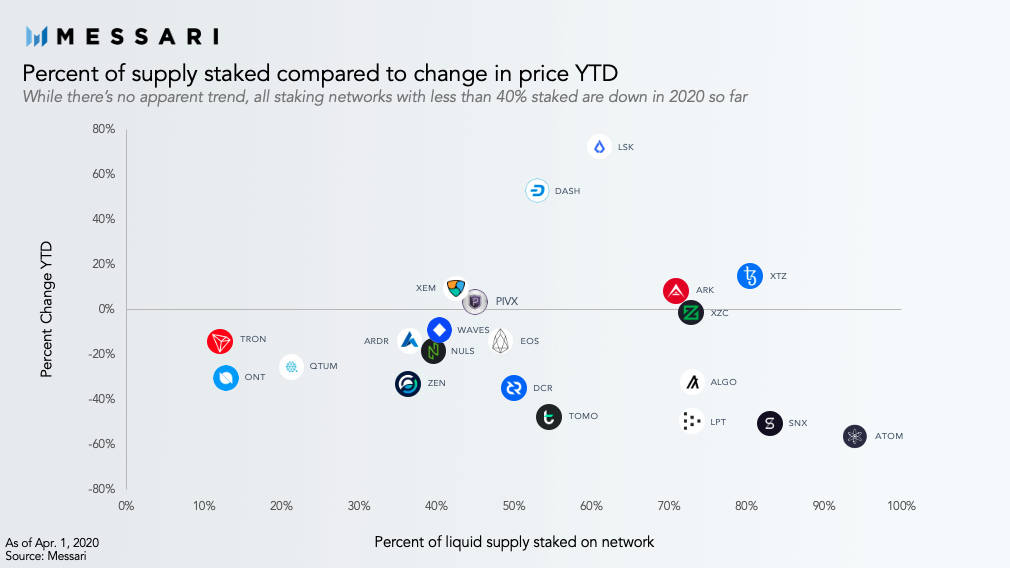

- In order to find out the impact of the token percentage stake over price, Messari analyzed the correlation between the percentage of liquid supply stake and price return YTD.

- Regardless of the lack of a fixed trend, the entire staking protocols having less than 40% of its liquid supply staked are bottom in price this year.

Over the last few years, staking has been a popular trend in the digital currency market. With the launch of the aristocrats, Cosmos and Tezos, increase of staking services and propaganda by the long-awaited Ethereum upgrade made to the conclusion that proof-of-stake (PoS) can be the next development of consensus mechanisms.

Percent of supply staked compared to change in price YTD

However, some investors have represented this theme by placing bets on specific networks and staking their holdings and looking for inflation rewards. The staking incentives and token cases are different from the protocols. Also, we can find a variation in the total number of tokens staked on a network at a given time.

In order to find out the impact of the token percentage stake over price, Messari analyzed the correlation between the percentage of liquid supply stake and price return YTD.

Regardless of the lack of a fixed trend, the entire staking protocols having less than 40% of its liquid supply staked are bottom in price this year. On the other side, the two networks with the showing the highest staking totals found the most substantial price drop YTD.

Staking can decrease the token velocity

While in some cases, staking can decrease the token velocity that means, the rates at which the funds are exchanged are reduced. This can further have the secondary impact of declining sell pressure.

The price movements depicted in the graph are in a close relationship with project-specific announcements as well as the overall direction of the entire market. Dash announced that it is aiming to increase network utility with the launch of on-chain contracts.

Home

Home News

News