- VanEck’s recent report sets out an interesting analysis with respect to the crypto-asset Bitcoin and Gold respectively.

- In addition to the crypto-asset’s correlation with gold the report also discusses the correlation of other assets as well.

- Chamath Palihapitiya, has also recently predicted that BTC will be known as “Gold 2.0” in the next 10 years.

A recent report released by U.S. ETF specialist VanEck sets out an interesting analysis with respect to the crypto-asset Bitcoin and Gold respectively. The so released document remarks that the correlation between the two assets are in its prime high as an impact of the COVID-19 global pandemic. The Corona catastrophe accompanied with the Global Stock Depreciation, which was the resultant of a high demand for cash conversion into fiat currencies such as the dollar , consequently affected safe haven assets like the gold.

On the other hand, Bitcoin had no immunity to the same. The global crisis also impacted the crypto-asset to crash down prices and fall into the stock market. Rumors were created with regard to the doubt status of the asset to still trust the same as a safe haven asset. However, at the end of the day, it can be ascertained that the correlation between the above mentioned assets are in their strongest points in history.

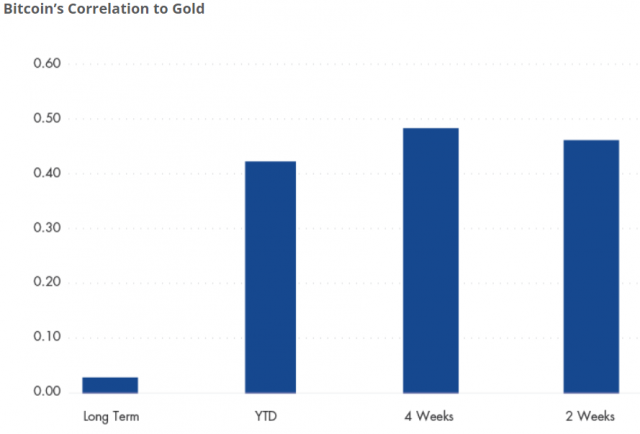

The graph above projects the correlation between bitcoin and gold. Though the correlation rate has rapidly increased in 2020, taking into account the statistical data from the last four weeks, in the long run , such factors become negligible. The report highlighted that the positive correlation has sharply increased since the fall caused by the COVID-19.

|

Common correlation coefficient values and correlation strength |

|

| 0.0 to ± 0.2 | (Almost) no correlation |

| ± 0.2 to ± 0.4 | There is a weak correlation |

| ± 0.4 to ± 0.7 | Correlated |

| ± 0.7 to ± 0.9 | Strong correlation |

| ± 0.9 to ± 1.0 | (Almost) perfectly correlated |

The above mentioned table can be utilized to determine that there is a change from a situation where there is no correlation to a state where there is a correlation that goes up two levels.

Correlation Comparison with other assets

In addition to the crypto-asset’s correlation with gold the report also discusses the correlation of other assets as well.

The assets that were compared are as follows:

- S & P500

- Nasdaq100

- US Treasury

- Bitcoin

- Money

- Rice real estate

- petroleum

- Emerging market currencies

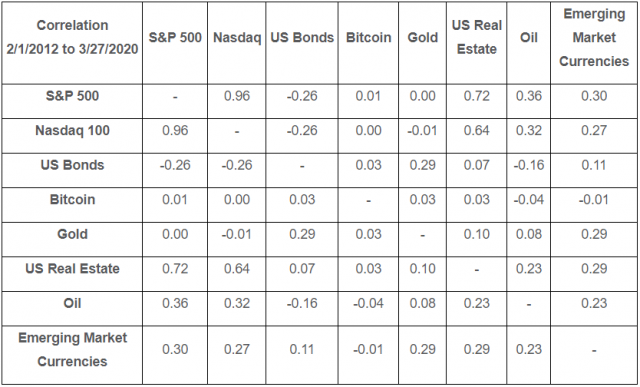

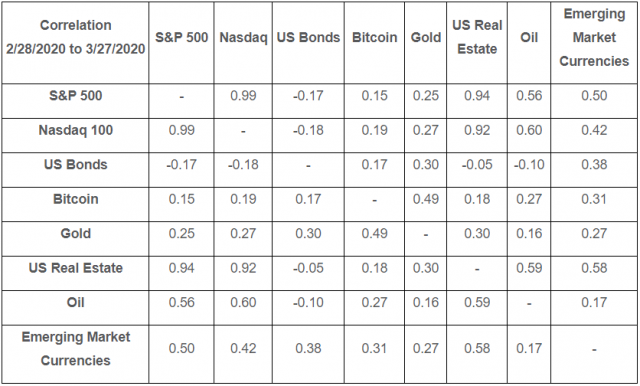

The table below shows, in order from the top, the correlation between each asset from February 1, 2012 to March 27, 2020, and the asset from February 28, 2020 to March 27, 2020.

As notable, the Bitcoin and other assets project a very low coefficient rate in the long run, i.e from -0.04 to 0.03. Meanwhile , the coefficient values of the last four weeks depicts that gold has the highest correlation with Bitcoin compared to assets such as the S & P500, Nasdaq100 and US real estate.

Thus one can ascertain from the above mentioned facts that Bitcoin is gaining its status as a safe asset in the global market in the current economic condition. The CEO of Social capital , Chamath Palihapitiya, has also recently predicted that BTC will be known as “Gold 2.0” in the next 10 years.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News