- BTC price was pushed below the level of $7k firstly due to the strong resistance level of $7500.

- The major downfall since the past few days for BTC has now arisen major concern among the crypto investors as BTC price falls below $7k mark

- Currently, it is facing an overall loss of -5.83%.

On the 7day-weekly chart, the major ongoing downfall can easily be noticed. Bitcoin price was pushed below the level of $7k firstly due to the strong resistance level of $7500. The price level has now become a multi-resistance area as BTC bulls made their fourth attempt to cross the price level and were unsuccessful.

It was expected that BTC will find relief on $7K mark but the crypto market forces had something else to offer to the world’s largest cryptoasset. BTC plunged below $7k and rested at the price level of $6900. Yesterday, BTC had price recovery to the level of $7300 which gave the market a sense of relief.

However, in today’s market, the bears came more strongly and forced the BTC price to reach a crucial support level of $6800. The current market capitalization is $126,706,006,031 and volume traded is $40,637,447,049.

Today’s downtrend has now made price recovery to $7k level a challenging task. Also, the bears are looking stronger which may force the price to drop to the level of $7k also.

Glassnode Indicates On Percentage Increase In BTC Whales

Since the starting of the year, the BTC whale percentage is on the rise. As BTC halving is round the corner, the percentage is taking giant positive leaps. The number of entities holding at least 1k BTC is now around 1850. There has also been a significant increase in the percentage of entities holding more than 1 BTC. This can result in BTC prices in both ways. An increase in whales percentage may increase the probability of pump and dump scenario which simply means more volatility for BTC.

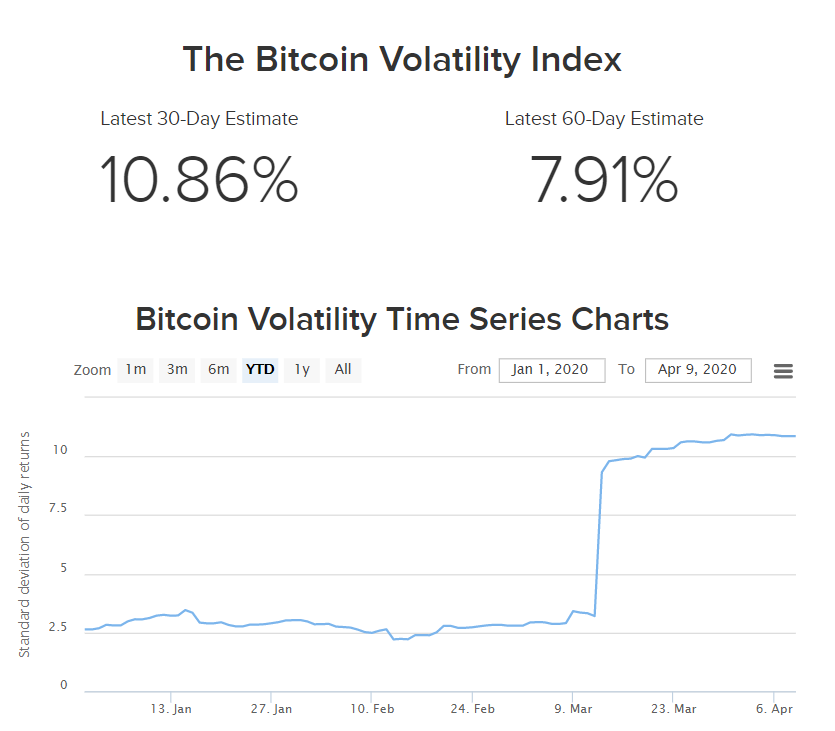

The graph justifies the statement as the vix percentage for BTC has taken a jump from 2.50% in January to 11% in April. Therefore, predicting the movement for BTC in upcoming days can be challenging for the market. However, until now BTC has been on the road to recovery from the critical price area of $3800 to reach the safe spot but a major resistance level of $7500.

Bitcoin Technical Analysis

The technical chart reflects on the price sustainability managed by BTC for the past few days. The sustainability, however, failed to keep BTC above $7k level today.

The technical indicators and oscillators are making a slight recovery in the levels but still possessing down-trending nature.

The MACD levels have taken a negative divergence to the bearish zone again which is not a good sign for the cryptoasset. It also indicates that the buying volume is slowing dying for BTC.

The 24hr- RSI had taken positive divergence from the oversold region and have reached a level of 40 but still possessing down-trending nature in the graph.

The 24hr-CCI had touched the tip of the oversold region but got positive divergence and managed to sustain the normal region.

Resistance level: $7000 and $7500

Support level: $6800

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News