- The overall market conditions are showing recovery signs as BTC surged above the price level of $8.9k again with ethereum sustaining the major level of $200.

- During the price recovery, IOTA also managed to avoid downfall below the major support level of $0.18.

- It is having a significant overall gain of 0.81%.

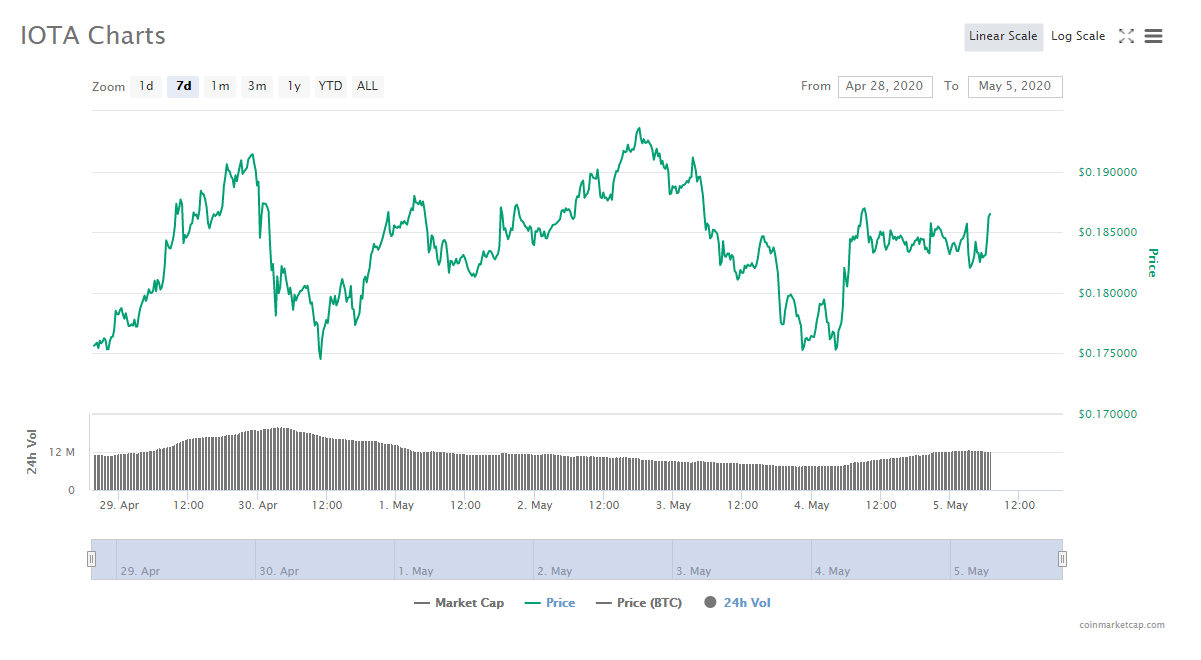

On the 7day-weekly chart, IOTA (Miota) price started by the crucial support level of $0.15. it indicated that there is a potential for major price recovery. The altcoin jumped from the price level of $0.15 to $0.19 quite sharp due to the bullish market. But, the resistance level of $0.20 kept the price recovery halted.

Today’s major positive movement in the market was enough to avoid downfall below the support level. The Miota is looking to surge above the level of $0.18. It indicated that the bulls are attempting for a heavy price recovery to the crypto asset in the market with the current price level of $0.17.

The overall recovery followed in the market can provide the altcoin the much-needed boost to the level of $0.20. The IOTA is having an overall gain of 0.81% with a market cap of $512,996,316 and volume traded of $12,968,761.

IOTA Technical Analysis

The technical graph reflects on the significant uptrend build by MIOTA Price during the overall bullish momentum in the market with price corrections at regular intervals.

MACD levels also reaching the bearish zone and showing negative nature. This also indicates that buying volume increases may provide the levels of some positive phase in IOTA.

The 24hr-RSI is showing positive nature and currently about to reach the bullish level of 60.

The 24hr-CCI is showing volatile nature by having sharp negative divergence from the tip of the normal region to the oversold region. However, the levels made a comeback to the normal region and nearly touched the overbought region today, which indicates that the altcoin will be sustainable on price recovery.

Resistance level: $2.00

Support level: $1.50

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News