- About 4% of Ethereum total supply is now locked in Decentralized Finance. This figure is the highest level ever achieved.

- In total, about $3.5 billion worth of assets are locked in Decentralized Finance.

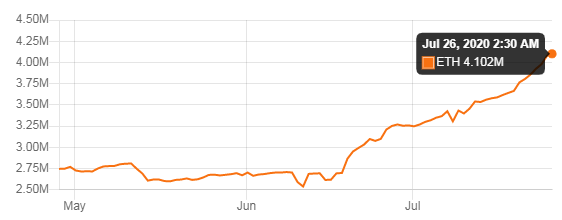

- Only 7 days ago, around 3.6 million ETH was locked in DeFi and now, as mentioned before, has reached the 4 million mark.

Decentralized Finance (DeFi) generally refers to digital assets and financial smart contracts, protocols, and decentralized applications (dapp). According to reports, about 4% of Ethereum total supply is now locked in Decentralized Finance. This figure is the highest level ever achieved.

DeFi Market Continues to Grow

In total, about $3.5 billion worth of assets are locked in Decentralized Finance. In the last week, it showed a growth rate of $1 billion. DeFi administers each protocol’s underlying smart contracts on the Ethereum blockchain and calculates the amount of ETH locked by multiplying total balance by their price in USD. The 4 million ETH is worth about $1 billion at the current fluctuating price of $275.

Since the month of May, the locked assets have shown a growth rate of 4%. With most of its growth beginning in mid-June. In just two to three months, it rose to about half a billion in a week. Since then the acceleration in growth has paced up to a very large extent.

Only 7 days ago, around 3.6 million ETH was locked in DeFi and now, as mentioned before, has reached the 4 million mark. Currently, Maker dominates the market space by capturing 22.90%. Followed by Maker is Compound, InstaDapp, Balancer, Uniswap, and dYdX.

The reason behind such a Steep Rise

The increase in the amount of ETH locked in DeFi can be accredited to the incentives given to users for using DeFi dapps through token giveaways. Users can avail them to create a new business model of the token holder’s governance.

Furthermore, these dapps have become more useful due to the increased liquidity which it brings along with it. This creates a possible wholesome cycle that will benefit the users and owners equally.

Home

Home News

News