Introduction

One of the most important set of standards to be observed by companies around the world is the ESG [Environmental, Social & Governance] criteria. These set of standards are increasingly gaining importance and can influence position of the companies in the market. These standards consist of:

- Firm’s use of Energy, Waste, Pollution, Utilisation of natural resources and treatment of animals

- Environmental risks associated with the functioning of a company and the approach adopted towards the same. For e.g. if any factory is emitting any toxic emissions, how are the pollution levels controlled.

- Are the dealings with suppliers and vendors in an ethical manner and same is reciprocated by them?

- Is the company making donations to the local community or encouraging its employees for volunteering activities?

- Fair treatment of the employees with regard to their health and safety

- Considering the interests of all stakeholders responsible for smooth functioning of the company and its activities.

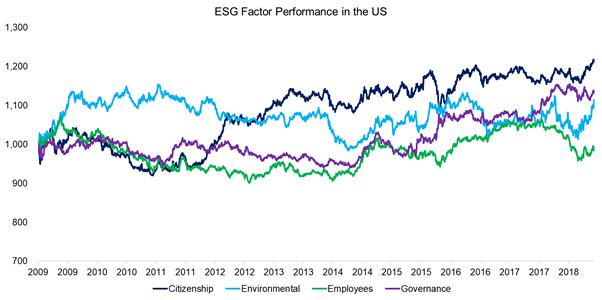

The importance of ESG criteria is critical for overall corporate governance and does have an impact on the overall stock performance. Below is the Factor performance of ESG in the US which shows that from 2009 onwards the importance of Environment and Governance is equally important as the Financial indicators.

There are certain firms which engage in ESG activities such as Plastic recycler firm, electric truck agencies etc. A lot of money is getting invested in such sectors and closely followed by allegations of fraud and misappropriations. Despite requisite focus for improvement in these areas, short-sellers attempt to ride their interests by anticipating a fall in the value of bond or stock. They are looking for firms in which investors have overlooked frauds and loopholes in the rush to gain exposure over a technology or a sector.

Hindenburg Research has potentially identified cases of two companies for exaggerating their technological companies:

- Nikola – Electric truck company

- Loop Industries – Canadian Plastic Recycler

Nikola Tesla was accused of exaggerating its technology and fake product launches. Though the claims were not acknowledged, it did admit to misleading the facts for one of its product. It highlighted that one vehicle was capable of moving under its own power instead of fuel but which was not the case.

Loop also claimed to have revolutionary technology capable of extracting usable plastic polymers from garbage. The research challenged that no such technology was discovered. The claims were denied by the firm but their share prices did fall drastically and are being subjected to US government enquiries.

Ideally, such shortcomings should be identified and due diligence conducted by the regulators and corporate governance. However, short-sellers play a significant role at such times by executing their strategies of selling their stocks when such news hits the general public. The share prices tend to drastically fall down and short-sellers will plummet any price stabilisations.

The below instance is of 1987 was when on a ‘Black Friday’ in October, the S&P index collapsed by more than 20% on a single day wiping out the entire gains which it had gradually accumulated in the past 5 years. The exact cause is still under the clouds but short sellers take advantage of such a scenario to maximise their gains.

Summary

Short-sellers help in filling up the gaps which might escape the laws and regulators. However, it is a debatable topic since the tactics of rapid selling can impact the overall stock market and the industry in the short to medium run.

The aspect of scrutiny should definitely gain importance by the Government agencies but such tactics on the sell and buy side should also be monitored by the federal authorities to prevent any wrong doing to the larger public interest.

Join The Coin Republic’s Telegram Channel for more information related to CRYPTOCURRENCY NEWS and predication.

Download our App for getting faster updates at your fingertips

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News