- Since August, October’s third week was the worst for DEXs in terms of the DeFi trading volume

- iI is observed that the total value locked in DeFi is still near high records, though the trading volume is reducing

With the steady decline in DEX’s trading volume and its decaying prices seem the DeFi investors are shifting towards Bitcoin. As the digital assets are continuing to trek new high’s the focus of investors is shifting towards Bitcoin, and meanwhile, the hype around the DeFi projects is fading.

Why is the Trading Volume of DeFi is on the Decline?

The fall of trading volume may seem to be correlated to the recent hack of Harvest Finance. As the hacker implemented a flash-loan exploit that utilizes millions of dollar worth of cryptos across DeFi exchanges, to drive down the price of USDT and USDC on Harvest Finance. After that, the hacker bought those coins at a discount to pay back the initial flash-loan that ended up profiting the hacker. However, the hacker did such activity several times, that according to data from Dune Analytics, led to a boom in the trading volume of DEX for a day. And since then the volume is continuing to decline.

Worst Time for DEXs

Since August, October’s third week was the worst for DEXs in terms of the DeFi trading volume. The weekly volume dropped to $3 billion from September’s $8 billion. However, according to data from Dune Analytics, Uniswap yet leading with 56% of the market share of all DEXs trading volume.

However, it is observed that the total value locked is still near high records, though the trading volume is reducing. According to data from DeFi Pulse, it is observed that after last week’s all-time high at $12.46 billion, the total value locked off has slightly dropped to $11.2 billion.

Bitcoin Bulls Leading the Death of DeFi Season

Bitcoin again in the spotlight with reducing hype around DeFi. It is observed that since early October the price of BTC has skyrocketed around 24%, having several high profile bets created by the corporates like Square and PayPal. This could also lead to triple the BTC user base in the future.

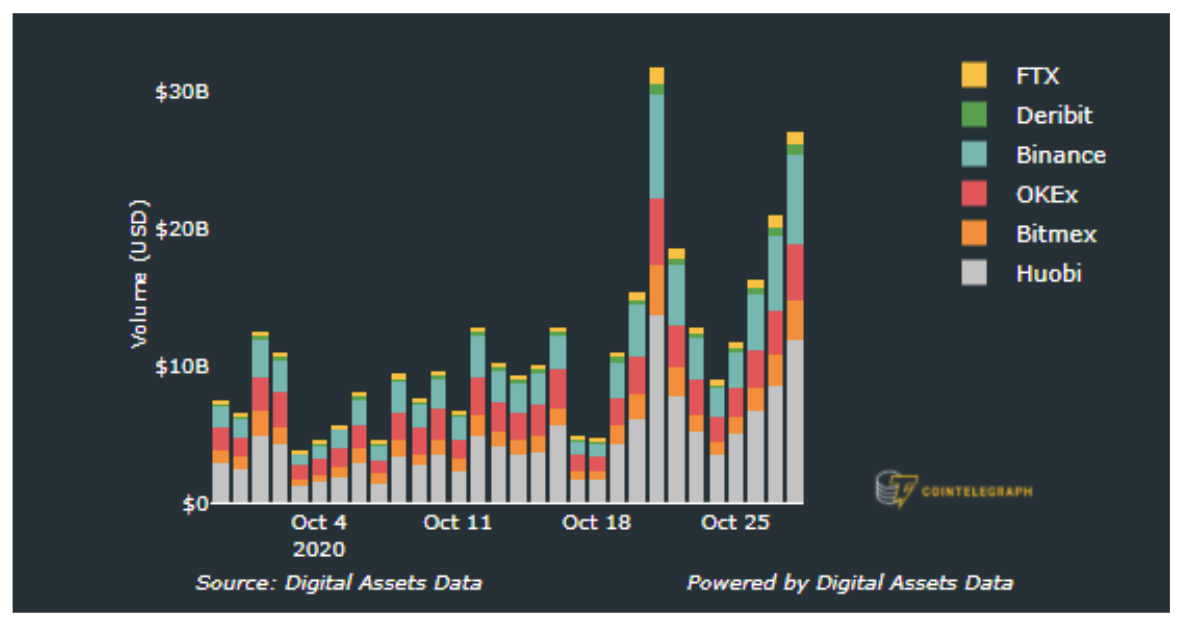

However, it is difficult to perceive the impact of corporate players on BTC’s price action, still, an indication from the recent securing of options and futures volume is disclosing that the bulls are at play.

DEXs are at Risk

As the investors are moving towards Bitcoin, the question is about the survival of DEXs. Indeed, the total locked value in DeFi is high, and might soon start to fade due to the declining trading volumes. This is because the reducing trading volume can reduce the yields for liquidity providers and the more investor’s interest will start reducing.

However, there are still several DeFi projects available that continue to receive investor’s interest. The launch of the Keep3r platform by Yearn led several investors to participate in the project and raised the price of KRP to $162.58 from $24, which is an increment of 570%. Hence, yet interest is available with the right project.

Join The Coin Republic’s Telegram Channel for more information related to CRYPTOCURRENCY NEWS and predication.

Download our App for getting faster updates at your fingertips.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News