- Ethereum is currently facing a bearish phase and its price has shown a consistent decline

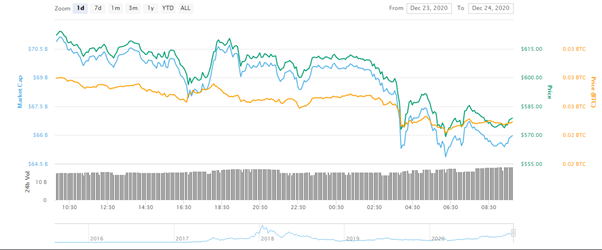

- The price of Ether was ticked at $576.33 in the last 24 hours which is a decrease by 8.08%

- This fall has been attributed to the rise in prices of Dollar impacting the bull run of Bitcoins and Ethereum in the crypto market

The past 12 hours have been volatile as the prices have been floating in the range of $574.13 – $610.87. With respect to its 52 week comparison, Ether is 505.516% up from the 52 week high and 14.47% low. These are indications that despite the volatility the fundamentals of the currency are relatively strong ensuring that it can survive large scale shocks in the markets.

Can this be termed as a Market Correction?

Ethereum has shown volatility in the past one month due to a variety of factors. The below 1 month trend shows that Ether has gone from a low of $500 to a high of $650 perhaps now indicating some form of stability.

Source: Ethereum – 1 month trend

One of the reason is that the exchange withdrawals have resumed which could be due to staking, yield farming and buyers sending coins to cold storage. In the last week, the exchange faced 232,000 Ether deposits and subsequently a net withdrawal of $293,000 which is one of the largest withdrawals. Such a heavy flow deposits may not occur soon which is perhaps causing the prices to stabilise.

In the early part of December, many investors had been trading higher volume on call options which did reverse initial bearish movements. Though there were no signs of investors buying neutral-to-bearish option strategies, the sudden bullish movements are perhaps settling down and not same levels of bulls may be achieved.

Other factors such as peaking of futures premium and recovery of spot volumes are an indication of possible stabilization in prices.

Though there are indications that Ether may not be bullish in the long run, it is not feasible to jump to a conclusion that the bearish trend may not stop here on.

The daily price movements have to be carefully monitored and investor sentiments should be carefully observed. Since Ether involves large whale investors, the action by a few such investors can determine the price direction of Ethereum and the overall crypto market as well.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News