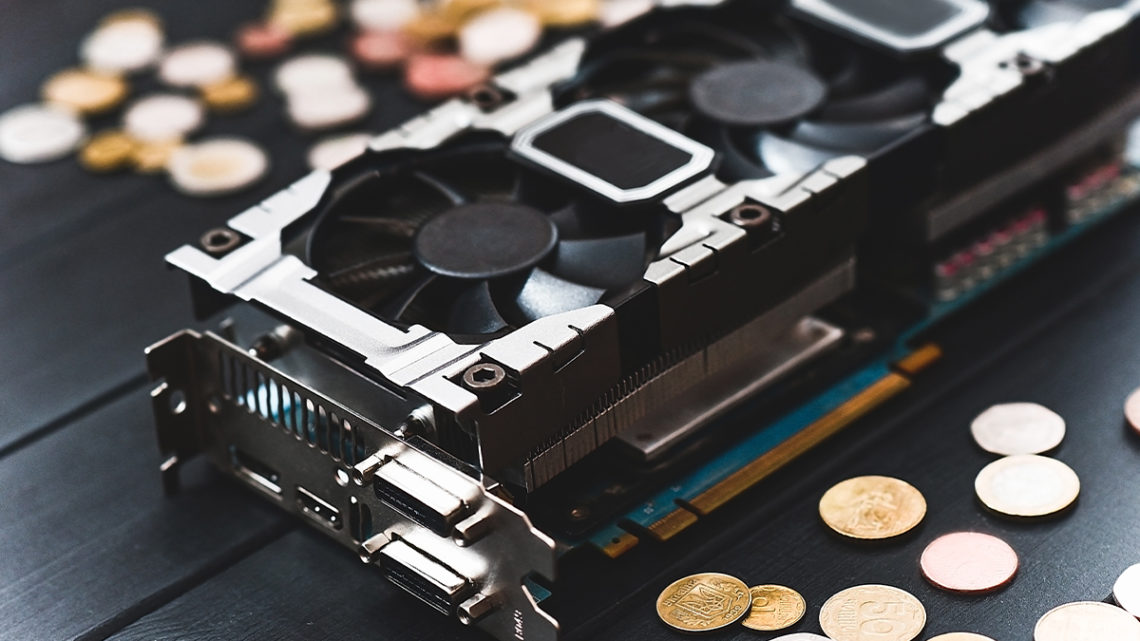

- With a boost in the price of Bitcoin, the crypto mining revenue has also surged

- With a surge in the revenue, it is also found that the hashrate has also improved

- Recently the market capitalization of some mining firms have also exceeded $1 billion

- Volatility makes the mining operations very challenging

After soaring in recent months, it is observed that Bitcoin is also helping boost the fortunes of the cryptocurrency mining sector. In recent weeks Bitcoin has achieved a new all-time high record after crossing the barrier of $42k. Along with the price of Bitcoin, the shares of public crypto mining firms are also surging, as such firms are triggering large orders to increase capacity. For example, a mining firm Marathon Patent Group has recently announced plans to raise funds through a direct stock offering and purchase new equipment to expand their infrastructure.

Soaring hashrate of the Bitcoin network

As the price of the flagship crypto token is skyrocketing, the reward for miners is also rising. And with the improving revenue from the crypto mining operations, the demand for mining equipment is also soaring. Following last week’s report from the crypto news-outlet Coindesk, it is found that the return on a Terahash per second TH/s has surged by more than 28%, whereas back in near the end of the Q3 2020, the return was by 7.8%. Observing the aforementioned fact, it is also found that the BTC network’s total hashrate had surged to create a high record at 150 TH/s, whereas a year before, it was 105 TH/s.

The soaring market cap of the crypto mining firms

The surge in the leading crypto-token price has hit a few of the public-held mining operators positively. Following the Hashrate Index data, it is observed that recently several crypto mining firms are exceeding $1 billion by market caps. Such firms, including Marathon, Hive Blockchain, Riot Blockchain, and Bit Digital, now have a market cap of more than $1 billion, after several large run-ups in their stock prices.

Bitcoin mining operations are quite challenging

The crypto mining firms also seek cheaper space and power to run the high-density racks. Such operators always yearn to spend less on backup infrastructure, which is an essential factor of the value of commercial data factors. However, the volatile nature of Bitcoin has made mining operations a more demanding customer segment for the data center sector. Following the scenario of 2014, when several BTC firms rented the space with providers like CenturyLink and C7 Data Centres. However, most of the customers had faced severe difficulties when the price of Bitcoin plunged.

Home

Home News

News