- Michael Burry received a short-term gain of 1,500% from his investment in GameStop

- His 1.7 million shares strike worth $271 million, reaching a significant peak

- GameStop shares climbed up to a value of 145% on Monday, while the day traders were crowding in

Value inflation occurred in the investment of Scion Asset Management’s chief. The worth rose from $17 million to a remarkable value of $271 million in less than four months.

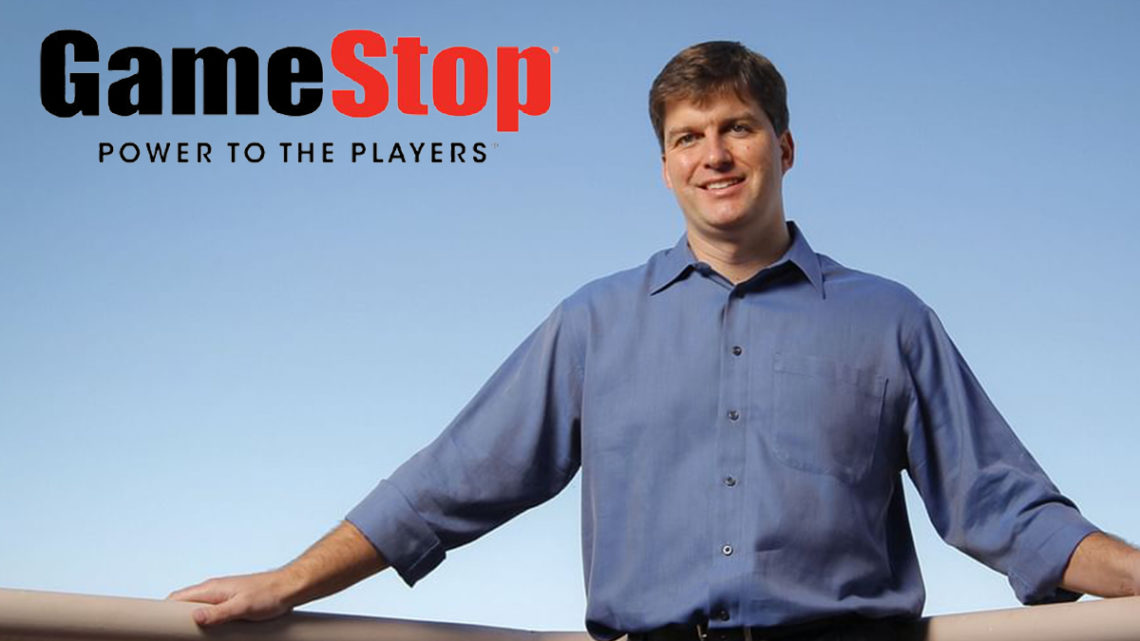

Michael Burry is a renowned investor who struck a bet of billion-dollar against the US housing market. Moreover, he emerged as the winner of the respective chance. He is an essential part of the crypto-asset market. However, his latest win could arise from an unexpected source: GameStop.

Michael’s iconic profit of 1,500%

The GameStop is an omnichannel retailer that functions digitally. The stock prices of the Fortune 500 company recently witnessed a rally of 860%. Within this context lies the respective victory of Michael.

Michael, the founder of the hedge fund Scion Asset Management, had an investment worth 1.7 million shares in GameStop when counted last. These shares were valued at $17 million in September end.

The video-game retailer’s stock price has crossed all sky-high values since then. The prices soared as much as 145% to a record high value on Monday. In an immediate response, the traders started crowding in. Besides, they also scorned the short-sellers for it.

The stake of Scion rose in value to $271 million and struck a significant peak. This implied a direct gain of 1,500% for Michael.

On Tuesday, the GameStop shares shut down at $148. This meant that the Scion’s position was now valued at around $252 million. Thus, the company accomplished a 1,380% gain in under four months.

Michael’s share buy-back

Considering the context of the company’s surge, Michael Burry could have easily made a higher profit. At the end of March last year, Michael was the owner of around 3 million shares in the video-game retailer. If that were the present case, the benefit would have been around $478 million on Monday. However, he decreed the stake by about 38% across the next half of the year.

Michael has been anticipating and trying to bring meaningful changes to GameStop for a while now. He was accompanied by Ryan Cohen, the co-founder of Chewy.

The Scion chief enclosed a document to the directors of the company in August 2019. He argued that the reason behind the low stock price and enormous less interest reflected a lack of trust in the management. He then put forward a call for a huge share buy-back.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News