- Uniswap v3 has performed unexpectedly despite the recent crypto markets crash

- Comparing to v2, Uniswap’s v3 remained capital-efficient and successful

- Liquidity providers could face difficulties shifting from the v2 in the short time frame

- High fees issues helped many to shift to shift to Layer-2 solution-based DEXs

- Uniswap’s v3 has gained enough traction in the DeFi ecosystem over such sell-off period

Uniswap is a decentralized exchange (DEX), and a DeFi focused automated market maker (AMM). Earlier this month, the exchange successfully launched its v3, which is the most potent version of the protocol. Following the recent market crash, it was expected that the scenario became unfavourable for the latest launched version. However, despite the high sell-offs, the exchange saw high trade volumes. Moreover, the newest platform took a position among the top five DEXs.

Uniswap v3’s performance is unignorable

Due to regulatory pressure globally, Bitcoin performed below expectation over the past few weeks. Where Bitcoin is the leading crypto asset, several other altcoins also began to show the impacts of BTC’s loss.

However, the recent fall of the entire crypto markets remained a more extensive test of the decentralized finance (DeFi) ecosystem. Notably, it was unexpected that the recent launch of Uniswap’s latest version will be successful. The cryptosphere stayed under pressure, and the newest DEX continued to lead in terms of the trading volume.

V3 remained capital efficient and successful

According to Johannes Jensen, product and project manager at eToro, the surges created critical issues. Jensen explained that issues existing in the design of the constant function market makers (CFMMs) are the driving force that showed the immediate success of v3.

Additionally, the primary issue caused an ability for liquidity providers (LPs) to offer bounded liquidity with a convincing price range. In contrast, the consequences of bounded liquidity positions caused a systematic implication of liquidity provider’s shares diminishing.

Notably, v2 gave proportional ownership of liquidity pools to the LPs. And the factor developed a challenging payout function. Ultimately, the feature gets more similar to an options contract than a direct claim to the underlying asset. However, with v3, we observed capital-efficient decentralized finance.

LPs could face challenges shifting to v3

The sentiment of Simos is acceptable, and v3 seems to continue to attract liquidity providers. However, the re-approval of tokens to migrate from v2 could hinder the shift. Moreover, the requirement of selecting the price range could be complicated for many LPs to understand. According to Jensen, some might never want to deal with the added demand of risk management.

However, better returns could act as a catalyst for attracting more LPs to the latest version of AMM. Elias Simos, a protocol specialist at Bison Trails, believes that the challenges of migrating to Uniswap v3 will soon vanish. Hence, better yields and upcoming products would drive the shift to the platform.

Layer-2 DEXs have observed mainstream adoption

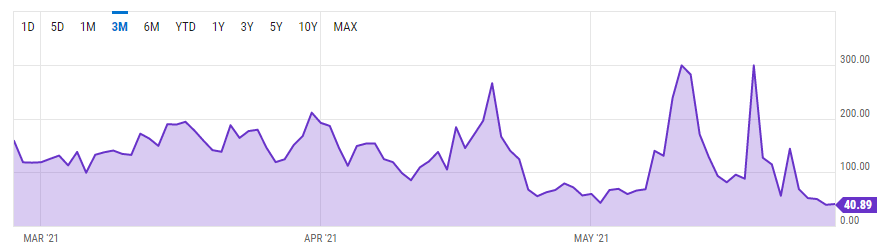

Another factor has been observed that proves that Uniswap v3 has remained positive. When the market crashed, gas fees were kept soaring tremendously to achieve unexpected levels. It is noteworthy that despite such levels of fees, the latest version of AMM attracted a good count of new users. Indeed, the fact became possible as users began to shift towards Layer-2 DEXs after observing high fees.

DeFi industry has proved its capability

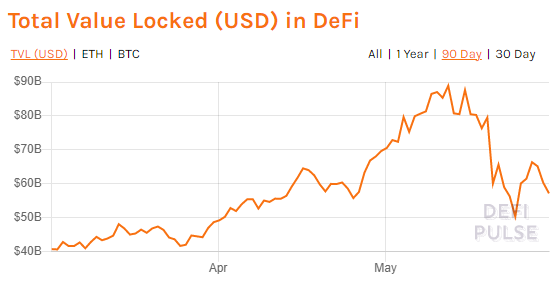

Alongside Uniswap, several DeFi protocols showed bullish sentiments. Notably, the DeFi market saw a total of $400 billion worth increment in its value after the sell-off period. Several projects surged in value, like MKR, skyrocketed by 91%, YFI surged by more than 72%. Simultaneously, AAVE also performed tremendously and is currently leading with $8.24 billion in value locked, as per DeFi Pulse’s data.

Likewise, Uniswap’s native cryptocurrency UNI also saw a significant increment in its valuation in the DeFi sector. Observing the tremendous act, it seems the decentralized finance ecosystem will continue to grow more in the longer timeframe.

Decentralized finance is printing positive indications

Observing the cryptosphere since the beginning of this year seems this year is monumental. Among the entire industry, DeFi has been observed showing positive signs since the beginning. Indeed, the whole sector has gained incredible positive growth. The growth in TVL, trading volumes, and new users have continued in its orbit.

DeFi and AMM have increasingly become an intrinsic part of how capital is allocated in crypto assets currently. Such claims came as DeFi and AMM’s play in capital allocation from LPs and their general use by daily crypto users.

V3 could help alleviate high fees issues

Jensen has highlighted the relation between decentralized finance protocols and Ethereum. Eventually, Jensen termed the relationship as a yin-and-yang relationship. It was observed that the DeFi remained directly proportional to Ethereum at crash periods. Ultimately, the presentation of the sectors led to high fees related issues.

Jensen believes that Ethereum will continue its evolution to a Proof-of-Stake future. Whereas the Uniswap v3 will help diminish some points like the issue of high fees. Moreover, the platform may attract a more sophisticated breed of liquidity providers. Ultimately, the LPs will help create new features for algorithmically adjusting price ranges. And the ranges will be based on the volatility or sentiment of the DeFi market. Where the DeFi sector has proved its staying capacity with prolific growth, Uniswap also followed its path. Uniswap’s latest version has gained enough traction with the users in the DeFi industry. It is noteworthy that Uniswap with DeFi had shown such positive signals over the heavy sell-off period.

Home

Home News

News