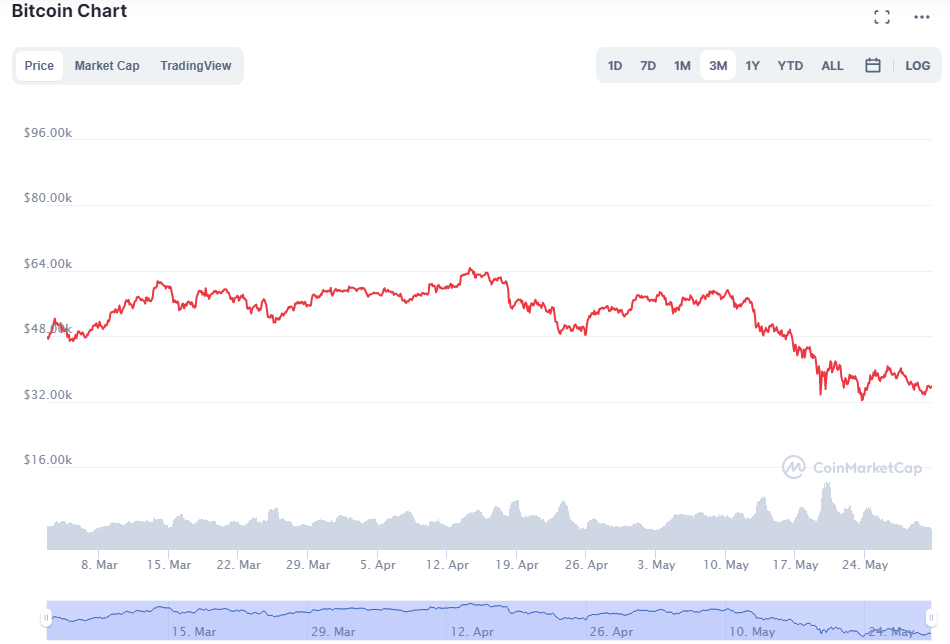

- Bitfinex CTO thinks that BTC will move to a range-bound trading period

- BTCs move to a range-bound trading period could heal the altcoin market and create bullish momentum

- With tremendous performances, the entire DeFi industry has proved its power to recover in the face of adversity

- Stable tokens have seen massive growth and use-cases over the period of the sharpest dip

Bitfinex is one of the significant and most liquid digital assets exchanges. Recently Paolo Ardoino, the Chief Technology Officer of the exchange, considered the recent digital currency markets crash positive. He stated that the crypto markets fluctuate.

According to Paolo, instead of worrying about future moves, it is wise to take a step back. Bitfinex’s CTO explained that markets do fluctuate, and this time BTC might enter in a range-bound period. It is noteworthy that the entire cryptosphere is indicating an unbeatable strength.

What if Bitcoin enters a range-bound trading periodas per Bitfinex CTO?

Traders using a range-bound trading strategy buy virtual currencies at the support level and sell at a resistance level. Such a strategy helps investors to avoid heavy losses from high-volatility breakouts.

Ardoino believes that BTC could now potentially move to range-bound trading. If the beliefs of Ardoino come true, the altcoin market will gain bullish sentiment. However, it is only possible if the reception remains good.

In contrast, poor reception could restart declines in the cryptocurrency market. And at the end, the performances will continue to wipe out more traders with more funds.

DeFi industry has proved its resilience

Recently we followed the performance of the entire decentralized finance industry. Unsurprisingly, DeFi followed the leads of Ethereum during the period of sharpest dips in the market. At the beginning of this year, Bitfinex CTO noted that an explosion of projects in the decentralized finance sector caused a bullish behaviour of Ethereum’s price. Hence,

However, several short-term protocols showed positive growth in terms of price and liquidity. Overall, the factors helped the entire DeFi industry to pass its most extensive test ever.

Cross-chain bridge protocols boosting DeFi liquidity

Where the cryptocurrency market sinks, integrations are trending as a method against pullback. Ren, a cross-chain bridge protocol has integrated with a couple of EMV-compatible sidechains. Such chains include Fantom and Polygon, which helps offset the high fees on the Ethereum network.

The integration of blockchain with DeFi projects, drives fees and volume to all users. Moreover, the bridge can potentially increase the TVL for the integrated blockchain’s protocol on DeFi. Now, each protocol will be benefited and using RenVM, the transaction speed will get a boost. Ultimately, the bridging and integrations will help boost DeFi liquidities.

How will DeFi perform in future?

Following all the data and metrics, it seems like the DeFi ecosystem will see more substantial revenue from DEXs. And the lending markets will also remain healthy with high securities. Following the performance of DeFi projects at such sell-off periods, Bitfinex CTO deemed that the industry has shown its resilience. Hence, the DeFi industry will continue to soar and achieve new highs.

Stablecoins are skyrocketing in the cryptosphere

Fiat pegged crypto assets are now at the epicentre of economic transformation for the money of tomorrow. Over the time when the digital currency market crashed, TerraUSD (UST) has been observed taking high impacts among stable virtual currency. Although UST’s performance remained unhealthy, other major fiat-pegged digital currencies boomed.

USDT and USDC remained healthy and maintained their peg with the US dollar. On the other side, DAI remained the most favourable among stable crypto tokens, as it maintained its peg with firm stability.

According to Bitfinex CTO, over the sharpest dip period, major stable cryptocurrencies held their peg. Such crypto tokens also observed massive transfer volume and use-cases across the cryptosphere.

Cryptosphere has the capacity to shape-shift itself

Following the overall scenario and performances of projects and projects in the cryptosphere, it seems space works as a natural system. According to Ardoino, seemingly like a natural system, the cryptocurrency and blockchain ecosystem could potentially shape-shift and evolve in the face of challenging situations. With the proven resilience of DeFi, few leading protocols are now expected to recover from challenges and grow.

Home

Home News

News