- The unwind will start, and the resultant price swings will be highly volatile

- More institutional traders taking shorting positions on AXS than retail traders

- The AXS token was also able to recover well after the May 19 crash

AXS, the governance token of Axie Infinity, has raked in a year-to-date price return of over 7,000%, compared with bitcoin’s roughly 33% and ether’s 212%, according to Messari. However, bearish trader sentiments could affect the value of the AXS token, although Axie Infinity is a blockchain-based project with rock-solid basics and great revenue models.

Denis Vinokourov, head of research at London-based quantitative finance management firm Synergia Capital, said that the surge is attributed to euphoria generated by an overcrowded trade. However, once the dust settles down, the unwind will start, and the resultant price swings will be highly volatile. Denis further added that market timing is a problem and is notoriously tricky.

Trading data obtained from crypto exchanges reveal that future traders are furiously taking short positions on AXS, and know that the crypto token’s Bull Run will end soon, and the values will tank. It is because the perpetual futures market for AXS has consistently seen negative funding rates.

The funding rate is defined as the cost of holding long/short positions in one crypto’s perpetual (futures with no expiry) market. The benchmark is often used by exchanges offering perpetual to balance the market and guide perpetual prices toward the spot price. If the metric shows a positive reading, it means the longs are paying shorts to keep the position open, as the market is skewed bullish. Conversely, a negative funding rate indicates a bearish sentiment towards the token associated with the perpetual.

AXS perpetual on two prominent exchanges, FTX and Binance, are negative

Checking the funding rates for AXS perpetual on two major exchanges, FTX and Binance, are negative. The latest data from FTX shows the one-hour average annualized funding rate for AXS perpetual was at -42.92%. The eight-hour-basis funding rate of the AXS/USDT perpetual on Binance has been negative for at least 14 days.

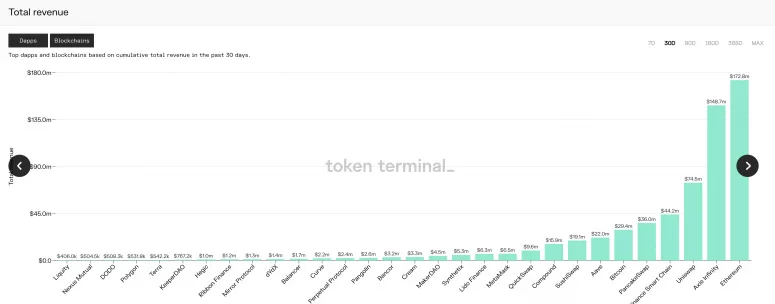

This bearish statement by crypto traders looks a bit misplaced since Axie Infinity, the Ethereum-based trading and battling game, has received much positive reaction from the market. In addition, it is a top revenue earning protocol on the Ethereum Blockchain.

Axie Infinity has raked in the highest revenue in a month

Token Terminal data reveals that Axie Infinity has raked in the highest revenue in the past 30 days among all blockchain-based protocols. It has earned $148.7 million, only behind Ethereum blockchain itself, at $172.8 million.

Jeff Dorman, chief investment officer at Los Angeles-based investment management firm Arca, gave a detailed account of Axie Infinity in his blog post dated July 12. Jeff described it as a company with a CEO and privately-owned equity, an actual business model and rapidly growing revenues, all of which existed before Axie issued its AXS token.

The AXS token has also recovered well from the May 19 crypto crash

The token was issued to flush finances to make the company self-sufficient and augment growth. Almost every customer and fan of the game had a chance to buy this token in the early days of its development. The AXS token was also able to recover well after the May 19 crash in the cryptocurrency market.

Source: TradingView

Analysts are not surprised by the differing viewpoints of crypto traders looking at AXS and those hyped by the Axie Infinity project. After the May 19 crash, investors adopted more aggressive trading strategies, hoping to maximize the potential returns.

Ashwath Balakrishnan, an associate at blockchain research firm Delphi Digital, said that the May 19 cryptocurrency crash was one of the most brutal in the history of cryptocurrencies. Therefore when AXS started surging, it was met with disbelief. Many traders thought it to be one more quirk of the cryptocurrency market. Balakrishnan concluded that traders are trying to understand the rationale of the rapid growth of AXS and adopt a positive mindset. When anything goes parabolic, we have people trying to short the top, so they start shorting on every new high. It is even more relevant after traders have incurred losses or lost some of their unrealized profits, the stakes were higher for them, and they shorted more aggressively.

Institutions and retail investors

Lennix Lai, director of financial markets at crypto exchange OKEx, said that the above phenomenon could be precipitated by more institutional traders taking shorting positions on AXS than retail traders. An excess of long accounts as compared to short accounts means the funding would be negative because long accounts belong to retailers, and short accounts belong to institutional clients who hedge their funds

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News