BTC rallies to $40K and maintains at this level

- Bitcoin is finally bouncing back from the $30k level.

- The flow of Bitcoin into wallets that belonged to the wealthiest crypto-traders

- Bitcoin (BTC) traders accumulated the benchmark cryptocurrency en masse

Bitcoin prices tanked on May 19, and values touched below $30,000 and then surged to over $40,000, and Bitcoin (BTC) traders accumulated the benchmark cryptocurrency en masse. It revealed the investor’s confidence in the asset’s long-term bullish setup.

The investor’s confidence in the asset’s long-term bullish setup remained strong.

When cryptocurrencies are in a state of limbo, this optimistic outlook is based upon Econometrics, a crypto-focused newsletter service. The newsletter focused on a flurry of on-chain data that traced the flow of Bitcoin into wallets that belonged to the wealthiest crypto traders, known in trade circles as ‘whales,’ and to entities that held the cryptocurrency in smaller quantities — the so-called “small fish.”

Nick, the author of the Econometrics newsletters, revealed that most address buckets are accumulating coins, Bitcoin is finally bouncing back from the $30k level. He based his findings on a heat map that witnessed Bitcoin flowing into the small fish and whales’ wallets.

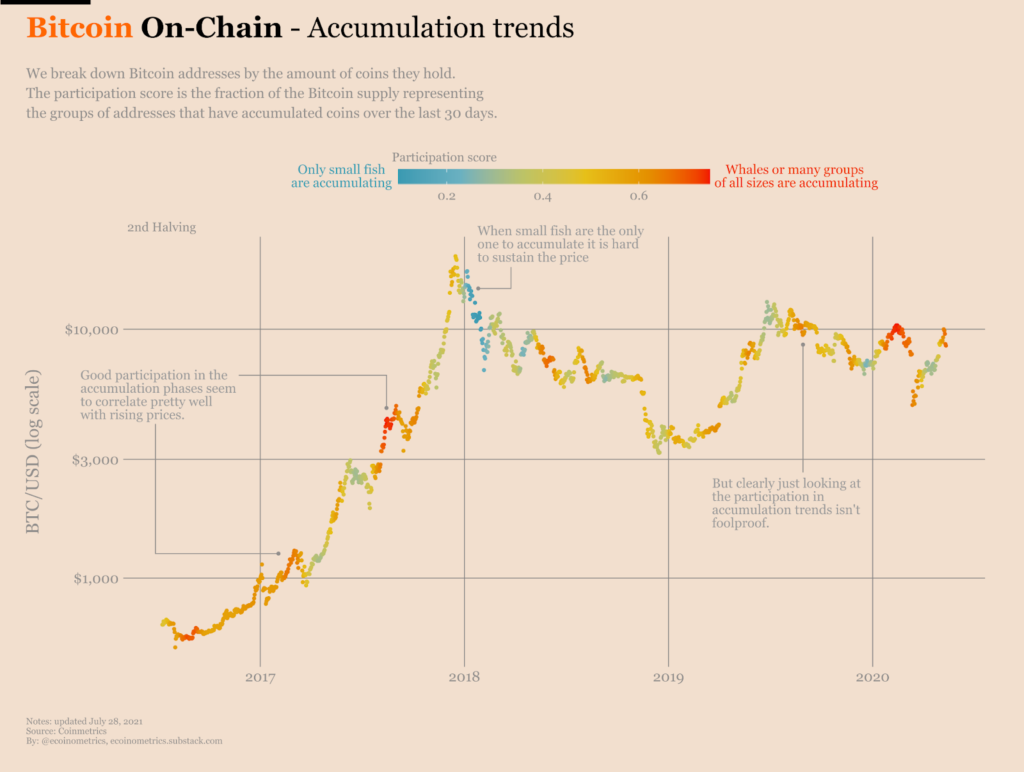

Bitcoin accumulation trends. Source: Coin Metrics

The chart above differentiates between the whales and the fish. The red color indicates that every group, regardless of their holdings – whales or fish — has accumulated Bitcoin in the past 30 days. The blue color represents only the smaller fish that have collected the digital asset in the same timeframe.

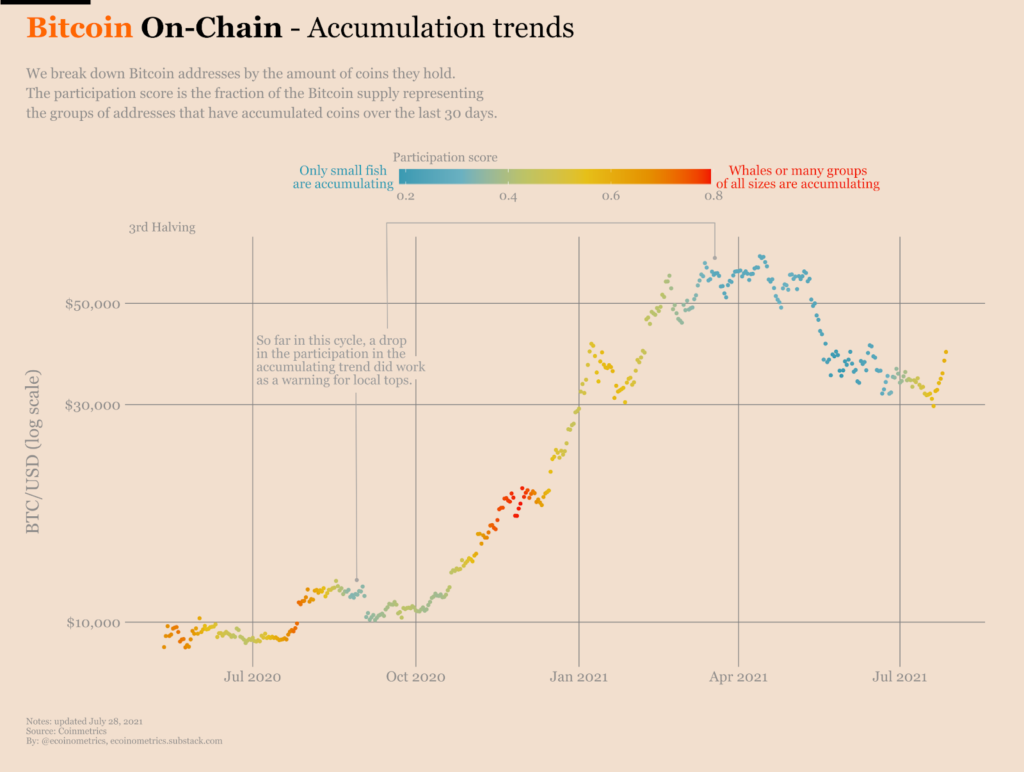

Nick added that plotting the chart for the current cycle; the proceedings are pretty much the same thing. Nick pointed to the July 2020–July 2021 graph.

Bitcoin accumulation trends in the past 12 months. Source: Coin Metrics

Investors are waiting for the prices to surge.

Crypto-focused data tracking service WhaleMap reported that the unspent transaction outputs currently belonging to Bitcoin whale wallets, and it has spiked. It suggests that the investors are waiting for the prices to surge. The experts advise the investors to wait for the cost of bitcoin to breach the $40,472 level, and the next resistance is only at around 47k. The whales will win.

Bitcoin’s inflows to whale wallets jump. Source: WhaleMap

However, the fundamentals that buoy the whales’ involvement in the current Bitcoin rally pointed to fears of rising inflation despite the United States Federal Reserve Chairman Jerome Powell’s attempts to trivialize the issues in the recent press conference on Wednesday.

Powell did admit that inflation has surged beyond the Fed’s projections for 2021. However, Powell blamed it on the unusual nature of the U.S.’ economic recovery. In addition, Powell said that supply bottlenecks had created shortages that have led to “temporary” price increases.

Powel’s comments are critical because the Fed sticks to its near-zero interest rates and $120 billion a month in bond purchases. According to a prominent journal that cited the National Bureau of Economic Research’s report of last week, which noted that the U.S. recession officially ended in April 2020

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News