BTC price recovery holds on to its 23% weekly gains

- BTC prices have surged and held on to their gains

- BTC/USD also broke the 21-week exponential moving average

- Bitcoin supply is once again at levels that previously priced Bitcoin at $53K

Bitcoin (BTC) is all set to make a comeback, and analysts predict that it will be a rerun of the bullish run years 2013 and 2017. With BTC breaching the $42,400 local highs on July 31, narratives are making sure that the market flips back to a bullish Bitcoin supercycle.

The Chinese mining ban had a crippling effect on the Bitcoin fortunes. However, Bitcoin was repairing the impact and slowly recovering the lost ground. However, last week’s recovery was more substantial than expected.

Instead of a dip in values, BTC prices have surged and held on to their gains which until last reports came in was a total of 23% in a week. What many experts had predicted as impossible has become true. It is hard to conjure the state of affairs of Bitcoin was so pitiable seven days ago, and today the Bitcoin surge has become the flavor of the month for analytics.

Investors’ maintained faith and their optimism are not unfounded

It was a painful three months for Bitcoin as it was hit by one cataclysmic event after another. It was the same headlines every day for the last couple of months-Carnage; mayhem and despair hung like a heavy cloud upon Bitcoin and the crypto trade in general. However, a minuscule number of investors maintained faith, and their optimism is not unfounded.

Jeff Ross, founder and CEO of Vailshire Capital said in Twitter comments Saturday that Bitcoin went on to print five green monthly candles in a row and went up ~10x in the second half of 2013. Jeff added that he is sure that 2021 will behave similarly.

BTC/USD 1-month annotated candle chart. Source: Jeff Ross/ Twitter

BTC/USD also broke the 21-week exponential moving average. According to analyst Rekt Capital is a sure shot and time-tested indicator of a bull run.

The supply shock is back.

While Ross was quick to add that such predictions are an intelligent guess, he reeled out an increasing number of on-chain indicators to support his predictions. Presently Hash rate is back above 100 exahashes per second (EH/s) after bottoming at 83 EH/s, while difficulty saw its first positive readjustment since the May price crash on Saturday.

Powerful Hodlers are now back in control.

Bullish sentiments are also reflected by Investor behavior. Powerful Hodlers with little to no history of selling their BTC are now back in control at levels never seen before. They were conspicuous by their absence since Bitcoin’s current all-time high of $64,500 in April.

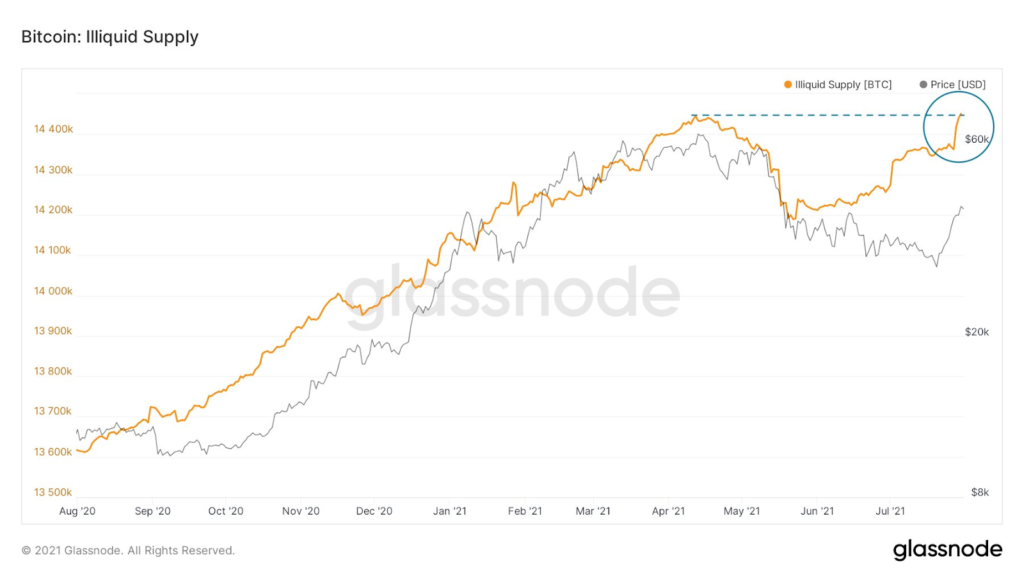

Lex Moskovski, a chief investment officer of Moskovski Capital, summarized alongside an accompanying chart from Glassnode that revealed that hodler conviction in terms of increasing the BTC supply becoming illiquid — taken off the market. Lex termed it very bullish.

Bitcoin illiquid supply annotated chart. Source: Lex Moskovski/ Twitter

Fellow analyst William Clemente commented on the same data that Bitcoin supply is once again at levels that previously priced Bitcoin at $53K. Thus, BTC is holding on to its position after ten straight green days is very reasonable but remains bullish over the coming weeks.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News