- The bull markets are fast approaching their second leg

- The largest cryptocurrency has a total market capitalization of $943 billion

- BTC is all set to break 2nd resistance at $61,000

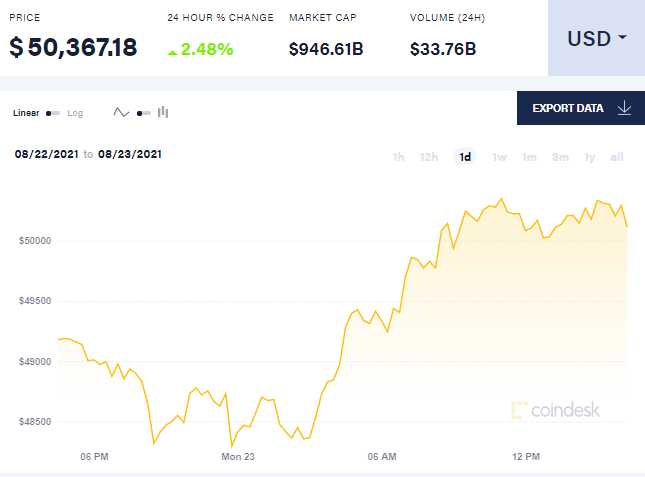

Bitcoin prices have surged and breached the $50K for the first time since the May 19 mayhem. Bitcoin prices plunged to $29,000 in June, and since then, the number one coin is surging ahead and has recovered more than 72% of its losses.

The bull markets are fast approaching their second leg as the Bitcoin (BTC) price was back on the offensive late Sunday, touching $50,000 for the first time since May.

The Bitcoin value breached the $50K mark and reached $50,270.00 on Bitstamp, gaining 3% on the day. The largest cryptocurrency has a total market capitalization of $943 billion.

Possibility of a supply squeeze

On-Chain Metrics are indicating the possibility of a supply squeeze may be imminent. Most long-term holders and institutional investors are strengthening their BTC holdings while prices remain at a discount. A sequence of higher lows and a positive daily close signal impetus for BTC since trading in the low $30,000 range.

The PayPal Factor Contributed to the surge

In April, the world’s biggest cryptocurrency had surged to an all-time high of $65,000. The surge in BTC prices this week can be attributed to two factors – The first is the announcement by Pay pal about starting services for buying, selling, and holding digital currencies in the UK. This can be characterized as the first international expansion of PayPal’s cryptocurrency services outside the United States. Earlier this year, PayPal has already launched cryptocurrency services for buying, selling, and holding cryptocurrency in the United States.

The second fact that has helped the surge in bitcoin prices was the announcement by Coinbase, a cryptocurrency exchange platform that it would buy $500 million in crypto on its balance sheet and allocate 10 percent of its quarterly profits into crypto assets portfolio last Thursday. It also announced that it would become the first traded company to hold Bitcoin rival Ether, DeFi tokens, and other crypto assets on its balance sheet.

Bitcoin is currently trading close to the significant psychological level of $50,000. Bitcoin is hovering around the 1st resistance of $49,200, and if we break $50,000, the 2nd resistance is seen at $61,000.

Bitcoin had started recovering and, after hovering in the range of $30,000 to $40,000 for many weeks, started surging and reached its present position.

Bitcoin fell steeply in June, triggered by a massive selloff. The selloff was precipitated by the Chinese ban on the corporates, financial companies, payment companies providing services related to cryptocurrency. There were moves to bring the unregulated DeFi sector under some form of regulation. Numerous central banks issued warnings against speculative crypto trading also led to the massive downfall witnessed in cryptocurrency.

The worst in the cryptocurrency business is probably over, and the cryptocurrency market seems to have come out of the crisis. The combined crypto capitalization stands at roughly $2.2 trillion, according to Coingecko. The combined crypto capitalization had dropped below $1.3 trillion during the depths of July’s bearish market action.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News