- Crypto and stablecoins are no currency as per the ECB president

- Christine Lagarde believes that such currencies should be considered as assets and overseen by assets regulators

- As per Lagarde stable tokens are pretending to be a coin, but significantly it’s associated with an actual currency

- If the people will want to transcat in digital assets, the European central bank cam embrace central bank digital currency

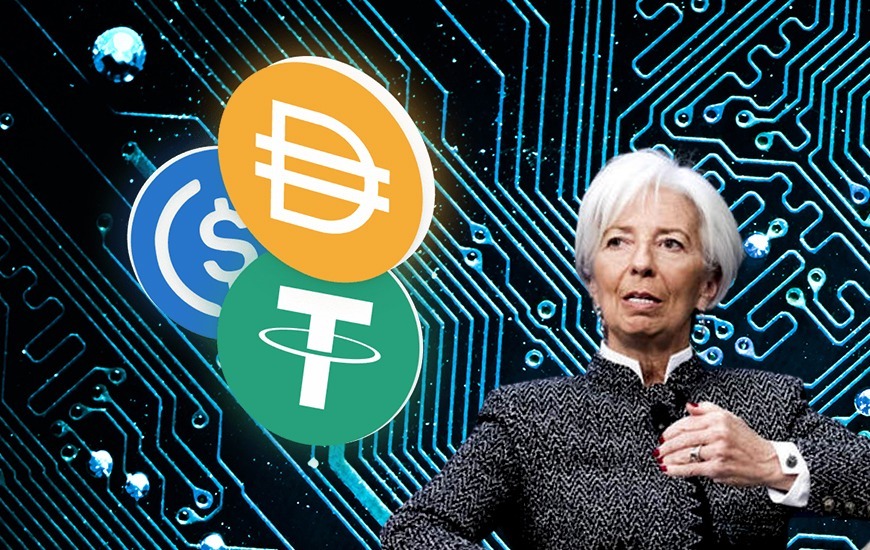

Crypto and stablecoins have gained more mainstream traction globally. Many believe cryptocurrencies have the true potential to change our traditional financial system. On the other hand, some individuals aren’t fond of cryptos due to heavy price fluctuation but do support fiat-pegged digital assets like stablecoin. However, recently Christine Lagarde, the president of the European Central Bank, emphasized that all types of cryptocurrencies and stablecoins are not currencies. She believes that such currencies should be considered as assets and overseen by assets regulators.

Should crypto and stablecoins be considered assets?

Klaus Schwab, the founder of World Economic Forum and its economic chair has recently interviewed Christine Lagarde. It has been underscored in the interview that the ECB president considers all types of crypto as assets that are to be governed by financial regulators. Moreover, she has also argued that the government-issued fiat-pegged stablecoins are also assets that tout themselves as actual currency.

According to Lagarde, Stable tokens are pretending to be a coin, but significantly it’s associated with an actual currency. She also noted that some claim such coins can be used for transactions but the value of such digital tokens will be aligned to the dollar.

Christine Lagarde also referred to USDT

The president of the European central bank referred to Tether (USDT) and noted that stablecoins issuer is required to be regulated to safeguard their investors against misinterpretation. According to Lagarde, recent history has shown that such stablecoins were not always available and as liquid as they were intended to be.

Christine Lagarde can embrace CBDC

In the interview, the ECB president was found supporting the central bank’s digital currency (CBDC). According to Lagarde, if customers want to conduct transactions in digital currency then a national digital currency option can be made available. Indeed, the bank is ready to respond to the demand for a CBDC and can have an European-based solution. On the other hand, she also added that the central bank is unlikely to hold Bitcoin as reserve currency in the near future.

Home

Home News

News