- Bitcoin largest month-on-month gains have been fabulous, but ETF debut in jeopardy

- The BTF had a good session in the first half, but it did lack a lot of steam

- VanEck to drop its fund on Monday, giving a tough week to the ETF market

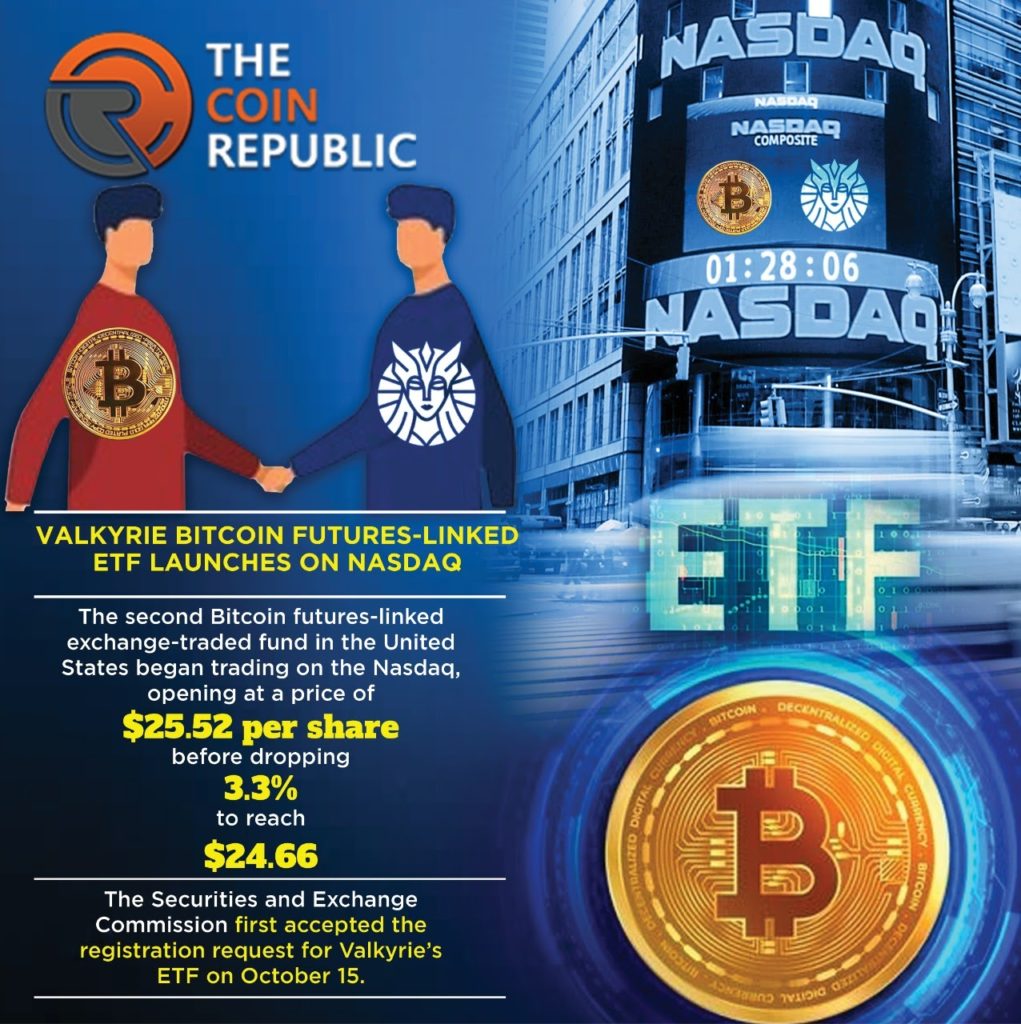

On Friday, the Valkyrie Bitcoin Strategy Exchange-Traded Fund (ETF) was dispatched on Nasdaq under the ticker BTF and dropped in esteem not very long after the ETF initially emerged from the door.

The second bitcoin ETF to dispatch in the United States followed bitcoin’s spot value developments on Friday, as BTF began the day above $25 and dropped to directly more than the $24 mark.

Valkyrie’s bitcoin futures ETF was authoritatively dispatched on Friday and arrived at a high of $25.60 per unit at around 9:00 a.m. (EDT). The senior ETF examiner for Bloomberg Intelligence, Eric Balchunas, tweeted about Valkyrie’s ETF after the initial couple of moments of exchanging.

The best ETF

The executives organization’s venture is following ProShares, a US ETF supplier, whose bitcoin fates ETF appeared on Tuesday. It has since amassed $1 billion resources under administration, quicker than some other asset.

It had the second greatest exchanging presentation ever and its prosperity has urged financial backers to climb into bitcoin. Bitcoin hit a record of $66,999 on Wednesday. It was last up 1.69% at $63,264 by 06:02 a.m. ET. The cost has acquired 47% so far in October – set for its greatest month-to-month gain so far this year.

It’s an exceptionally serious industry – when you contemplate a ton of ETFs, Thomas Perfumo, head of business tasks and system at crypto trade Kraken, told Insider. He didn’t realize that the first day, or first-mover, an advantage for this kind of bitcoin ETF structure would matter that much, he said, discussing which one could wind up number one.

The stock in this manner fell in esteem as it followed the spot cost of bitcoin’s drop before the end of the week. BTF tapped a low of $23.96 per unit and as the day advanced it crept over the $24 handle.

The Proshares ETF BITO additionally followed bitcoin’s spot market cost and plunged under the $40 handle to $39.39 down 3.5%. BTC spot markets tumbled from $63,735 per unit in the first part of the day (EDT) to a low of $59,954 on Bitstamp at 12:15 p.m. in the early evening.

BTFs rise

BTC figured out how to hop back over the mid-$60K per unit position during the exchanging meetings on Friday evening. An incredible number of bitcoin fans were eager to see Valkyrie’s bitcoin futures ETF dispatch after the Proshares ETF saw an amazing business sector execution this previous week.

Also read: FTX ATTAINS THE 25 BILLION MARK AS PER EVALUATION

After the end of the week closes, one week from now the crypto local area expects the Vaneck bitcoin prospects trade exchanged asset to dispatch on Monday. Following quite a while of dismissals from the U.S. Protections and Exchange Commission (SEC), there will be three bitcoin-related ETFs on Wall Street.

With Vaneck’s asset, two ETFs will be recorded on the New York Stock Exchange (NYSE) and Valkyrie’s bitcoin futures ETF is recorded on Nasdaq. Not long before the end chimes on Friday, Valkyrie’s BTC figured out how to move over the $24.30 district. BTF’s ascent toward the finish of the exchanging day on Friday followed bitcoin’s spot value bounce after BTC went from $60,600 to $61,150 per unit.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News