- This month, Bitcoin has weathered the storm, and the focus now moves to how its financial products are faring

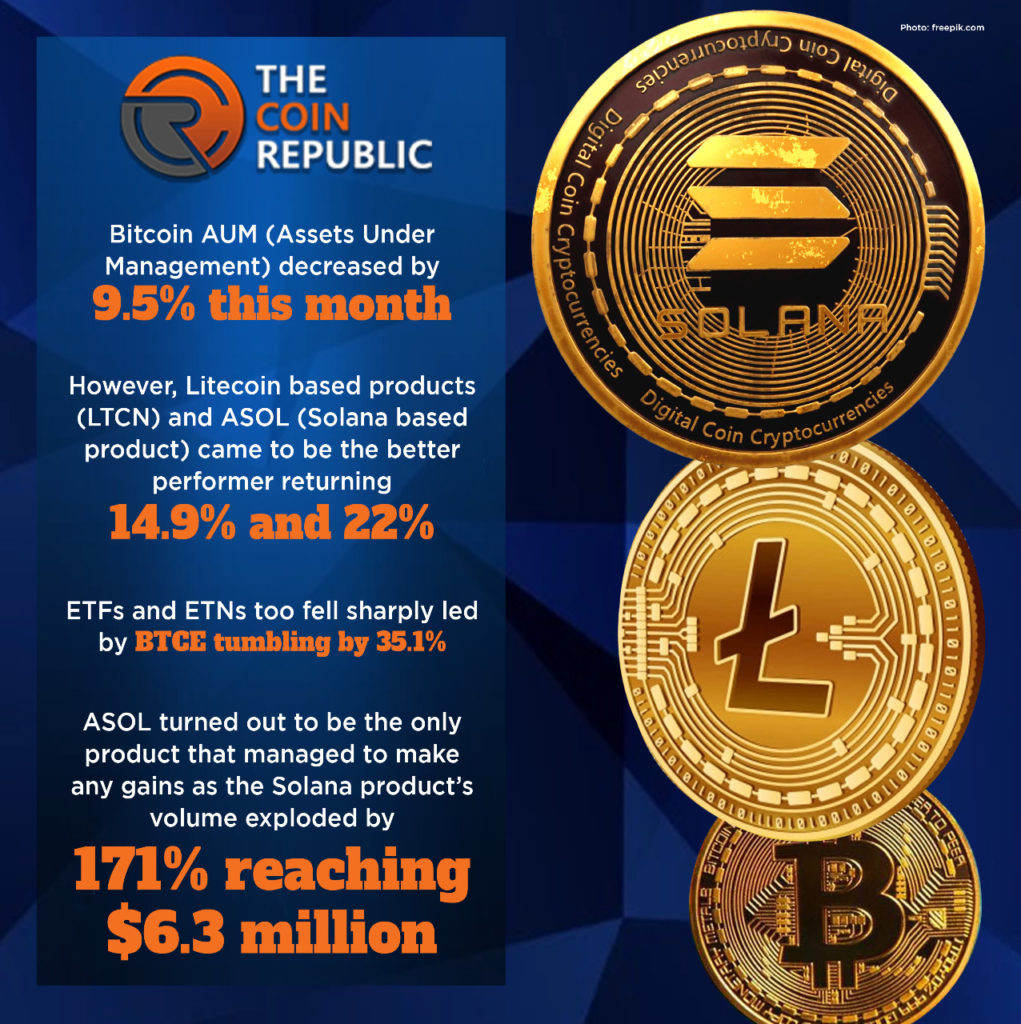

- This month, Bitcoin AUM (Assets Under Management) fell by 9.5 percent, the highest drop since July

- The Solana product’s volume skyrocketed by 171 percent, hitting $6.3 million. ASOL was the only product that managed to generate any gains

This month, Bitcoin has weathered the storm, and the focus now moves to how its financial products are faring. Looking at the numbers, it’s clear that Litecoin and Solana are rising where the king currency is losing. While the month of November has produced conflicting signals in general, the market’s figures are currently lower than they were at the start of the month. However, because the spot market was not particularly profitable, digital asset-based investment products had a similar outcome.

This month, Bitcoin AUM (Assets Under Management) fell by 9.5 percent, the highest drop since July. However, Litecoin-based products (LTCN) outperformed the market, returning 14.9 percent despite GBTC losing 12 percent market share. The growth of Litecoin was not the only one. Even 21Share’s ASOL managed to post a 22 percent return. However, LTCN and ASOL could not compensate for the overall losses. Despite the fact that this was the third month in a row with positive average weekly net flows, inflows fell by 56.2 percent. Daily volumes across ETFs and ETNs also dropped dramatically, with BTCE plummeting 35.1 percent and the Purpose ETF plunging 32.2 percent.

The Solana product’s volume skyrocketed by 171 percent, hitting $6.3 million. ASOL was the only product that managed to generate any gains. As November draws to a close, even the month’s biggest gainers are losing ground, topped by LTCN, which has dropped 20.44 percent in only three days. It’s barely 9.92 percent away from invalidating the month’s 45.9% gain.

The situation is identical for BTCC, which has plummeted 14.44 percent, GBTC, which has down 14.02 percent, and ASOL, which has dropped 12.45 percent. In the past, the end-of-year performance of many assets has shown to be a head start for the following year. The success of these products in December will be critical in determining the direction of ETFs, ETPs, and ETNs in 2022.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News