- Bitcoin has sheltered at a temporary support level of $39,000, but acquirers are short at this time as the market steps into weekend price action.

- Uncertainty revolving around macro factors appears to be escalating amid Russian invasion of Ukraine, making contributions in selling pressure.

- At the time of writing, Bitcoin was trading at a market value of $39,480.23, gaining 1.14% in past 24 hours.

Bitcoin Crawling Up

Prior to the current bearish trend, the benchmark cryptocurrency saw some reprieve. Bitcoin activity increased as a result of the Russian invasion of Ukraine, according to a report by research company.

The US, Europe, and the International Community have resolved to exclude Russia from the Society for Worldwide Interbank Banking Telecommunication (SWIFT), the traditional monetary system’s communication lines. As a result, Russia has effectively become a monetary outsider.

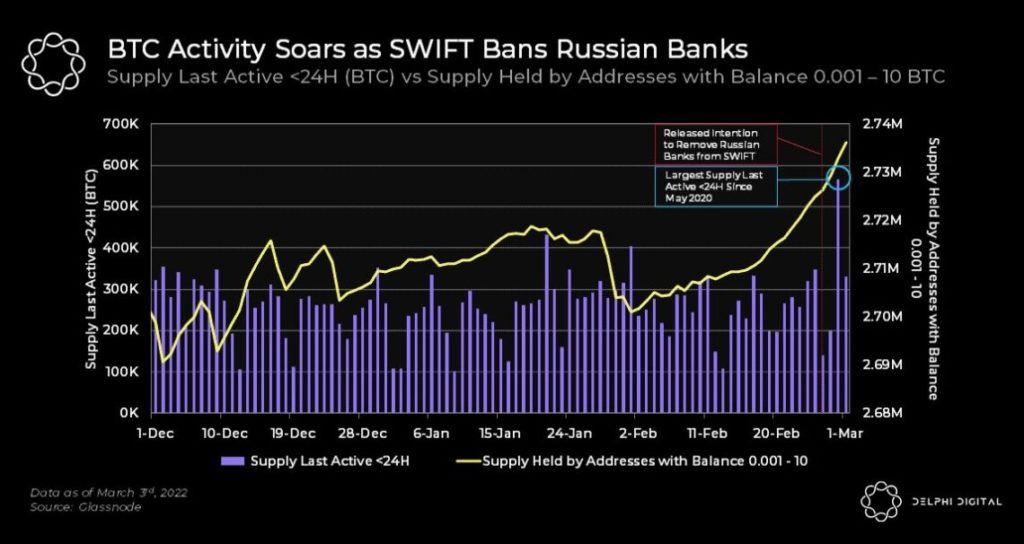

As can be seen in the graph below, after the penalties were announced on March 1st, Bitcoin’s active supply soared to its highest level since May 2020. The launch of the shutdown procedures to limit the occurrence of COVID-19 at the time sent international markets into a tailspin.

This improvement in Bitcoin active supply might indicate that investors have boosted their holdings to protect themselves against future developments. Meanwhile, as Brian Armstrong and other crypto exchange CEOs have documented, folks on the ground have utilized BTC and other altcoins to securely transit wealth beyond borders.

The BTC supply owned by accounts with balances between 0.001 and 10 BTC was over 2.73 million, according to further data given by the research company.

The organization stated the removal of the Russian Ruble from the global monetary system triggered a sell-off, with the currency falling 20% over the weekend. BTC has surfaced as one of the possibilities for Russians looking to retain their wealth. BTC was forced to trade at a 40% premium as a result of this.

ALSO READ – NFTs for each and every person alive!

Hard-Line For Bitcoin?

According to sources, Bitcoin needs to stay over $40,000 to avoid more losses. Now that vital support has been lost, a $36,000 revisit is imminent.

BTC’s price profited from the “safe haven asset narrative,” as per a pseudonym expert, but that impetus appears to have faded. Discussing the possibility of buying BTC’s slide into upcoming lows, which would allow the asset to recapture prior highs.

He indicated that BTC needs a push over $46K to maintain its bullish trend, which he believes would be difficult after such a drop. In terms of BTC’s future, I’m undecided about what’s next. There’s still have some optimism for a turnaround till the digital asset lose the present level, but the bulls must pull through after the weekend. As for the weekend, a lot of chop is anticipated, as is customary.

As this article was being written, Bitcoin was still sitting on top of cryptocurrency market, trading at a market price of $39,480.23, bullish by 1.14% in previous 24 hours.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News