SUN ZU Lab identified the pain points of the investors in the chaotic crypto market of today and has come up with solutions to guide them through it.

SUN ZU Lab was founded collectively by two professionals – Stéphane Reverre and Vincent Madrenas, in 2020. The team collectively possess 75+ years of experience in international capital markets.

The team of the company now consists of 15+ experts in their fields and is continuously expanding!

SUN ZU Lab aims to bring about more transparency to the growing crypto space through unprecedented analytics solutions. They work to provide professionals with the ability to optimize their strategies and save money on their trading costs.

On their official website, you can read free in-depth publications on everything from data-driven research to accurate non-quantitative analysis that their team of experts have carefully curated.

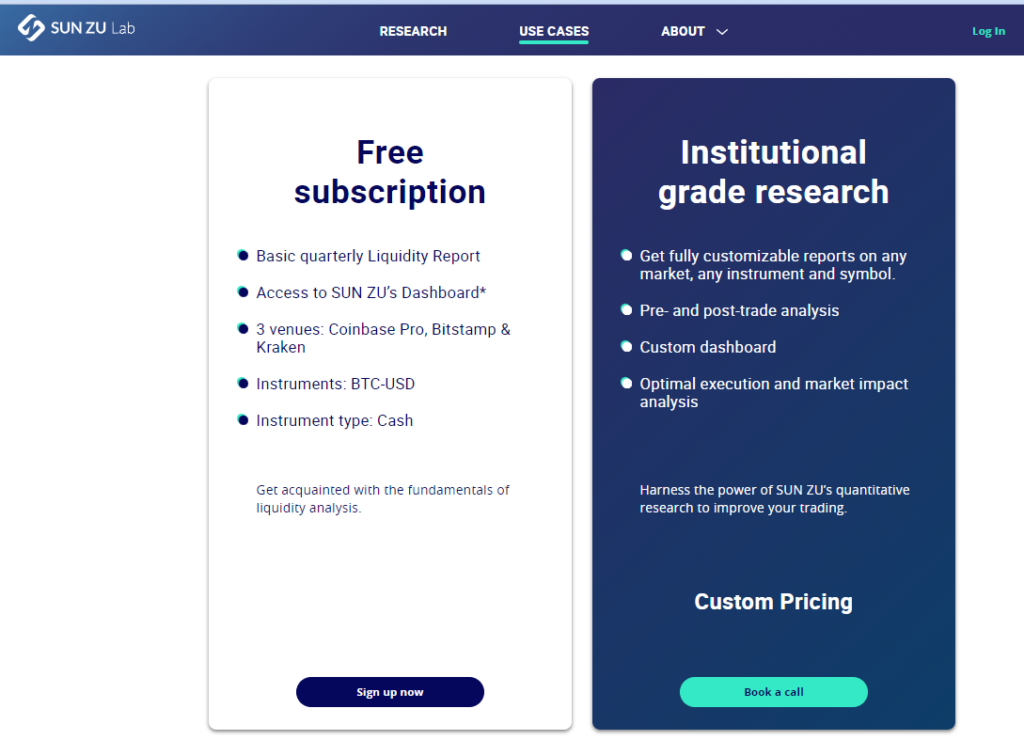

There are two models on which SUN ZU Lab operates:

Portfolio Manager of a Tier 2 Crypto Hedge Fund:

“We have long been using the same broker, and the question of execution quality has become a recurring issue. Our broker was not equipped to provide pre and post-trade, so we had to turn to SUN ZU Lab to help us understand whether we were getting the best prices.

Investors often struggle with the best execution. In simple words, they want to make sure that the price they are getting at the time of buying and selling digital assets is the best.

SUN ZU Lab comes to the rescue. The company’s liquidity analysis assists investors in figuring out that the price they are getting is the best price available in real-time by comparing aggregate order books of several trading venues. Besides, it’s always good to be in a better position when it comes to negotiating the price with the knowledge of hidden costs and margins.

Investors who take investing in crypto seriously usually have a diversified portfolio. But more often than not, it might be difficult for them to get a clear idea about its liquidity. In addition, even if investors do know what’s happening in the market today, however, things can change tomorrow.

SUN ZU Lab has a solution for that, too; it will monitor for you the overall liquidity of your portfolio automatically and regularly. They gather microstructure data, compile and analyze it, and give information on how much time and impact it will have on your portfolio. Investors can follow particular assets and, based on price and/or volume patterns, figure out the “right time to make a profit.”

SUN ZU Lab provides more such solutions, details of which you can find on their official website!

For publishing articles on our website get in touch with us over email or one of the accounts mentioned below.

Home

Home News

News