- Bitcoin price Surged above the $31000 mark showing green signals of a No-more bear market bloodbath.

- Bitcoin has been consolidating inside a range-bound area, and now finally, after being sideways for almost 20 days of Trading Sessions, finally the traditional cryptocurrency escapes the range.

- Other altcoins also started rallying bullish as soon as Bitcoin weathers calm waves of recovery all over the cryptocurrency market.

Bitcoin price is surging and has gained 3.40% of its market capitalization in the last 24-hour period. Trading volume has increased by 33.14% in the intraday trading session. The traditional cryptocurrency Bitcoin just escaped the range-bound area of $28650 and $31200 over the daily chart. Bitcoin(BTC) price is presently CMP at $31637, and the last 24-hour lowest and highest hit by BTC is at $31400 and $31840, respectively. The whole cryptocurrency market showed signs of recovery as soon as BTC started its recovery out of the range-bound area over the daily chart. It’s the traditional ritual as all other altcoins just follow the paved path of BTC in which the whole cryptocurrency market rose from the ashes.

Bitcoin again resembles the Phoenix bird, which is very famous in Greek mythology for rising from its own ashes. Here, the traditional cryptocurrency resembles the traits of the same bird. However, it’s a matter of time to see if BTC sustains above the horizontal range-bound area or if it falters and again gets caught in the consolidation phase. The volume to market cap ratio is 0.06189.

Small whales are becoming increasingly popular in the Cryptocurrency industry, particularly with Bitcoin

Whales are units- individuals, organizations, and exchanges who hold a massive amount of Bitcoin in the market, and small Whales are the ones who hold a significant amount of Bitcoin in the market. It’s not always Bitcoin; it may be any particular token from different cryptocurrencies. Pantera Capital and Fortress Investment Group are two examples of well-known whales. Satoshi Nakamoto, is another giant whale and is also widely speculated in the cryptocurrency world. Satoshi Nakamoto is said to have mined millions of Bitcoin already.

Like other majority stakeholders, Bitcoin whales are also one of them: their actions have an enormous influence on Bitcoin, the traditional cryptocurrency. Bitcoin whales impact the cryptocurrency market through increased volatility, decreased liquidity, or both.

Whales reportedly put significant sell orders lower than the other sell positions in the cryptocurrency market; the price starts falling, causing a chain reaction. The token gains its stability back when the whales pull back their large sell orders from the market or accomplish their goal of creating enough panic to drag the price where they wanted, and as a result, they accumulate more number of coins; this strategy is often known as “sellwall”.

The above TradingView chart shows different levels from where BTC price is coming, and the token currently stands above the horizontal range-bound area over the daily chart. Bitcoin whales are on the move as BTC starts gaining by falsifying the thoughts of Bear Market at the doorsteps of cryptocurrency investors. This may be considered as the stoppage of the bear market, and this bullish momentum of Bitcoin reminds the investors of good old trading days from the Bull run. However, Bitcoin price must sustain above the range-bound area and accumulate above $35000 level to diminish the thoughts of the bear market and save investors from being terrified.

Trading Volume Spikes

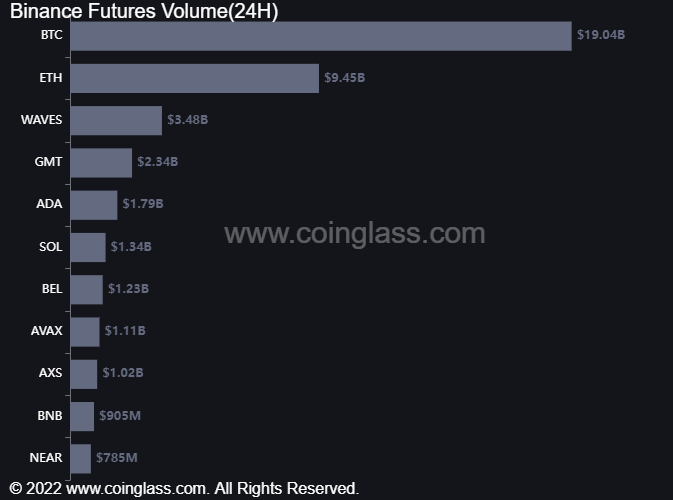

According to Coinglass, the trading volume for Bitcoin and different altcoins have gained massively in the last 24-hour period. Bitcoin price has gained around 3.61% today and also volume has massively increased to $19.04 billion in the intraday trading session. After Bitcoin and Ethereum the one who gained massively is WAVES coin by acquiring around 3.48 Billion of volume in the last 24-hour period and that’s quite huge for the altcoin like WAVES.

Bitcoin Price: Technical Analysis

Technical indicators suggest the uptrend momentum of Bitcoin over the daily chart. However, the Ichimoku cloud indicates the red cloud over the BTC price, signifying the higher level of the token. Relative strength index showcases that Bitcoin is breaking out of neutrality. But it looks like BTC bulls falter to sustain at the current level, and Bitcoin may fall back into the range-bound area. MACD exhibits the bullish momentum of Bitcoin over the daily chart. The MACD line is ahead of the signal line after a positive crossover.

Conclusion

Bitcoin price is surging and has gained 3.40% of its market capitalization in the last 24-hour period. Technical indicators suggest the uptrend momentum of Bitcoin over the daily chart. However, Ichimoku cloud indicates the red cloud over the BTC price signifying the token’s fall from the higher level. Bitcoin whales are on the move as BTC starts gaining by falsifying the thoughts of Bear Market at the doorsteps of cryptocurrency investors.

Technical Levels

Support Levels: $28650

Resistance Levels: $34000

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News