- Ether’s 12-hour closing price remains tight between the $1,910 and $2,150 range for the past 12 days.

- As per the data by CoinShare weekly Digital Asset Fund Flows report, investment products and cryptocurrency funds witnessed a $141 million outflow.

- In this scenario, Bitcoin (BTC) was the major concentration after experiencing a $154 weekly net redemption.

Falling US Stocks And Russian Regulations Shoots Up The Situation

Regulatory uncertainty was emphasized in investor sentiment after an updated version of Russian mining regulation was unveiled on 20th May. Document in Russian parliament’s lower chamber no longer held the obligation for crypto mining operators registry.

As per the local media Duma’s legal department said that these measures may “potentially incur costs on fed budget.”

Nasdaq Composite Index added extra pressure on ETH price when it went down by 2.5% on 24th May. Additionally, a heavy tech stock-driven indicator pressured Snapchat to plunge 40%, exhibiting escalating inflation, labor disruptions, and supply chain constraints.

Derivatives and On-Chain Data Under Bearish Control

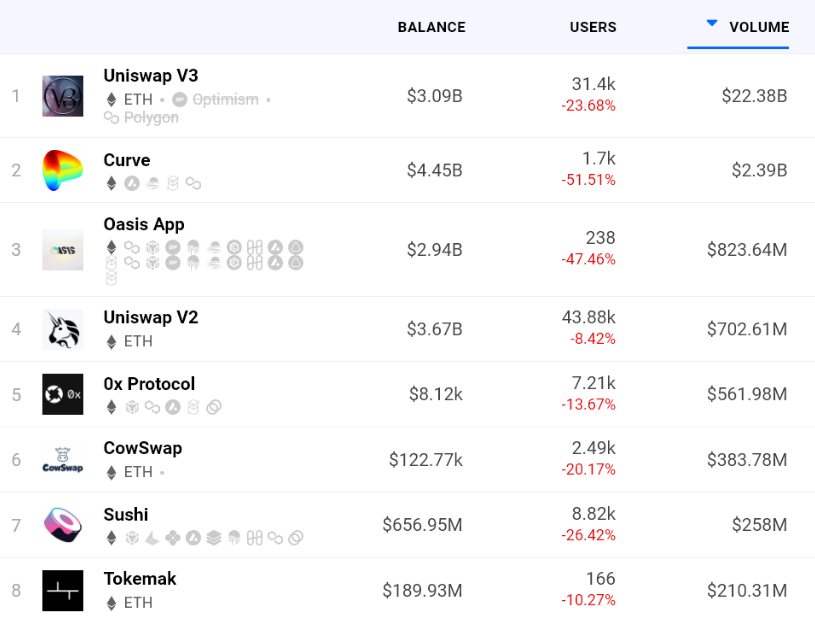

Total active addresses on the biggest dApp of the Ethereum network have plunged 27% from last week.

Most active dApp witnessed a substantial decrease in users. For example, Uniswap (UNI) V3 weekly addresses declined by 24%, and Curve (CRV) witnessed 52% fewer users.

Quarterly futures are utilized by whales and arbitrage desks due, majorly, to their scarcity of a volatile funding rate. These fixed-month contracts specifically trade at a minor premium to spot markets, pointing out that sellers request extra money to withhold settlement longer.

Future contracts on ETH went under the 5% neutral-market threshold back on April 6. There’s a lack of conviction from leverage purchasers as the present 3% basis indicator stays depressed.

Ether might have increased 2% after testing $1,910 channel resistance on May 24th, but on-chain data exhibits scarcity in user growth, while derivatives data indicates bearish sentiments.

Until there are some morale improvements that can accelerate the use of dApps, and Ether’s future premium regains a 5% neutral level, the chances of price surpassing $2,150 resistance appears low.

ALSO READ: ALGO Price Analysis: Flurry of bullish activity pushes Algorand Price up

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News