What Is USDD?

USDD is Over-Collateralized Decentralized Stablecoin which is issued by Tron Dao. This might seem like a fancy definition. Let’s make it simple. USDD wants to become the market leader in crypto adoption and also in the settlement fee. The major questions that arise here are what is USDD pegged to, Is there any mechanism to ensure any smooth running of USDD and keep it stable. Let’s look at this one by one.

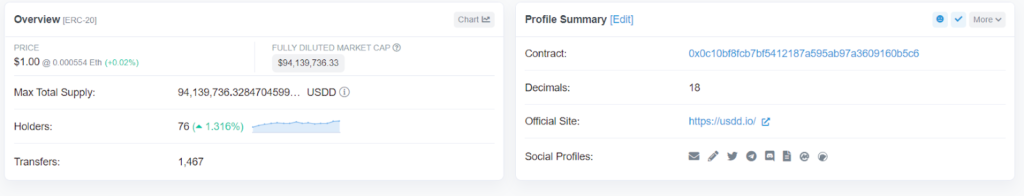

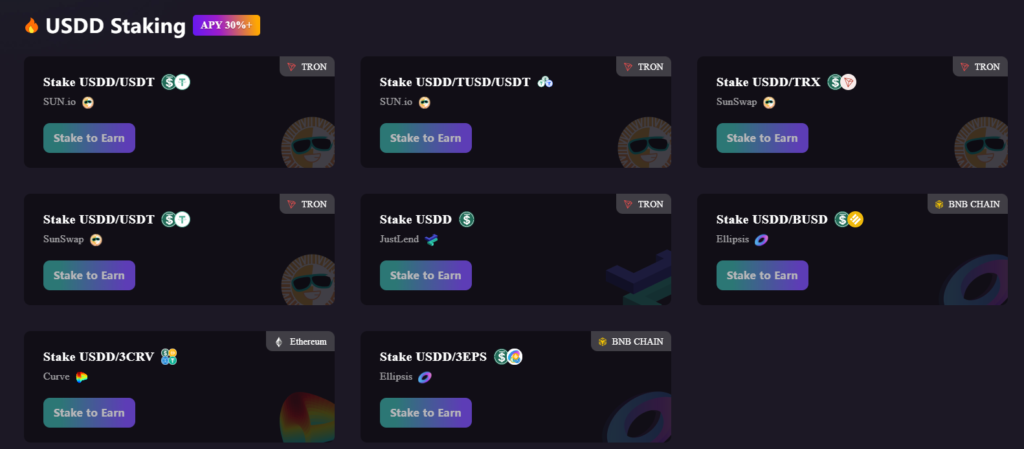

According to the whitepaper of USDD, it is pegged to USD to make a stable, decentralized, and tamper-proof system. This will resolve the major issue of the settlement between the traders. The Tron Dao reserve will be issuing the USDD and they will also set a benchmark of a 30% interest rate annually. USDD has been released on 5th May in circulation as their USDD 1.0 road map.

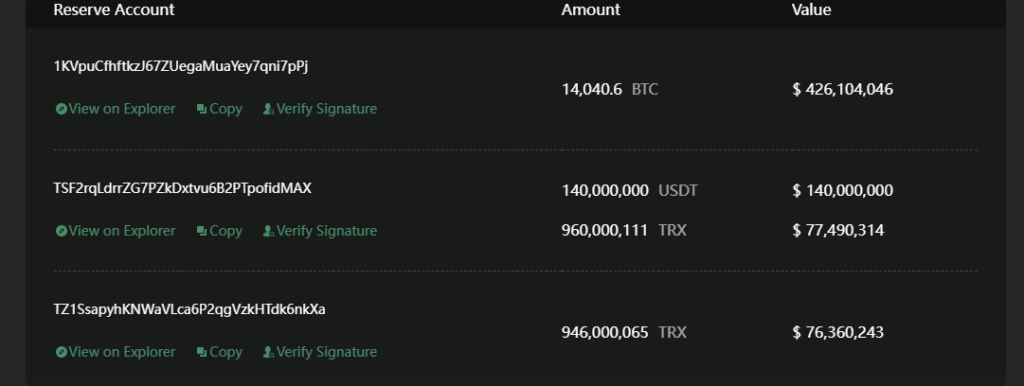

To keep any stable coin stable, there must be sufficient assets behind them. Tron Dao reserve has introduced high liquidity assets like BTC, TRX, and USDT. The minimum collateralized ratio will be maintained at over 130%. This is 10% higher than DAI which is considered one of the best stable coins. The current collateralized ratio of the USDD is 202%(at the time of writing)

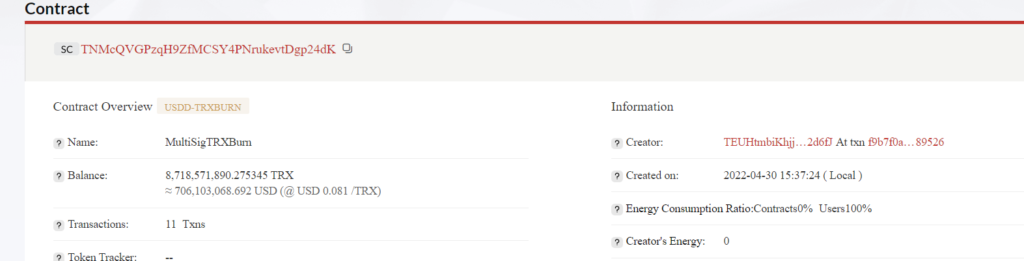

You can also check the burning and issuance of the TRX and USDD on (https://tdr.org/#/records). The burning contract address of the TRX is (TNMcQVGPzqH9ZfMCSY4PNrukevtDgp24dK )and the issuance contract address is (TRFGnuUqED3NDpMYgqZY1X3gAeVHNw1SDq ).

What Makes USDD Stable And Keep It From Short-Term Fluctuations?

Before let me introduce you to the super representative. Block producers in the TRX network are called super representatives. They are elected by voting and one has to pay 9999 TRX to become a super representative. The top 27 accounts with the most votes become the super representative and from 28th to 127th become the super representative partners. They will need to run TRON nodes for the block production and will get rewarded for it.

Now let me tell you why you needed to know about the Super Representatives(sr). USDD protocol runs on the TRON network and it needs a decentralized oracle to keep the price intact with the USD. The votes by the users and the SR will act as an exchange rate with USD.

In simpler terms, SR will act as a money exchange and instead of swapping your money, they will tell what the current price is. Whoever votes within the 1 Standard deviation to the elected median gets incentivized.

This tells you how the stable coin rate is maintained with USD.

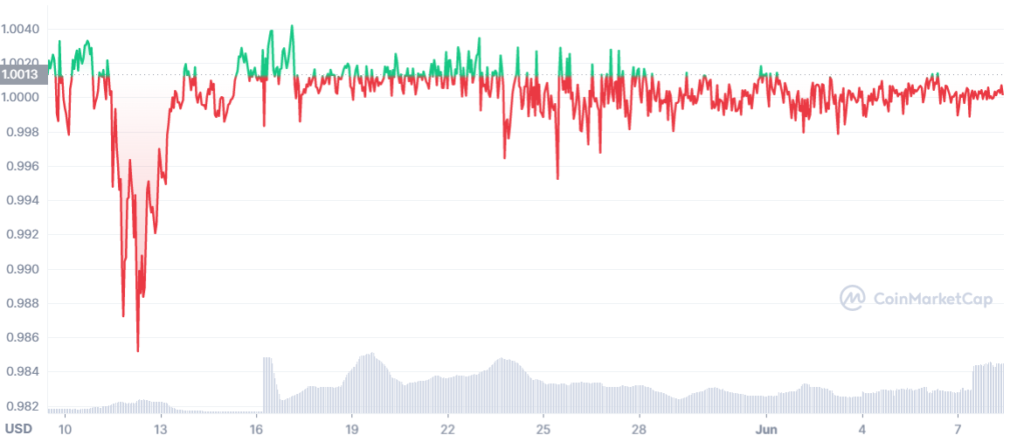

To keep the price in check if the price of the USDD falls below a specified level, then USDD will burn to push the price high and vice versa. If the USDD is burned, then the TRX price will be volatile. That volatility will be absorbed by SR. Once the stable coin is burned, TRX will be minted. For that short period, the minting power of the SR will be diluted. In the long term, the SR will be rewarded by the spread fee between the TRX and USDD which is currently set to be a 0.5% minimum.

One can also arbitrage in the USDD If the USDD falls below $1 one can exchange USDD for $1 worth of TRX and that USDD will be burned. If the price of the USDD increases above the $1, one can swap $1 of TRX for USDD. As a result, this $ 1 TRX will be burned and the supply of USDD will increase.

Does USDD Have Some Worms Like UST?

Let’s do some Maths but before it that, let me explain what is a collateral ratio. Well, a collateral ratio is the total asset/Total USDD issued. Now the total asset as per the TRX DAO website is $721,148,727( at the time of writing) and the total supply of the USDD is $703,094,264. Now, let’s divide these it comes out to be 102%. Wait how could that be true. I mean it is over-collateralized where is the other 100%. Well, the formula has changed a bit, which is collateralized ratio= (Total RESERVE +Burnt TRX )/ USDD supply.

Now for instance think about what happened with UST they were giving a great return from their anchor protocol and so will the Tron DAO of 30%. These returns have not been digested by some critics.

Let’s see a scenario suppose the TRX price decrease because of the minting and (TRX burnt/ USDD supply)=0.3. Now from the reserve, let’s remove the TRX for a second and then the ratio comes out to be 0.8 which is an 80% collateral ratio. If the TRX price decrease by 25% then the reserve will be $57,408,104.25. The new ratio after the decrease of TRX price by 25% and the decrease of BTC price by just 10% will be 0.94 which is 94%. This might be when the trouble of deppeging began. If one includes the interest rate paid by the TRX DAO on the USDD then who knows what kind of spiral can be seen. One might argue that TRX BURNT/USDD SUPPLY will never reach 0.3 which can be true but if you look at the SR rewards and consider the burning and the minting rate this might be the worst case scenario.

Note: This is just a pretended scenario and not financial advice or in any way opposed to USDD or TRX.

Is USDD The Answer To Stable Coins?

The answer is much more complicated than a simple Yes or No. USDD has various features which the others stable coins do not have. They are working on the hybrid models which may push its adoption of it to a large scale. On another hand, they have considered the TRX burnt as their collateral and have added TRX to their reserve. The other thing is the people’s perception of the algorithmic stable coins which is bad. Can USDD and Justin Sun be able to change that? Let’s see what the future holds.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News