- Solana Coin’s retracement phase has turned bearish as buyers lost around 20% of costs this week.

- Last evening the bears managed to close a daily price candle below the 20-day SMA, which also acted as short-term resistance.

- The market cap again slipped below $11 billion last night, resulting in a 9% drop today.

While the bulls are attempting to register a bullish rally for the Solana coin, the bears are also seen active near the $43 resistance area. Due to the roller-coaster ride, the bulls were rejected twice near resistance, so it castled significant bullish odds.

Everyone expected a pull back in SOL near immediate resistance, but this retracement phase turned bearish as buyers lost around 20% of costs this week. Now the price action is showing five bearish candles on the daily price chart.

Due to the downside momentum, the SOL bears are aiming to retest the latest support at $26 earlier in July. Hence buying can be expected near this support level.

On the lower time frame, Solana coin price action is showing a lower-low formation and a price closing above the previous swing high would indicate a trend reversal. Amid a minor selloff, last evening’s bears managed to close the SOL daily price candle below the 20-day SMA, which also acted as short-term resistance.

Solana coin is trading at the $31.6 mark at the time of writing and the bulls may attempt recovery in the $30 area. Thus, the market cap slipped below $11 billion again last night, resulting in a 9% drop today.

The trading volume has come down gradually over the past several days. But SOL traders need to keep an eye on the downside, if the trading volume bar rises above the average selling point at this level, buyers may face further trouble.

Buyers need to manage SOL price above support level

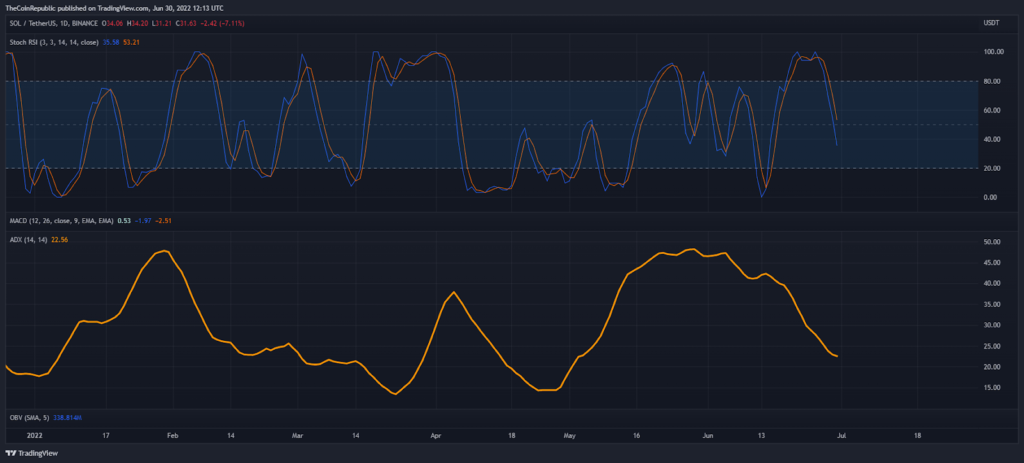

On the daily price chart, the Stoch RSI is showing a sell signal for Solana coin, which acts as a signal for a trend reversal from the overbought zone.

Furthermore, the ADX indicators have seen a sharp decline over the past few days. During a downtrend, a low valuation of the ADX indicator indicates weakness in ongoing trend for the Solana coin.

conclusion

Solana coin recorded a steady recovery in the last few days, buyers were also ready for this pull back. But bulls need to accumulate SOL coin near recent lows to see another bullish rally near the $100 conceptual round level.

Support level – $26 and $20

Resistance level – $50 and $100

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News