- BITI, world’s first exchange-traded fund is proving to be a success.

- Latest data reveals short exposure has experienced a 300% boost.

- Shorts are in the limelight due to their first-time accessibility.

Bitcoin continues to be a popular institutional investment target. The main aim of the institutional flows is to offer exposure to shorting BTC in the first week of July. However, Some experts believe it is little early to call Bitcoin Future bright.

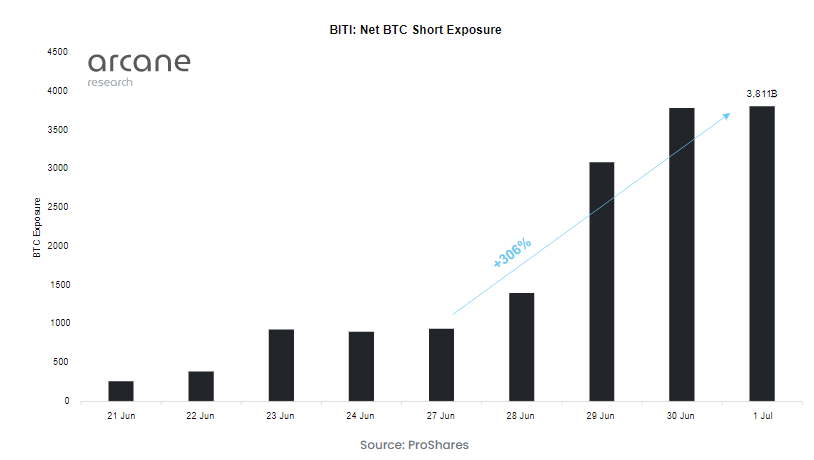

The recent launch of the ProShares Short Bitcoin Strategy ETF (BITI), the first exchange-traded fund (ETF) to be “short” BTC has proved to be a success. According to the latest data, a rise of 300% in short exposure is recorded. This only accelerated the trend.

ALSO READ – Bitcoin-friendly Próspera hits back at controversy in The Guardian

Arcane on Twitter in a comment informed that the growth of the first inverse BTC ETF, BITI has only increased further. BITI became the second-largest bitcoin related BTC ETF in the U.S just after four days of trading. Following which the net short exposure has expanded even more. Last week, it experienced a rise of 300%. The launch of BITI comes at a time when BTC/USD has reached a low of $17,600.

Shorts Are The Hype

However, analysts still remain hopeful that the downside situation will take turn. The BITI inflows also indicate that the institutional sentiment is complying with it. CoinShares reveals that the weekly inflows into Short BTC products were recorded to be at $51 million as per the latest data.

Even though shorts are the hype and the long BTC investment is only $20 million, there is an increased demand for such products. CoinShares further added that this points towards the fact that investors are adding to long positions at current prices. The reason investors are attracted towards shorts could be because of their first-time accessibility. And not because of the renewed negative sentiment.

GBTC Premiums Continue to Run Negative

Meanwhile, Bitcoin investment vehicle, Grayscale Bitcoin Trust (GBTC) continues to face tough times. Grayscale started a legal action after the SEC rejected its application to convert the Trust to a Bitcoin spot ETF. GBTC premiums are running in negative for a year now. At various points, it is recorded at over 30%. GBTC Premium is the difference between shares of GBTC and Bitcoin spot price.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News