Soon after the fall of prominent crypto exchange FTX, almost every other player in the crypto exchange space started their innocence. Leading crypto exchanges came forward and started showcasing their financials, balance sheets and holdings info—partially, if not completely—without someone asking for it. Crypto.com and Coinbase were seen to lead the race along with other exchanges.

CEO Assuring of Coinbase Reserve’s Security

Coinbase CEO, Brian Armstrong went on to Twitter and posted a long thread detailing about the assets and reserves within the crypto exchange. He assured the assets kept with the firm are completely secure and backed one to one.

Armstrong started with sympathy for those affected by the FTX collapse. In addition he stated that Coinbase had neither exposure to FTX or its native FTT token nor with its sibling trading firm Alameda Research. While explaining the current situation in his long thread of Tweets closing up with a blog with more details on the firm’s “approach to transparency and risk management.”

Coinbase claims that it has assets and holdings of its customers in one to one ratio. It signifies that the firm has funds for the customers which are available “24 hours a day, 7 days a week, 365 days of the year.”

Crypto.com Went an Extra Mile

Leading US exchange is not alone in the race Crypto.com took this further with a window showcasing most of its holdings and their diversification.

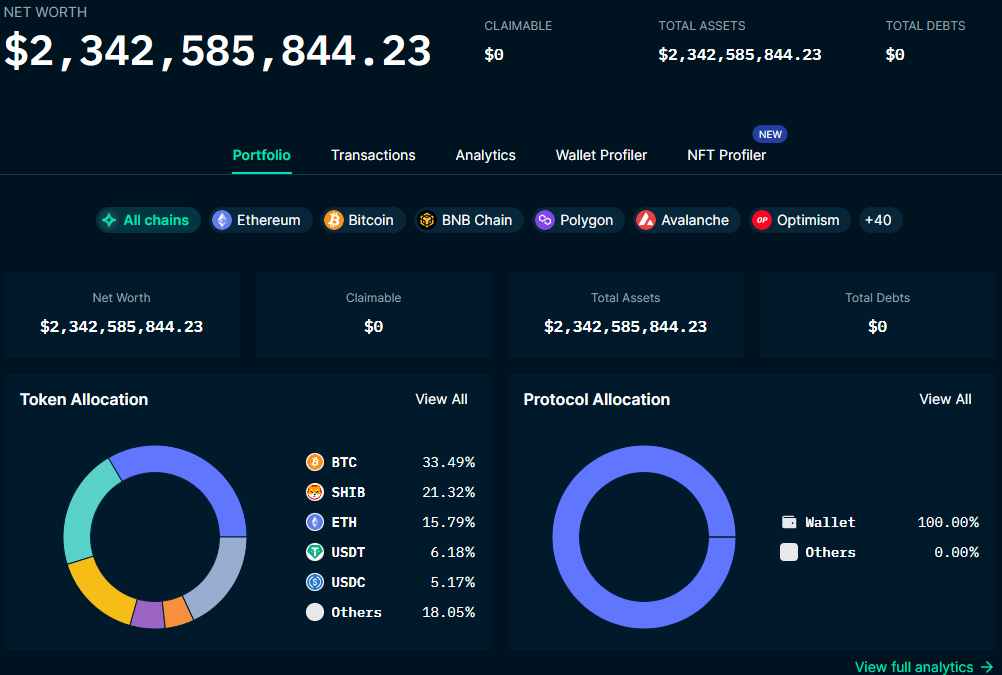

Crypto.com partnered with the blockchain analytics firm Nansen which created a profile of corroborated data of assets belonging to the crypto exchange. Although the dashboard released on Friday was only showcasing proof of reserve, but partially.

According to the finding, Crypto.com reserve holds about 33.49% of bitcoin (BTC), followed by Shiba Inu (SHIB) 21.32% and Ethereum (ETH) 15.79%. USDT and USDC stablecoins are about 6.18% and 5.17% of the exchange’s overall allocation, while 18.05% of it belongs to other assets.

Citing the dashboard, people within the crypto community started pointing out the comparatively larger holding of SHIB tokens than ETH. The company holds about 559 million USD worth SHIB while 481 million USD worth ETH. The biggest portion of the reserves held in bitcoin is worth 878 million USD.

Given the crypto community’s skepticism for Crypto.com holding Shiba Inu in abundance, CEO Kris Marszalek came forward to look into the matter. Marszalek said the crypto exchange has “one-to-one reserve of its customer’s assets” and also cited the reason for having more SHIB tokens simply because users have purchased it.

The initiative was not demanded but worth welcoming. Yet several lacking still stands as not showcasing the entire reserve holdings which are being promised would be seen in the future.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News