- Record number of BTC investors have withdrawn holdings from exchanges.

- As per Glassnode, such levels were observed only 3 times before.

- FTX crash is changing investor behavior of all categories of holders.

The data

Crypto and blockchain data tracker Glassnode reported on Monday that an increasing number of people are withdrawing their Bitcoin holdings since crypto exchange FTX filed for bankruptcy a few days ago; investors are choosing to “self-custody.”

Self-custody implies that investors are choosing to hold their crypto wealth in non-decentralized formats. FTX is essentially centralized which meant that the developer team running the exchange had control of all holdings and transactions connected to the exchange.

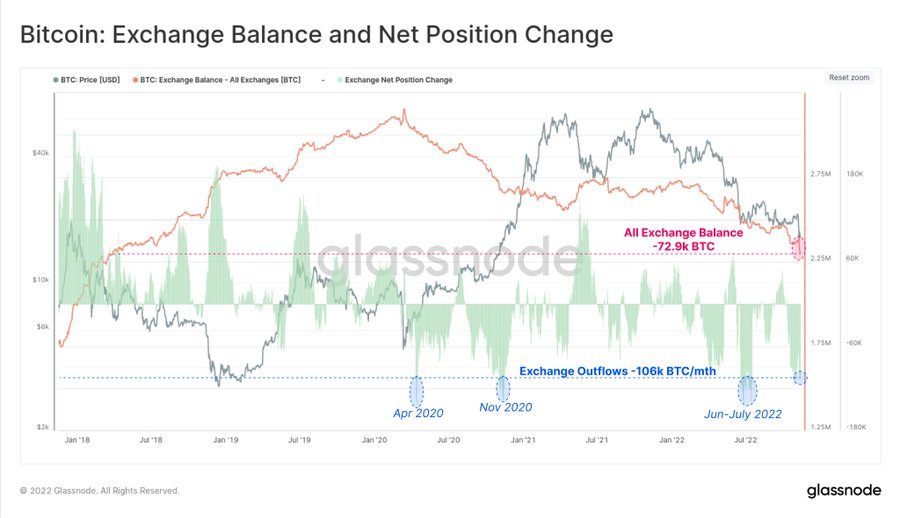

In a tweet dated November 14th, Glassnode reported that BTC was being withdrawn at the rate of 106K $BTC per month. The data tracking agency added that similar rates were observed only 3 times previously – April 2020; November 2020; and June-July 2022. Over $3 billion in Bitcoin has been withdrawn from exchanges till now.

Glassnode reported earlier that 90,000 wallets had received BTC from exchanges as of November 9th. It tweeted the snapshot of a graph in which the ‘Exchange Net Position Change’ was encircled at all the record levels.

Increases were reported in all categories of BTC holders: ‘shrimps’, ‘crabs’, ‘sharks’ and ‘whales.’ Over 33,700 shrimps were added on the chain (shrimps are BTC investors holding less than 1 Bitcoin); over 48,700 crabs were added (crabs hold between 1 and 10 BTC); over 78,000 sharks were added (sharks hold between 10 and 1000 BTC); and over 3,600 whales were added (whales hold 1000 or more than BTC)

Stablecoin deposits are on the rise while miners are struggling

While exchanges show decline in BTC and ETH holdings, stablecoin deposits like USDC are increasing in exchanges. At present, the ‘buying power’ stands at around $4 billion per month. On November 10th, $1 billion in stablecoins were added to exchanges. An all time high of $41.2 billion is held in stablecoin in exchange reserves.

Bitcoin miners are also under renewed pressure due to all-time-low mining hash prices. 7,761 BTC were distributed in the past week which was 9.5% of the balance held. Multiple big ticket mining corporations shut shop this year due to rising crypto price volatility, rising energy prices and rising hashrates.

Sam Bankman Fried (SBF), former CEO of FTX crypto exchange, announced that FTX was in a deep liquidity crisis and that the now-largest cryptocurrency exchange would buy it out. However, the exchange canceled the deal at the last moment explaining that FTX’s books were too messy for it to handle. FTX ceased withdrawals on November 11th and enforcement authorities stepped in soon after.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News