- Nouriel Roubini has called the cryptocurrency ecosystem corrupt and has asked who will bail out Binance

- Dr. Doom has also taken a swing at the Proof of Reserve concept. Meanwhile, BTC has seen a drop of 70% in the past 1 year.

The Crypto market has seen much criticism since Bitcoin’s inception. One of these famous crypto critics is Nouriel Roubini. Nouriel Roubini is one of the world-renowned experts on asset and credit bubbles. He made a name for himself in the financial meltdown in 2007-2008. In a conference in front of students, he predicted the housing market bust and submitted his findings to the IMF in the same year.

Roubini has been a long-term critic of cryptocurrency. He has even said that Crypto should not be called currency. He has appeared on various talk shows and interviews and criticized the crypto ecosystem. Recently, at a discussion forum, he called the crypto ecosystem Concealed, Corrupt, Crooks, Criminals, Con-men Carnival Barkers, and CZ.” He has also taken a shot at Binance CEO CZ and has asked, “Who is Going To Bail Out Binance.”

Is Roubini Right Not To Call Crypto A Currency?

A currency is a unit that can be scalable to many transactions and a stable store of value in terms of being a store of wealth and should offer purchasing power to buy goods and services. The Dollar and Euro are currencies as they offer stable purchasing power and are a single ‘numeraire’ across the globe. Now let’s look at cryptocurrency. There are more than 1000 units of exchanges, and due to extreme volatility, it cannot offer stable purchasing power. If any business or individual has purchased Bitcoin at around $60,000, they would have observed a loss of 65%! Meanwhile, there are other criteria where Bitcoin and other crypto assets fail to be called currency.

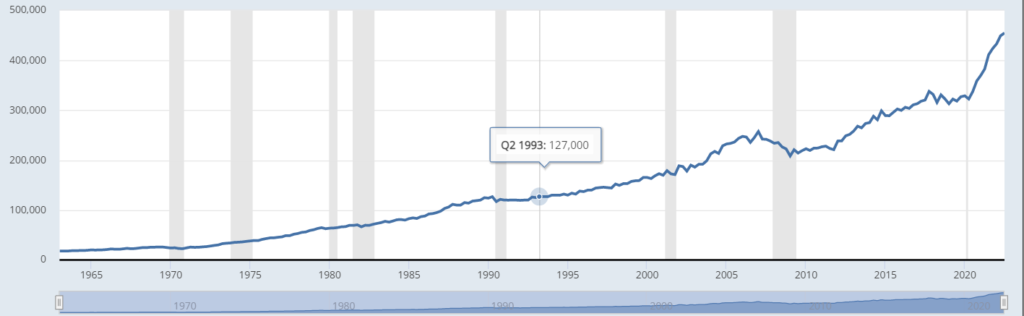

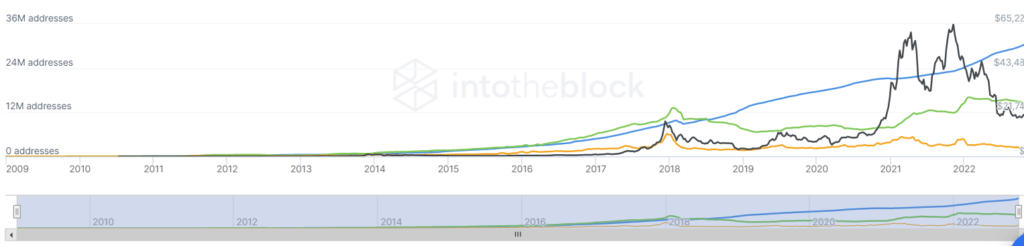

If we look at historical prices of crypto, they typically look like bubbles. Bitcoin’s inflation in the past few years has been worse than the South Sea or Mississippi Bubble. BTC has peaked more than 60x in the past few years. However, many Bitcoin enthusiasts have argued that it has beaten inflation and has given great returns. If we look at the holders and supply of BTC for the past few years, it was controlled by very few whales who have been dominating the market. Meanwhile, more than 85% of the holders came after BTC peaked at $20000 in July 2017.

If we look at July 2017, the number of Holders was around 6 Million, and the value of holders peaked at 33 Million in 2022. Meanwhile, BTC’s traders increased from 2 Million in 2017 to 3.3 Million in 2022, which changed how the price behaves in this ecosystem.

There are various to and fro in the crypto space if we look around the currency part, but it has given one thing, which according to many, is one of the greatest assets, and that is decentralization.

Beware Of ICOs Bearing Gifts

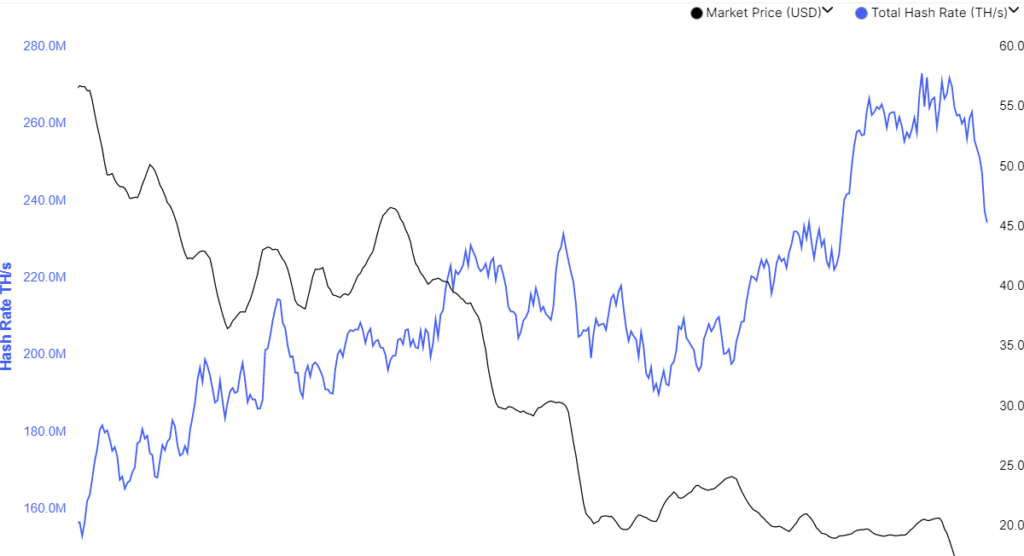

Dr. Doom has always been skeptical about the decentralization of cryptocurrencies. If we look at the ratio of the volume of the centralized exchange (CEX) to the decentralized exchanges (DEX), it is equivalent to 45. It means CEX has 45X more volume of BTC than DEX. Dr. Roubini says more than 90% of transactions occur through centralized entities. Many people have argued about the Proof of Work and Proof of Stake as a way to decentralize. As per a report by Cambridge Bitcoin electricity consumption index

44.95% of the global hash rate is generated through North America by a few companies and 20% through provinces in china. BTC mining could become more centralized in the near future.

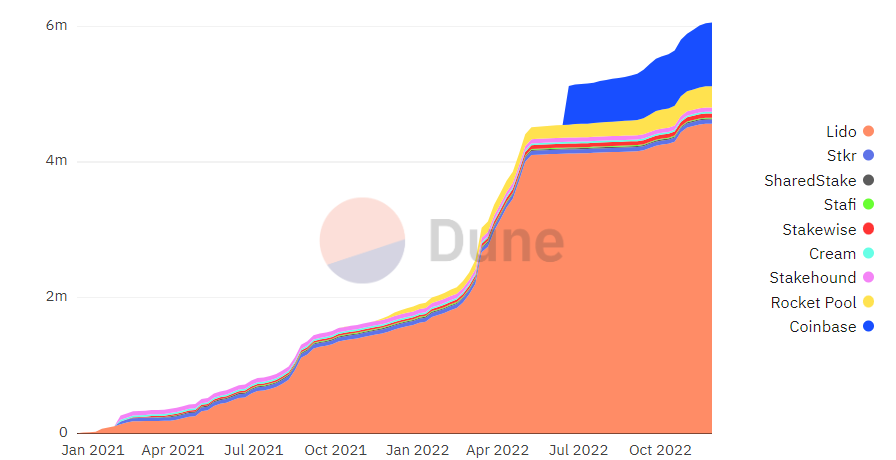

If we look at the Ethereum 2.0 liquid staking pool, more than 69% of the stake is controlled by Lido.

Coinbase has a 13% stake in ETH 2.0. Vitalik Buterin once said that there is an inconsistent trinity in Crypto: “You cannot have at the same time a system that is scalable, decentralized, and secure. You can choose, at best, two out of three.” It looks like he has chosen the first and last.

Looking at the given figures, we can safely agree with Dr. Doom’s statement that Crypto is not as decentralized as we think.

Initial Coin Offerings or ICOs saw its peak in 2017, when anyone could develop anything and make people invest millions of dollars in their projects. Eventually, they scam their users and flee with their money. The narrative of the story has not changed much. Dr. Nouriel has criticized these types of ICOs and has urged people not to fall into the trap. If we look at the Uniswap Dex, it consists of more than 40,000 smart contracts. Since its inception in 2018, the DEX has processed more than 1 trillion in volume. Recent findings by the University of Barcelona have shown that more than 98% of the ICOs on UNISWAP from 2018 to 2021 were rug-pull schemes. Many analysts have questioned the inefficiency of the method, but it is not uncommon to see such rug-pulls. There are a lot of such fake ICO in various ecosystems, but now it has developed itself as an NFT scam.

FTX, Binance, Proof Of Reserve And The Falling Dominos

It is clear that Nouriel Roubini is no friend of crypto exchanges and is not a fan of Proof Of Reserves either. Proof of Reserves has been praised by many as a way to check the balances of crypto exchanges. However, Dr. Doom has other thoughts. In a recent tweet, he said that Proof Of Reserves is a gimmick to fool the commons.

Proof of Reserves (PoR) is the gimmick used by crypto exchanges/lending platforms to pretend that their customers funds are safe. As these assets are in the exchange custody they are on its balance sheet & customers assets aren’t safe in bankruptcy. These are banks NOT exchanges!

— Nouriel Roubini (@Nouriel) November 22, 2022

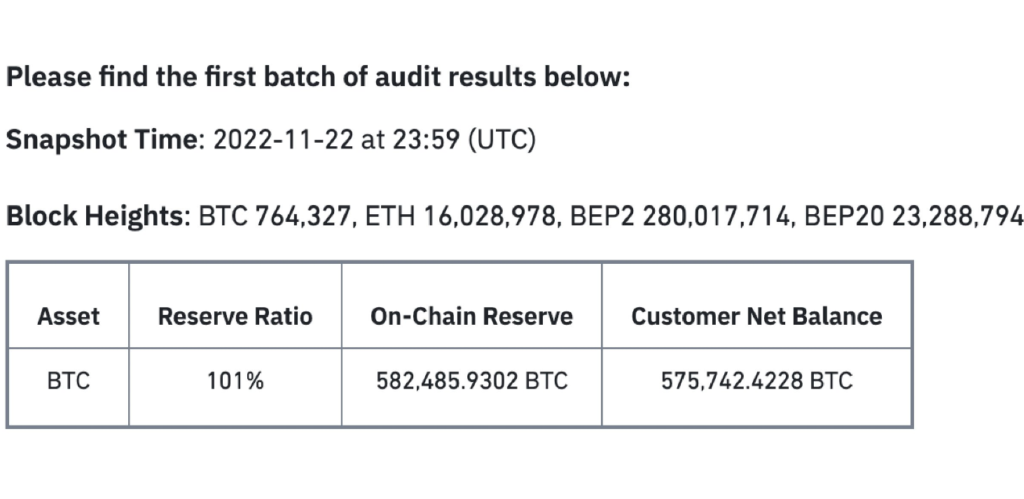

Binance has recently given Proof Of Reserve Audit, which according to various analysts and Gemini co-founders, is a scam. If we look at the audit, we can see they have their reserve ratio as 101% but have failed to mention the liabilities.

Binance has also deployed approximately $ 1 billion BUSD for the crypto market recovery. The question here to ask is why only Busd. They have renamed the fund ias Binance Industry recovery initiative.

https://etherscan.io/address/0x043a80999cee3711d372fb878768909fbe7f71e6

The movement of the funds from the Cold wallet has also been suspicious. Many people claim that nobody moves $2 Bn for an audit. Meanwhile, CZ has defended his position and said there would be third-party audits

Binance has always been in the limelight since the FTX bankruptcy. In a conference in Abu Dhabi, Dr. Doom urged the Emiratis to expel Binance exchange founder Changpeng “CZ” Zhao, who is a resident of the United Arab Emirates and has a license to operate in the country. He has also stated that Binance is banned in the UK from trading and is under investigation for illegal money laundering by the US justice department. Roubini has a reputation for being a pessimist on Wall Street and has also issued a recessionary warning for the global economy.

Will Binance sustain and prove such critics wrong? It is time to tell.

It Is Difficult To Argue With The Belly, For It Has No Ears

For many people, Crypto has been a get-rich-quick scheme. They want to enter the market, become rich fast and exit. This makes them vulnerable to false schemes like FTX. They fail to recognize that money does not come out of thin air. They expect 100x or 200X returns within a short span of time, which is impossible. Despite several harsh warnings by the critics like Nouriel Roubini, retailers are dazzled by the crypto-verse. If we look at recent data, Bitcoin is approximately 20% down from its 2017 high. Companies like BlockFi, DCG and various other ‘giants’ have gone bankrupt. Roubini called BlockFi’s bankruptcy filing the “The domino of crypto extinction.”

Many people have lost their hard earned money to rug-pull schemes like FTX. There is no strict regulation to help you get your money back if one of these crypto companies goes bankrupt – no matter how big they are. Exchanges have been accused of hiding their liabilities and claim their users’ funds are “protected.”

It would be unfair to say that Blockchain and Crypto have not revolutionized Finance. But the hype surrounding crypto is not good. Critics like Dr. Roubini are needed to keep the crypto industry in check. Crypto has become a playground for institutions as their greed has no end. If one plays greedy in this market, one can get trapped. Someone has correctly said, “We are all born brave, trusting and greedy and most of us remain greedy.”

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News