- Exchequer Chancellor introduced 30 regulatory reforms to boost economic growth post-Brexit.

- Issuance of CBDC, their digital pound, is part of the reforms.

- Financial Market Infrastructure Sandbox will be launched in 2023.

Every living entity needs a favorable environment to grow. Likewise, an industry needs an ecosystem of encouraging surroundings to boom. Post-Brexit, the UK is now bringing in 30 regulatory reforms favoring cryptocurrencies to boost the sector.

🚨NEW: “When the UK Financial Services Act 2023 Becomes Law, All the Power Will be Vested in the TREASURY to Introduce the CBDC [hypothetically due to a possible emergency situation]”

— SPiR!TVAL | Deaton 4 Senate (@truthcrumbs) December 9, 2022

-Former Swiss Bank Director pic.twitter.com/t5Hocge6ij

Exchequer Jeremy Hunt, the Chancellor, had shared a bundle of 30 regulatory reforms to boost the economic growth post-Brexit for the UK’s financial services. Issuance of the UK’s digital pound, their very own Central Bank Digital Currency (CBDC), experimenting with the blockchain while the expectation of investment in crypto business, made the cut.

‘Edinburg Reforms’ is the name of the Chancellor’s 30-point reforms released on Friday. This is meant to “turbocharged growth,” pushing the UK’s financial sector at the leading edge of innovations.

The UK government may soon come up with something on CBDC establishment. The Bank of England and Treasury is currently investigating the digital pound. This comes in the wake of many jurisdictions worldwide unanimously working on their respective central bank-backed digital coin.

The Investment Management Exemption is about to come in crypto, which ought to bring foreign investors bringing funds into the crypto industry of the United Kingdom. This could be a lucky break for crypto assets.

The recommitment of governments for Financial Markets Infrastructure Sandbox will allow the crypto firm to experiment with decentralized technologies in a supervised space. This sandbox is expected to launch in 2023.

With such technology, consumer protection is of paramount importance. And the ‘Edinburg Reforms’ have thought of it and allowed this to be an important part of the reforms. Now, To encourage cut costs and innovations, the government is looking to reform the Consumer Credit Act of 1974.

Benefits of ‘Edinberg Reforms’

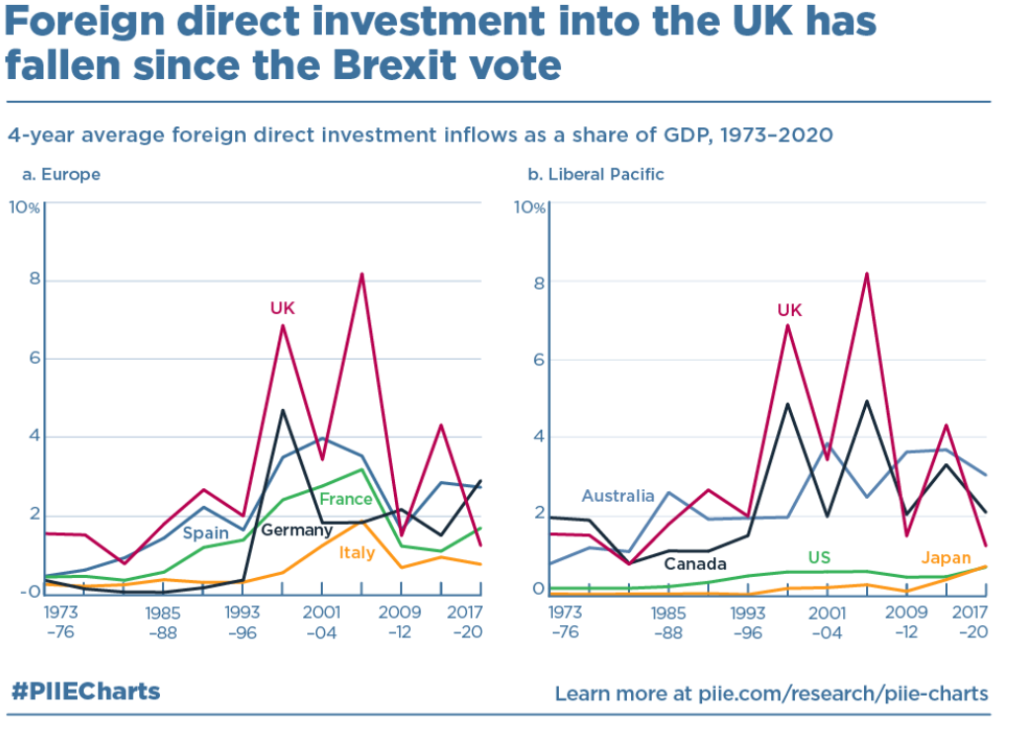

These reforms are expected to boost the UK’s economy as the county is going through financial turmoil post-Brexit. This will boost investments in the crypto industry, both international and domestic. Moreover, the distrust is caused by recent events in the crypto industry, shall be addressed through them. Also, Foreign Direct Investment (FDI) dropped post-Brexit considerably.

The above chart shows a clear drop in FDI and a steep decline from February 1, 2020. The date when the UK announced its Brexit.

Countries working on CBDC.

The island nation of Bahamas became the first to launch its CBDC, called the Bahamian Sand Dollar, in 2020. Followed by Argentina CBDC, Australia wholesale CBDC, Avant, Azerbaijan CBDC, Bangladesh CBDC, etc.

Recently Indonesia has launched a three-step program for their CBDC, in which the first step is the issuance of Whole sale cryptocurrency for interbank settlement. The second step is issuance for retail purposes, which daily use cases will follow in the third step.

The crypto industry welcomes such steps. The involvement of jurisdictions worldwide will boost investments, launch new and exciting projects, and finally bring the bull market back.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News