- ASIC miner is now available at a very low price for specialized mining equipment.

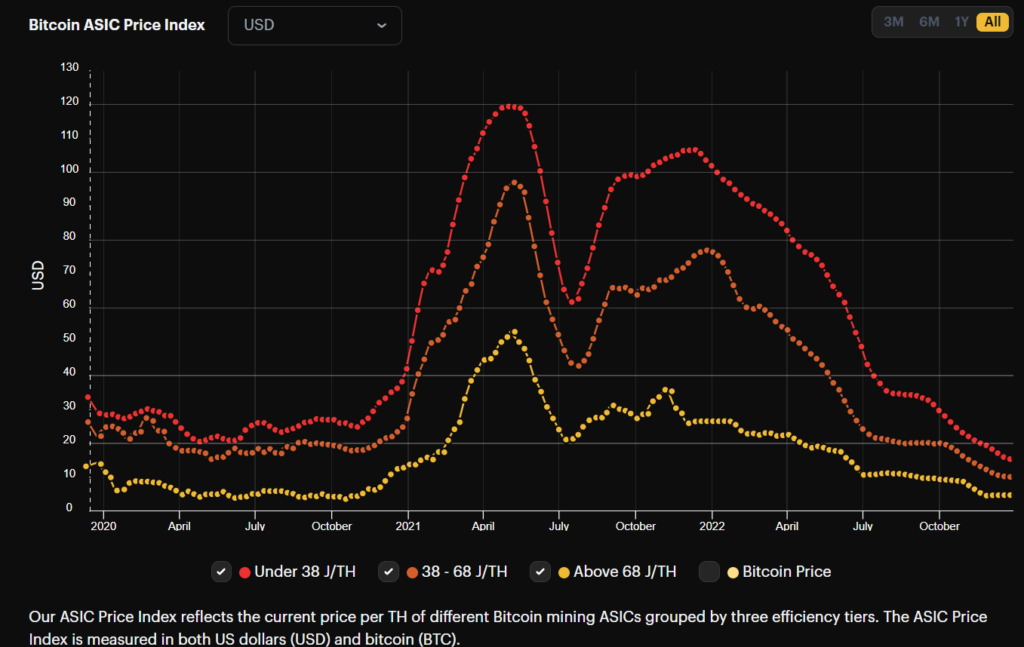

- Tier-I, Tier-II and Tier-III ASIC machines are available at 86.82%, 89.36% and 91% discounts, respectively.

- The discounted price is per May 2021 prices.

Another negative news for Bitcoin miners who are already suffering from a trifecta of problems rising electricity prices, increasing difficulty and dropping BTC prices. ASIC mining machines are selling for the lowest price since 2020, which is being viewed as another sign of the ongoing bear market.

Per the latest data from Hashrate Index, the most efficient ASIC miners generate at least one tera hash per 38 joules of energy. And these machines are available at an 86.82% discount concerning May 7, 2021 price, which was $119.25 per terahash and is now down to $15.71 by December 25, 2022.

This category of miners includes Bitmain’s Antminer S19 and MicroBTC’s Whatsminer M30s.

The mid-tier mining machines’ prices have also reduced, averaging at $10.23, which were previously sold for $96.24, meaning an 89.36% drop.

The least efficient machines in the list are the ones that use more than 68 joules per terahash, which are now priced at $4.72, which were previously priced at $52.85, meaning a 91% drop.

This drastic fall in price can be attributed to the recent problems major mining companies are facing as they struggle to remain profitable in 2022. They are either filing for Chapter 11 bankruptcy, cutting down losses, selling their BTC holdings and equipment, or taking debts just for survival. Major firms that have done some or all of these to stay afloat are Core Scientific, Riot Blockchain, Bitfarm, Marathon Digital and Argo Blockchain.

Another side of the coin

As every coin has two sides, this steep fall has been a piece of relatively good news for some buyers, as many Russia-based mining facilities, like BitRiver, was able to capitalize on comparatively low electricity prices, equipped with some up-to-date hardware were capable of mining 1 BTC at just $0.07 per kWh.

In the run-up to the previous halving in May 2020, ASIC prices were still moving downwards. Prices started bottoming around the halving itself and moved up aggressively once the parabolic phase of the bull market started. pic.twitter.com/1KcPipRGXh

— Nico Smid (@Smidnico) December 20, 2022

It could be very early to predict the next move of these ASIC miners’ prices; Nico Smid of Digital Mining Solutions pointed out in his tweet on December 21 that the ASIC miners’ prices were also low during the last halving cycle and had aggressive moves from then on. Similar things could be repeated as the next cycle is on April 20, 2024.

After Effects of the price drop

It is known that Bitcoin miners are suffering from a trifecta of problems, and most institutional miners have either left the industry, barely surviving the harsh environment, or have filed for chapter 11 bankruptcy. Some have even outsourced their facilities or shut down existing facilities to cut costs.

This massive exit of miners from the cycle should trigger the lower difficulty level scenario; coupled with cheaply available mining equipment; miners could have a boost. Although all these are mere speculations at the moment but plausible.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News