- There has been a considerable drop in volumes since January 2022.

- Uniswap managed to get a trading volume of $1.9 billion and TVL at $3.57 billion.

- The global cryptocurrency market grew by 6.24% in the last 24 hours.

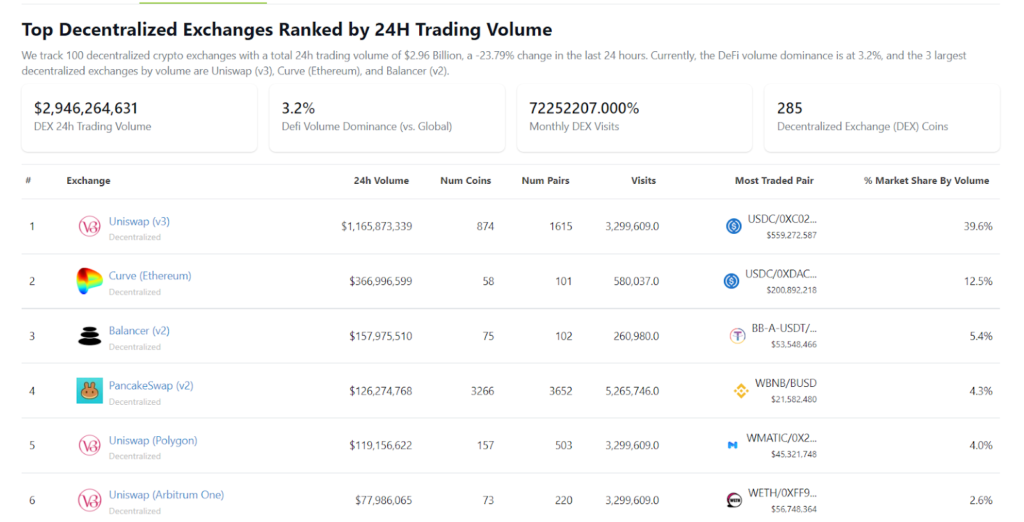

Ever since the advent of crypto winter, the whole industry has been battling lower trading volumes, and this has been a major cause for the lackluster performance of almost every coin and token. Statistics show that there has been a noticeable drop in Decentralized Exchange (DeX’s) trading volumes since January 2022.

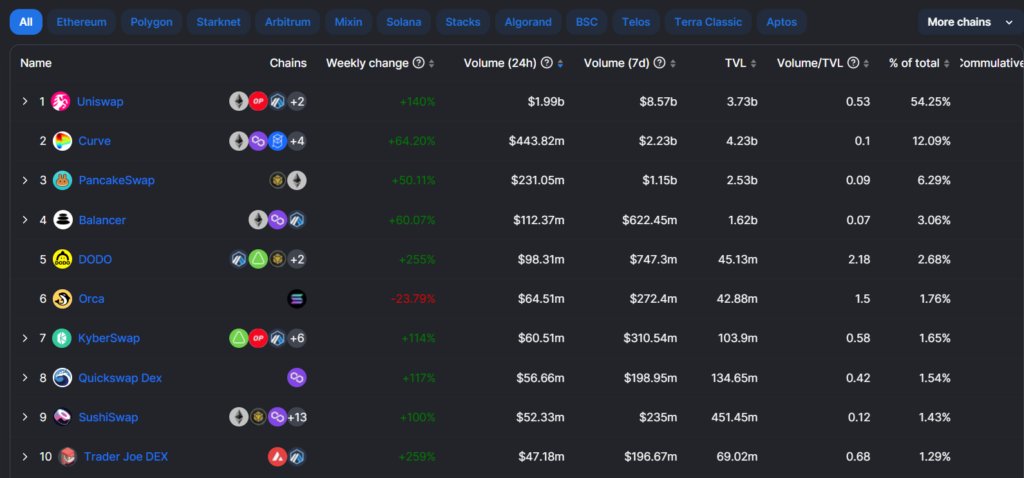

DeXs saw a spike in volumes in November 2022 but has been lackluster for the past 44 days. Uniswap version three(V3) saw the highest trading volume at $1.9 billion and the second highest Total Value Locked (TVL) at $3.57 billion in 24 hours on January 14, 2023. Metrics also highlights the second-largest trade volume in 24 hours on Saturday at $399 million and the highest TVL with assets locked on the DeX platform at $4.19 billion.

Domination of Uniswap V3

The first two weeks of January 2023 saw a relatively lower performance, but on January 13, 2023, metrics show that there has been a global swap of $15.33 billion settled among DeX platforms.

Just last month, DeX protocols saw nearly $43.65 billion in swaps, which means that the first two weeks managed to reach 35.12% of last month’s volume, a much-required feat.

As in the last 24 hours, the recent global cryptocurrency market prices saw a growth of 6.24%; DeX volumes have also been fueled and grown over the past few days, where Uniswap V3 managed to ride atop on volume wave capturing $1.9 billion swaps in last 24 hours.

The leader here, Uniswap, is followed by Curve with $399 million volume, Balancer with $190 million, Pancakeswap with $176 million, Uniswap Polygon with $164 million, Uniswap Arbitrum with $142 million, Sun.io with $132 million, Uniswap V2 with $91 million and Uniswap Optimism with $77 million.

Noticeably the top five smart contract platform tokens managed double-digit gains last week. Ethereum grew by 20.6%, BNB by 16.6%, Cardano by 25.4%, Polygon by 23.2%, and Solana by the highest of 68.5% against USD over the last seven days.

The smart contract platform coin economy jumped 8.5% against USD in the last 24 hours. Data hints that DeX Curve is the top DeFi exchange, with maximum TVL on Saturday.

At the time of writing, Curve managed $4.19 billion TVL, Uniswap did $3.57 billion, followed by Pancakeswap with $2.46 billion, Balancer with $1.61 billion, Sun.io with $578.83 million, Sushi with $448.9 million and Biswap with $232.3 million.

While there has been a decline in DeX platform volumes, centralized spot market exchanges have also seen a decline in volume in the last few months. As far as Cex and DeX trading volumes are concerned, it’s a relief from crypto winter, especially when December 2022 was the hardest.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News