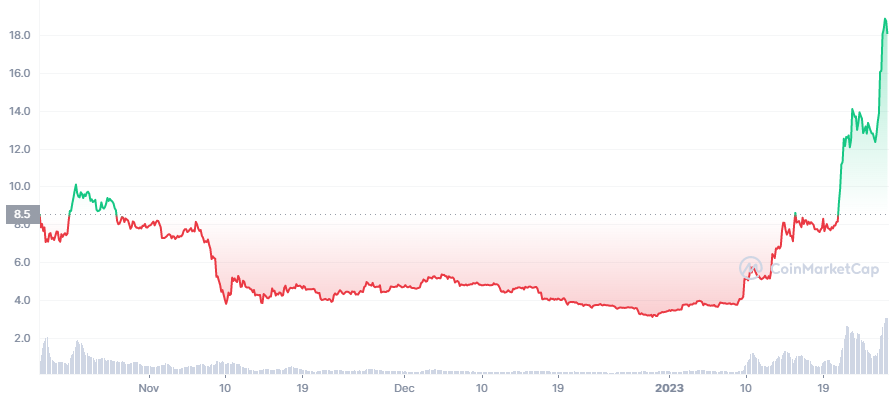

Aptos, a Layer 1 Proof-of-Stake blockchain’s APT token, recently marked its one-year high with an increase of more than 500%. Along with Bitcoin, APT is following the bullish trend. In recent hours, the token climbed around 35% from its trading price of $13.6 to its current trading price of $18.42.

The current trading price of Aptos was $18.42 with a 24-hour trading volume of $2.87 Billion. Aptos is up 35.45% in the last 24 hours, with a current market cap of $2.95 Billion.

APT is the native token of the Aptos blockchain. It is following a bullish trend since the beginning of this year. The reason for this price surge is not yet clear, but as data indicates, half of APT’s $2 Billion volume in the past day has come from the South Korean won trading pair on Singapore-based crypto exchange, UpBit.

Last year, the S. Korean crypto exchanges frequently list digital assets at higher prices than their global counterparts; the difference has been dubbed the “Kimchi premium.” The Office of Seoul Central District Prosecutors opened an investigation into 2 Billion Korean won worth of illegal remittances generated by arbitrage traders taking advantage of it.

At present, Aptos is one of the largest Defi ecosystems, according to Defillama. It has grown significantly in the past month. Meanwhile, the DeFi volume on Aptos moved from $14 Million last month to $51 Million in January.

It can be seen that Aptos outperformed the market since the beginning of 2023, but it did get off to a rough start when it’s mainnet launched in October. Meanwhile, the project gained a lot of backlash for not releasing its tokenomics sooner than it did. Criticism of Aptos was piled as it promised speeds of up to 150k transactions per second, which indicates speeds of 4 transactions per second after its big debut.

Aptos Co-Founder, Mo Shaikh, noted on Twitter at the time that it was a sign of “the network idling ahead of projects coming online.” And the Aptos supporters include many of the venture capital firms that have become mainstays in the industry: Andreessen Horowitz, Multicoin Capital, Jump Crypto, Tiger Global Management, Blocktower Capital, and Coinbase Ventures.

In the run-up to the launch, the project closed a $200 Million strategic round and a $150 Million Series A round. The list also adds two companies that filed for bankruptcy: Hedge fund Three Arrows Capital and Sam Bankman-Fried’s FTX Ventures.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News