- Meta recently announced earnings of February 1, 2023, with the next expected date being April 26, 2023.

- Statista estimates that Metaverse will reach 700 million people by 2030.

- Revenue-wise, the highest would be e-commerce, followed by gaming.

The social media conglomerate changed from Facebook to Meta on October 28, 2021. The owner and founder Mark Zuckerberg, who is very passionate about the metaverse, considered this a radical step. This was a clear sign of how serious he is about the metaverse; however, the company’s newest financial statement shows that the billions of dollars plunged into the project were worth the reward.

Facebook Changes Name to Meta in Embrace of Virtual Reality pic.twitter.com/jq1vE5V0zS

— Digibase (@cryptosbase) November 28, 2021

Was the decision right?

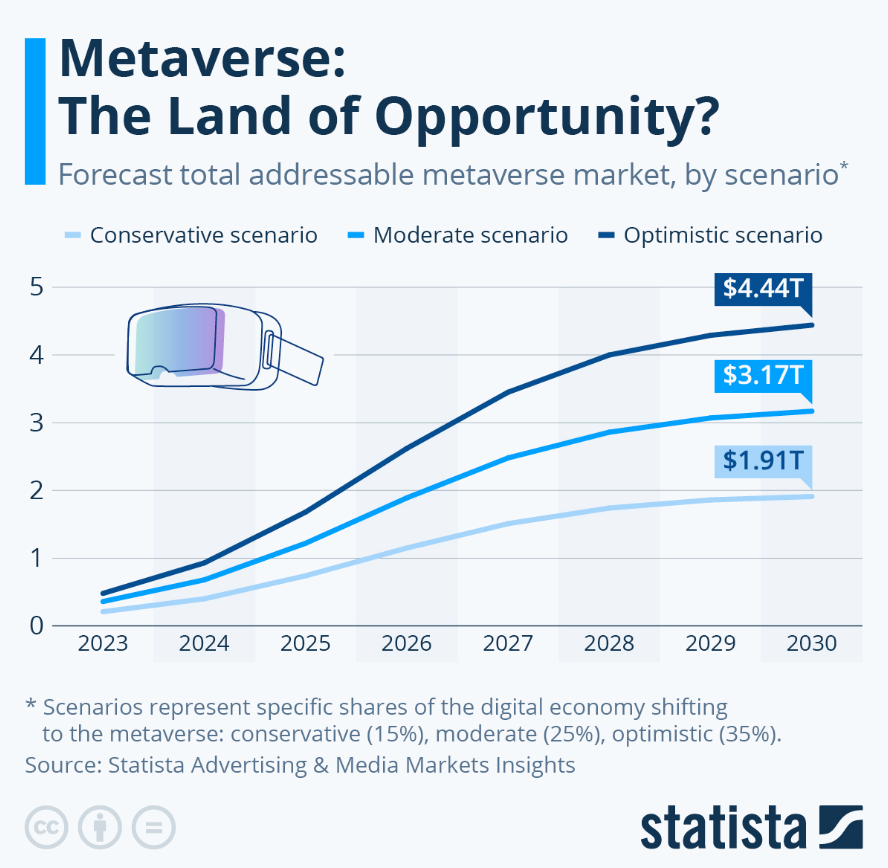

With everything happening around the metaverse, newer players entering the area, and the buzz it is creating worldwide could hint at the positives of the decision. A forecast by Statista gives a glimpse of the results. It even looked at the conservative addressable market scenario, where 15% of the digital economy had shifted to the metaverse, clearly showing that Zuckerberg, if supposedly shooting for a bull’s eye, has successfully hit very close to the target.

Statista Analysis

Statista, the Hamburg, Germany-based company, specializes in market and consumer data, providing statistical reports on market insights, consumer insights, and company insights in various languages like English, German, French, and Spanish.

Its analysis says that the biggest revenue segment in 2030 would be e-commerce with $201 billion, and gaming with $163 billion. By the end of this decade, the Metaverse is expected to expand its reach to 700 million people worldwide, and South Korea will lead the penetration, according to the forecast.

How is META doing?

At the time of writing, META was trading at $186.53 with a correction of 1.19%. It previously closed at $188.77 and opened at $183.46. It has a market cap of $494.59 billion, with a volume of 76.62 million shares. Analysts have given a 2.70 rating for moderate buy. The upcoming Earning date is estimated to be April 26, 2023, and the actual EPS as on February 1, 2023, was $3.00.

The estimated price target is around $203.10, with a 9.3% upside. However, the higher limit is around $290.00, while the lower limit is expected to be around $80.00.

Meta-Chart Analysis

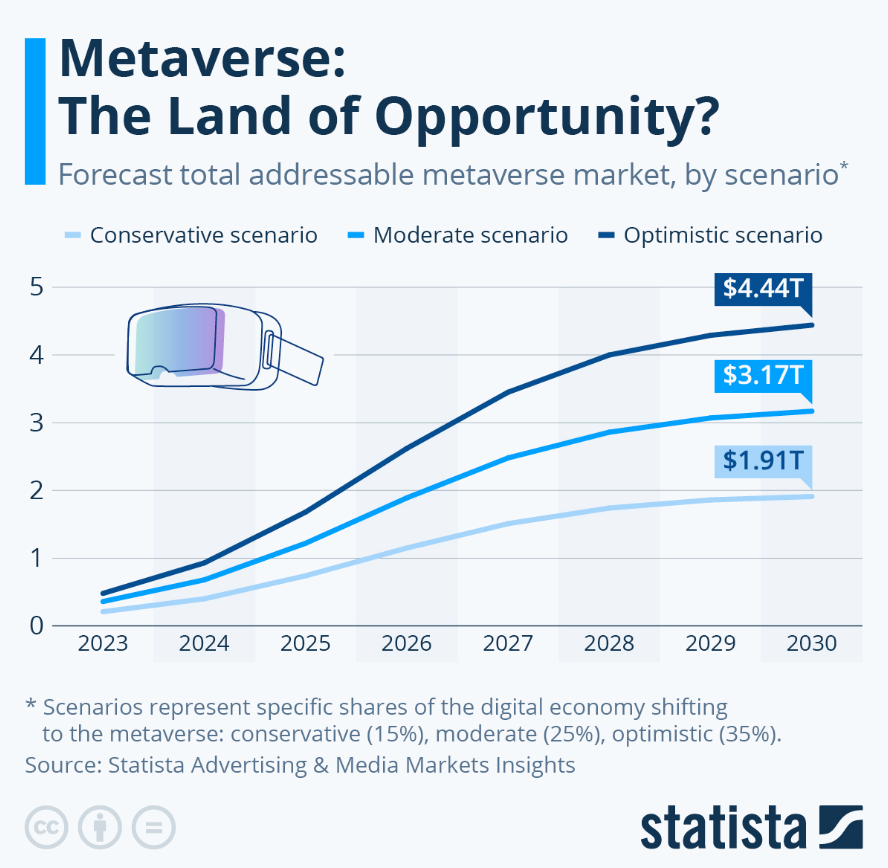

Meta recently announced earnings on February 1, 2023. This fueled the buyer to create a gap-up opening and a support zone in the process. Whenever such a gap-up appears, the price comes slightly down to fill it; it may or may not happen immediately. But still a possibility nonetheless.

If the price moves upward, it is expected to consolidate between the support zone and the supply zone, which is marked by S1 at $236.42 and S2 at 253.16. If the price action enters the supply zone, it will consolidate here for a while before finalizing a direction to break. Either north or south, that would depend on market sentiments.

The consolidation between the support and demand zones would present decent buying opportunities; as the zone is in a stronger position, a piece of negative news or sentiment in the market would push the price below the zone. So it can be assumed that the price might not be going below the demand zone for some time.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News