- Last year was the biggest year ever for crypto hacking with $3.8 Billion stolen from DeFi Protocols.

- The North Korea-linked hackers almost exclusively used Tornado Cash to launder cryptocurrency stolen in hacks.

Earlier this month, Chainalysis, the Blockchain analysis firm, released a report. In which the firm added that 2022 was the biggest year ever for crypto hacking with $3.8 Billion stolen from cryptocurrency businesses.

1/ #DeFi protocols as victims accounted for 82.1% of all #cryptocurrency stolen by hackers — a total of $3.1 billion — up from 73.3% in 2021.

— Chainalysis (@chainalysis) February 1, 2023

In this 🧵we dive deeper into this👆and take a look at the role of North Korea-linked hackers.https://t.co/l1OJ9p5jEC https://t.co/f4IGk3gPhI pic.twitter.com/PaqcWQaBJX

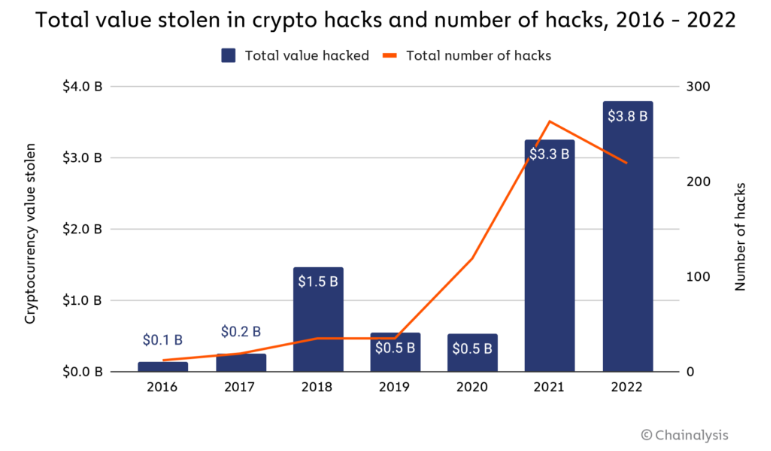

As clearly seen in the above chart, the total value stolen in crypto hacks from 2016 to 2022.

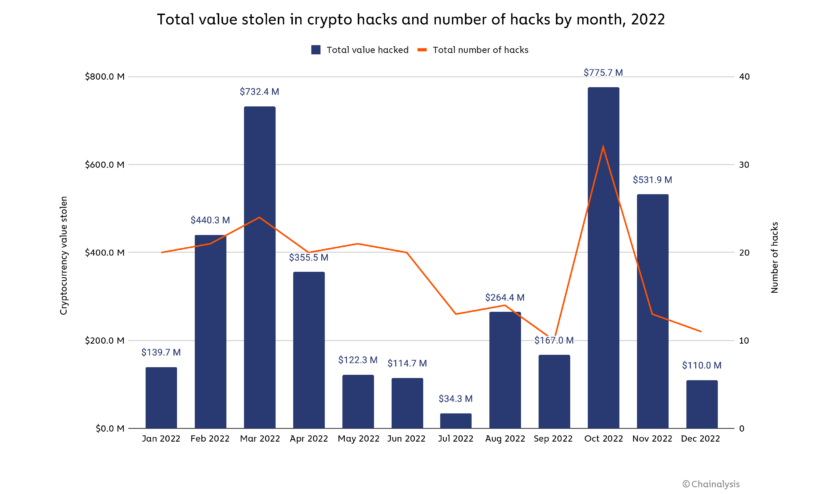

Moreover, the hacking activity “ebbed and flowed” throughout the year, with huge spikes in March and October the latter of which became the biggest single month ever for cryptocurrency hacking. From the above chart just in October month around $775.7 million was stolen in 32 separate attacks.

The crypto platforms affected by the Hacks

Several crypto-linked platforms were most affected by the hacks. While the role of North Korea-linked hackers drove much of last year’s crypto hacking activity and shattered their own yearly record for most cryptocurrency stolen.

DeFi protocols were the biggest victims of cryptocurrency hacks. According to last year’s Crypto Crime Report, Chainalysis wrote about how decentralized finance (DeFi) protocols in 2021 became the primary target of crypto hackers. And then in 2022 the trend intensified. As victims, DeFi protocols “accounted for 82.1% of all cryptocurrency stolen by hackers — a total of $3.1 billion — up from 73.3% in 2021. And of that $3.1 billion, 64% came from cross-chain bridge protocols specifically.”

Cross-chain bridges can be understood as the protocols that let users port their cryptocurrency from one blockchain to another. It is usually by locking the user’s assets into a smart contract on the original chain, and then minting equivalent assets on the second chain.

The report states that “Bridges are an attractive target for hackers as the smart contracts in effect become huge, centralized repositories of funds backing the assets that have been bridged to the new chain — a more desirable honeypot could scarcely be imagined.”

Chainalysis further wrote about how it makes DeFi safer in its report. It noted that “as all transactions happen on-chain, and the smart contract code governing DeFi protocols is publicly viewable by default, users can know exactly what will happen to their funds when they use them.”

The report said “the DeFi code auditing conducted by third-party providers is one possible remedy to this.” Chainalysis named the blockchain cybersecurity firm, Halborn, and suggested that it is one such provider, and “is notable for its clean track record — no DeFi protocol to pass a Halborn audit has subsequently been hacked.”

The Chainalysis also wrote in its report that the “North Korea-linked hackers such as those in cybercriminal syndicate Lazarus Group have been by far the most prolific cryptocurrency hackers over the last few years. In 2022, they shattered their own records for theft, stealing an estimated $1.7 billion worth of cryptocurrency across several hacks we’ve attributed to them.”

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News