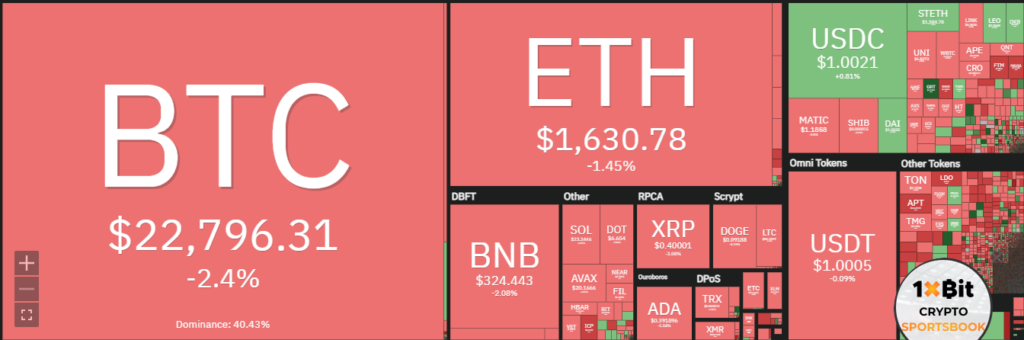

- Bitcoin last week marked the price range of $22K, after soaring above the $23K level.

- Additionally, the global crypto market cap is currently down by almost 2.39% over the last day.

Most of the cryptocurrencies are performing bearishly, which seems like they are waiting for the Fed Chair’s speech to regain and bounce back. While the Fed Chair Jerome H. Powell’s speech is scheduled for Tuesday on February 7th, 2023.

Notably, the global crypto market cap is $1.06T, a 2.39% decrease over the last day. And the total crypto market volume over the last 24 hours is $48.90B, which makes a 27.31% increase. The total volume in DeFi is $5.31B, 10.86% of the total crypto market 24-hour volume. The volume of all stable coins is now $42.41B, which is 86.72% of the total crypto market 24-hour volume.

The bearish crypto market

Bitcoin dipped after hitting the $24K level last week, which seems like the investors are waiting for the Fed Chair’s speech. After that some more price action can be seen in most of the cryptocurrencies. It can be expected that if crypto continues to rebound, venture capital in blockchain projects is likely to move upside.

However, most of the digital assets traded flat over the weekend. After an average start to earnings season, investors are thought to be looking ahead to Federal Reserve Chairman Jerome Powell’s speech, before they make any big decision.

According to the data from FactSet, “less than 1% of the companies in the S&P 500 reported earnings that were above estimates. This is below the five-year average of 8.6%, and the 10-year average of 6.4%.”

Last week, David Siemer, CEO of a SEC registered digital asset investment manager Wave Financial, said in an interview that the market is giving mixed signals and pointed out the resilience of consumers. He further added that the Fed’s actions may currently have a slow effect but it doesn’t mean it won’t eventually have a major effect. He said it will take around a quarter or two to see the actual results to the economy of the Fed’s actions.

Moving towards the crypto market, then the Chief Executive Officer of BitBull Capital, Joe DiPasquale noted that the crypto markets are “optimistic” after a modest rate increase. He added about Bitcoin that it will move around the $20K support level for the next few months, barring other unforeseen events and market action.

Last year was not good for the crypto industry and the new year brought some hope for the crypto investors. Major collapse may have shook up the confidence of major crypto enthusiasts, but the bounce back of Bitcoin in the last month gave some hope to them. And now it is expected that a 25 bps rate hike at the next FOMC meeting in March, so that half of the market expects no further hikes in May.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News