- Nikola (NASDAQ:NKLA) stock noted an increase of 22.33% in one month.

- However, $NKLA stock can dip more in its coming trading days.

Nikola Corp. (NASDAQ:NKLA) is an American manufacturer of battery-electric and hydrogen-electric vehicles, electric vehicle drivetrains, vehicle components, energy storage systems and hydrogen fueling station infrastructure.

$NKLA Stock Price Analysis

$NKLA stock noted a dip of 4.36% in its price on Monday. The stock was opened at the price of $2.82 and closed at $2.65. In one month of time-frame, the EV stock noted an increase of almost 22%.

The one week high of NKLA stock was noted at $2.98, while its low was at $2.43. The stock is down by almost 2.23% in one week.

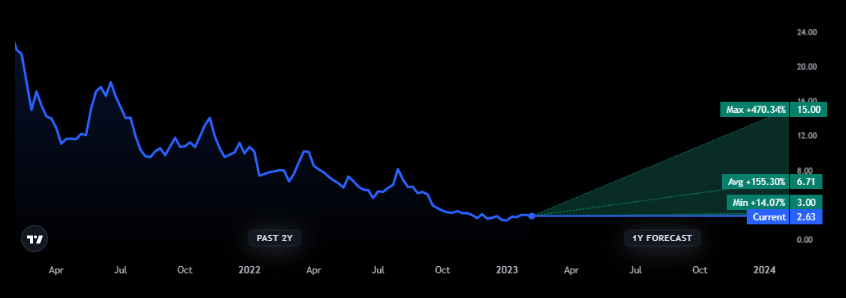

According to the technical analysis of Tradingview, it suggests strong selling of NKLA stock. While the price target for NKLA stock that seven analysts are offering in one year, price forecasts have a maximum estimate of $15 and a minimum estimate of $3.00.

Will NKLA be the best EV stock?

The Fed’s rate hikes and slowing economy maintains the selling pressure, thus $NKLA stock is said to be fundamentally weak stocks that might be avoided for now. But the fact can not be avoided that it may take quite more time for this stock to improve its performance.

The United States added around 517K jobs last month, which is far above the forecast of 185K, as Bloomberg reported. The unemployment rate in January was 3.4%, which is below the 3.6% economists’ forecast. The rising interest rates and a slowing economy have kept auto sales under pressure.

Due to rising concerns between the United States and China, it could be said that there will be disruption seen in the electric vehicle (EV) stocks. According to a Bloomberg report, “the U.S. keeps saying that it wants to set a “floor” under the relationship with China. Its recent moves against Beijing and new pressure from Congress make achieving that look increasingly unlikely.”

This would increase tariffs or other trade barriers, and make it further expensive for vehicle manufacturers to source components from China.

Additionally, the public and private investment along with robust demand amid global sustainability initiatives boosted the growth of EV market, high EV prices have damaged the sales.

It can be seen that the EV adoption is restricted by inadequate charging infrastructure. As a new report by S&P Global Mobility states, the U.S. needs to quadruple its charging infrastructure by 2025 and grow it more than 8x by 2023.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. Investing in or trading stocks comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News