- DeFi TVL on Ethereum Layer 2 Protocol jumped 50% in less than 2 months of 2023.

- Major protocols working on the network are believed to have fueled the growth.

2023 so far has proved to be a good year for crypto. Bitcoin is up to $24,596.70 at the time of writing hints towards positivity in the market. An Ethereum Layer 2 Protocol, Arbitrum also seems to be riding the happy waves, with its Total Value Locked (TVL) gaining nearly 50% in the last two months.

New Year, New Growth

The initial days of 2023 for the Ethereum Layer 2 scaling solution were on the base level of sadness and with low momentum. Whole Decentralized Finance (DeFi) market was greatly affected by the bearish market, harsh crypto winter, and major collapses. The TVL across the network went southwards. But as days passed, Arbitrum managed to gain some traction, recovering from this setback due to an increase in their TVL.

Earlier, the TVL was $1.05 billion, which jumped to more than $1.5 billion by the mid of February 2023. Representing more than 47% growth in the protocols TVL in less than eight weeks.

At the time of writing, the TVL stands at $1.6 billion, with a positive change of 6.73% in the last 24 hours. The GMX Dominance, however, is 30.97%.

What does this mean for Arbitrum?

This unexpected and happy incident places Arbitrum ahead of other protocols like Polygon, another layer 2 scaling solution on Ethereum. This caused the protocol to have a seat at the high table surrounded by Avalanche with TVL of $992.06 million, Fantom at $536.89 million, Solana with %256.9 million and Cardano at $120.74 million. Beating Cardano, Arbitrum now sits on the fourth chair.

The sudden Gusto; Why?

A crypto entity can grow only concerning its adoption. The same is believed to be the driving factor for Arbitrum TVL to rise. Noteworthy launches this year garnered much-required attention toward blockchains. And catering to this attention, visible growth can be seen across the market.

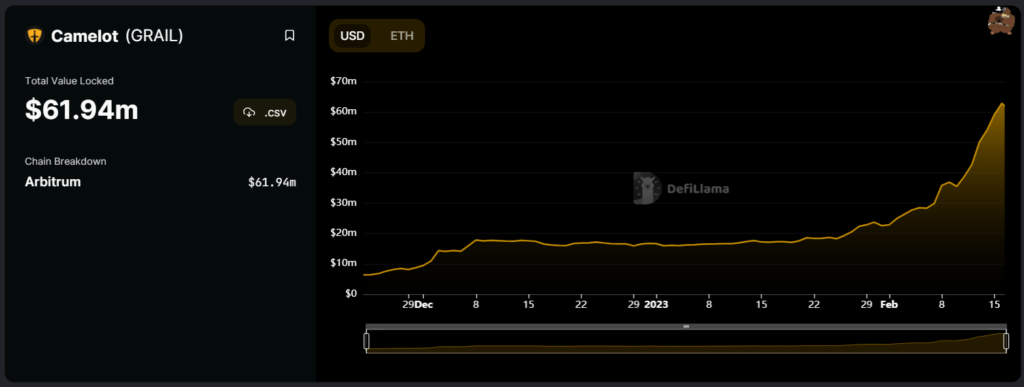

Camelot Decentralized Exchange (DEX) was launched in December 2022. Their native token, called GRAIL, performed exceptionally, hitting a high mark of more than $3,000. Overperforming other token releases, causing high demand on the network.

Other noteworthy protocols include a derivative platform called GMX, which has a current TVL of $600.61 million at the time of writing. Another launch on Arbitrum was Uniswap V3, which managed a TVL of $2.95 billion. Other important and noteworthy protocols include SushiSwap, ZyberSwap, AAVE V3, Curve and Synapse, all indigenously operating on Arbitrum.

Interestingly, Arbitrum does not have any native token and is powered by Wrapped Ethereum (wETH). It offers a considerably lower fee than other Ethereum Layer 1 blockchains.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News