- 1 Marred by recent failure, mStable governance is to vote for its future.

- 2 Possible options are merger, acquisition, or complete closure.

Community of DeFi protocol mStable are about to vote for the future of their decentralized stablecoin investments service. This service could not make the desired progress in recent months, as per the proposal from the community regarding the same.

MIP 30 – mStable Governance Path Resolution

The project has three options: it can either be merged with another crypto project, or another project can acquire it; if these do not work, they finally have to pull the plug on the service.

The Merger Option

Two major contenders, SpoolDAO and Idle Finance appeared for the merger. If it merges with the first contender, all MTA holders can swap their tokens with SPOOL tokens. They will then automatically become members of a thriving community/DAO, with additional benefits of currently offered mStable products.

If the community picks Idle Finance or Idle DAO, the stakeholders, products, and printers shall be preserved on both sides. The main goal here will be leveraging the existing resources to amplify potential outcomes. MTA tokens will be swapped to IDLE, meaning that mStable treasury assets will be converted to Idle DAO.

There will also be a potential transition of product focus; team migration will be taken care of, along with the consolidation of the respective product portfolio into a single one.

The Acquisition Plans

For the acquisition of protocol, two contenders are in the race, dHEDGE, and Origin Protocol. If they select dHEDGE, all the mStable products with uncompetitive yield will be migrated to a 20% APY offered by Torros Finance’s stable yield strategies– Significantly boosting mStable TVL. At the same time, the yield strategies can become mStable vault strategies.

If mStable is acquired by Origin Protocol, MTA holders can swap their tokens for Origin’s governance tokens. At the same time, the exchange rate will be determined at later stages but is supposed to be mainly based on mStable’s treasury value.

Pulling the Plug – Last Resort

If nothing works and governance finally decides to shut all the mStable products, the Builder subDAO is supposed to move immediately for the execution of product shutdown. The product shutdown is expected to be over by April 2023, and the governance proposal will define the timeline for MTA and DAO.

If the voting is finalized before April 1, 2023, the customer support and hosted front end should be available until September 30, 2023.

mStable, where does it stands now?

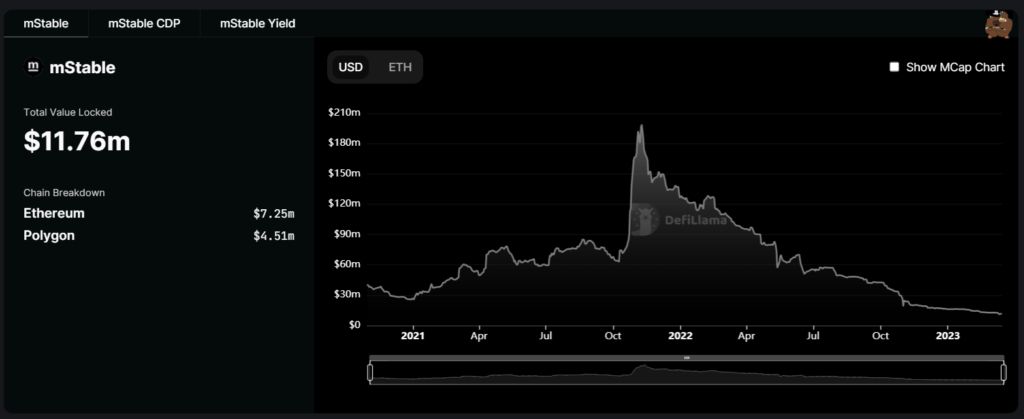

These decisions are considered last-minute efforts to save the DeFi protocol from doom. The last few months were not good for the protocol and were dotted with numerous setbacks, like an uninspiring user adoption rate and depleting product revenue. At the same time, many top leaders exited, including its co-founder. The TVL of $11.76 million is a sad affair for the protocol.

If no significant change occurs in the plans or content, the proposal will be moved to a Snapshot vote, scheduled for March 20, 2023. Voting will be open for 5 days, providing ample time for discussions. Governors will be allowed to change their vote concerning the discussions.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News