One of the leading cryptocurrency exchanges, Coinbase, is investigating elevated error rates across its app and website. Customers may face difficulties trading or selecting certain assets for withdrawals during this time. However, they have been assured that their funds are safe and that the company is working to fix the problem.

We're currently investigating elevated error rates across https://t.co/ohqDivlp6Y (web and mobile). Customers may have trouble trading or selecting assets to withdraw. Rest assured funds are safe and we're working to fix ASAP. We'll update you here shortly.

— Coinbase Support (@CoinbaseSupport) March 16, 2023

Coinbase Resolved the Issue

In another Tweet, Coinbase (COIN) said their efforts to improve the situation are working. However, still, some customers might face difficulties and see error screens.

We appreciate your patience as we identify the issue and implement a fix. We’re beginning to see improvement, but some customers may still see error screens. https://t.co/nB5qCcYVSk

— Coinbase Support (@CoinbaseSupport) March 16, 2023

At around 5:47 p.m. ET, Coinbase fired another Tweet alerting consumers that the problem had been resolved and that they should no longer face any troubles regarding degraded performance while trading on Coinbase(dot)com.

This issue is now resolved and customers should no longer experience degraded performance while trading on https://t.co/ohqDivlp6Y. https://t.co/XdHsiVpU60

— Coinbase Support (@CoinbaseSupport) March 16, 2023

The issue came to light just a few days before Coinbase said their users were facing recurring issues while logging into their accounts.

What Effect Did this Have on Coinbase (COIN) Share Prices?

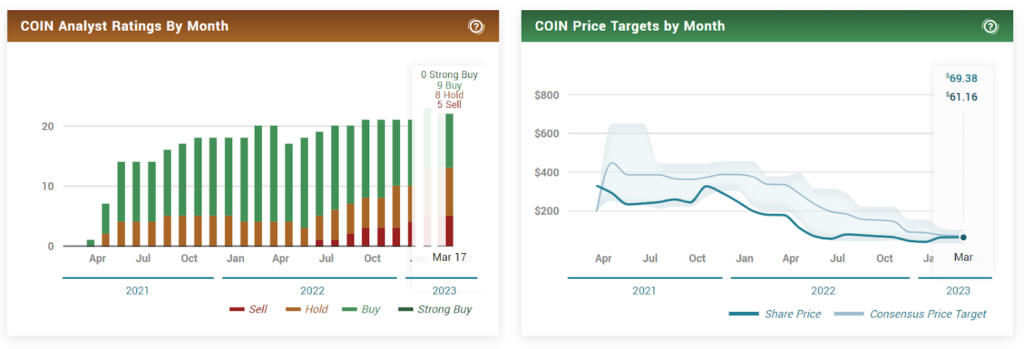

When writing, COIN was trading at $67.78 with a gain of 5.13%; previous close and open were at $64.47 and $64.40, respectively. Market Cap remains strong at $17.752 billion; at the same time, the volume was 15.45 million shares, and the average volume was 20.43 million. Analysts have targeted the price at around $69.38, with an upside of 2.4%.

Short interest seems bearish, with 22.65% float sold short and a 2.17 rating for HOLD. As per December 2022 data, the revenue of $604.95 million dropped by 75.78%. Operating expenses increased by 4.34% to $1.08 billion, and the operating margin dropped by 65.21%. Net income dropped by a whopping 166.29% to negative $557.0 million, and the net profit margin dramatically dropped by 373.69% to negative $92.07.

Earnings per share (EPS) was negative $2.66 after a massive correction of 179.39%. Profit margin shrunk by 83.55%, and Return on assets suffered by 2.31%. In comparison, the return on equity was corrected by 44.35%. The revenue per share was $14.17, and the quarterly revenue growth dropped by 75.08%.

Coinbase (COIN) – What Does the Chart Say

A short-term trendline indicates a slow but upward trend; the moving average is also going up, gradually, again indicating a positive movement ahead. But as both these indications are not clear or definite, nothing can be said for sure.

Support 1 acts is strong; a movement that could push the price below it is a rare possibility. The $73.51 mark can act as immediate resistance, and the price could consolidate between S1 and the point. However, if it crosses that mark, it could move to R1 and cross R2.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News