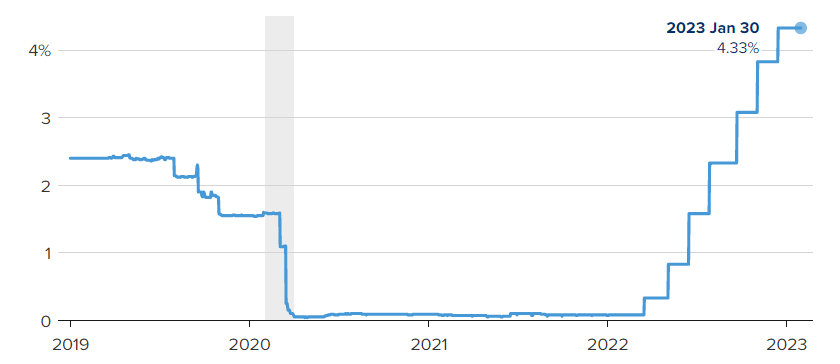

- The Federal Reserve raised the rates 8X since last year.

- The global crypto market plunged several points ahead of the hike.

The U.S. Federal Reserve will raise the interest rates in the upcoming policy meeting again. Ahead of the announcements of an actual rise in the rates, the financial markets, especially the crypto market, were found in a bit of discomfort. A majority of cryptocurrencies were seen retreating, while only some of them managed to hold their position till now. The equity markets, on the other hand, are also in relatively better condition after the bloodshed going on in the banking sector for a couple of weeks.

Interest Rate Jumped from 0.8% to 4.33%

With the upcoming supposed rate rise, the United States central bank is about to complete one year of interest rate hike streak. The Fed is expected to raise the bar by another 25 basis points or 0.25%. Until last year, the rates were around 0.8% which started shooting significantly and reached up to 4.33% in January 2023. The upcoming hike will be eighth in this order and will likely bring the rates beyond 4.5%.

The Fed started increasing the rates in March last year to curb the wildly surging inflation. Until the rates hike, the inflation hit a 40-year high, which later came to control. Though the decision to tighten the monetary policy helped the one economic situation, its efficacies started tension in the other sectors—the recent chaos in the banking sector, for instance.

Following the Fed’s action, many industries were likely to hit with an impact, which the traditional and burgeoning decentralized finance asset class shared.

Fed Interest Rate Hike Impact Financial Systems

The impact on banking industries was long-term. Several prominent banks within the U.S. collapsed in recent weeks and are suspected of falling prey to the monetary policy tightening, along with other factors. Silvergate, Signature, and Silicon Valley Bank were voluntarily shut down or taken down by regulatory authorities. Other prominent names like First Republic Bank and Credit Suisse were reportedly struggling.

However, the recent relieving measure by the financial authorities to give out liquidity in the market gave some relaxation to the sector. In addition, other necessary measures were also promised to improve the situation with the global banking system.

The broader crypto market started witnessing the direct impact of interest rates increasing soon after its first installment. In addition to other factors like the Russia-Ukraine war and the failure of crypto projects and firms, the incident ignited the recent crypto winter.

In contrast to the banking sector’s recent trembles, the cryptocurrency market was in a relatively better phase, mainly trading in green. Prices of Bitcoin (BTC) and Ethereum (ETH), like major cryptocurrencies, continued to grow and hit 28,000 USD and 1,800 USD marks, respectively. The global crypto market also sustained well above 1 trillion.

But the news of interest rate hikes came to slow the forward-moving pace of cryptocurrencies. The majority of cryptocurrencies were trading below their prices 24 hours before.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News