- Cleveland-Cliffs recently raised the base price for their steel product, causing a sharp drop in the stock price.

- They are the biggest automotive steel supplier in North America.

Cleveland-Cliffs, the largest steel supplier to the automotive industry in North America, recently increased steel prices, causing shares to decline. On March 13, 2023, the company announced that they are increasing current spot market base prices for all of the carbon hot and cold rolled, along with coated steel products, by a minimum of $100 per net ton. The current price is $1,200 per net ton. This caused a considerable drop in share prices.

Cleveland-Cliffs (CLF stock) – The Number Game

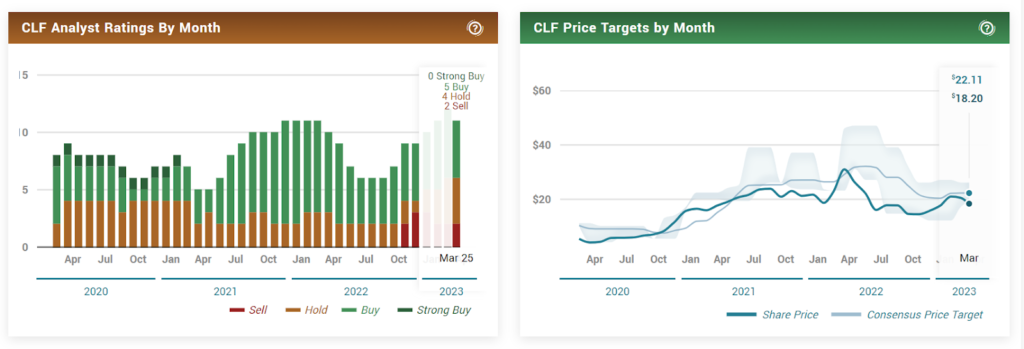

When writing, CLF stock was trading at $17.43 with a drop of 1.25%; previous close and open were at $17.65 and $17.20, respectively. In comparison, the fifty-two-week range dropped by 47.29%. It has a market cap of $8.973 billion, with a volume of 9.70 million shares and the average volume of 10.56 million. The price target was $22.11 with an upside of 26.8%.

Analyst trading for hold is 2.46, and the short interest is healthy, with 6.61% of shares sold short. Concerning December 2022 data, Cleaveland-Cliffs’ revenue dropped by 5.65% from $5.04 billion, and revenue per share was $44.29. The operating expenses were hiked by 52.78% from $55.00 million, and the operating margin was 9.50%. Net income suffered by 123.96% from negative $214.00 million; the net profit margin dropped by 125.39% from negative $4.24.

EBITDA dropped by 91.09% from $131.00 million, and Earnings Per Share (EPS) suffered by 124.27% from negative $0.43. Return on assets and equity were 7.24% and 19.88%, respectively. The last earnings were reported on February 13, 2023, where estimated revenue was $5.202 billion, while it was reported to be $5.044 billion, with a surprise of negative $157.932 million and a drop of 3.04%.

Concerns with the next earnings

Cleaveland-Cliffs’ next earnings will come out on April 21, 2023, with estimated revenue of $5.202 billion. Reports suggest post earnings of negative $0.21 per share, making a 112.28% year-over-year (yoy) decline. In the meantime, the Zacks Consensus Estimate for their revenue is a projection of net sales worth $5.09 billion, down by 14.58% from the same period last year.

At the same time, the CLF’s full-year Zacks Consensus Estimates are hoping for earnings of $1.82 per share, a drop of 40.33%, while the revenue is supposed to be $20.53 billion with a drop of 10.7%.

Cleveland-Cliffs (CLF) – Candle Exploration

Despite lackluster earnings, CLF stock still gained some traction, but the decision to rise base prices was noticeably bad for the share price. There is a steep downward-sloping trend line indicating a bearish trend. However, it might be a good sign if it successfully crosses the trend line.

For a while, the price is expected to consolidate between immediate resistance (I_R1) at $19.45 and immediate support (I_S1) at $15.92. If it goes above I_R1, it might go toward the supply zone; if it drops below I_S1, it might go toward the demand zone. However, the lower limit of the zone serves as a strong support, so the possibilities of going down further are slim.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News