- 1 Fabio Araujo, initiative coordinator claims Real Digital.

- 2 CBDC will work as PIX (SPB) for financial services.

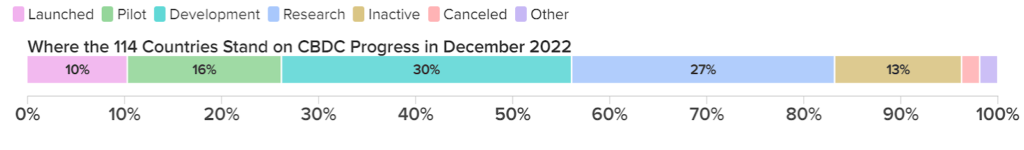

- 3 11 countries have reached the end of the CBDC track while 114 are still on it.

Banco Central do Brasil; The Central Bank of Brazil (BCB) has kept an open platform for the firms of the crypto market. The pilot program of Central Bank Digital Currency (CBDC) is a trial of the establishment of the CBDC-crypto hemisphere. The centre of the initiation will be for the bulk transactions and is anticipated to be on its full run. Nigeria’s eNaira was launched as a catalyst in the space of CBDCs to widespread interest. Bahamas was the first to launch CBDC worldwide named as ‘Sand Dollar’.

Naming Brazil’s CBDC; ‘Digital Real’ the expanding approach relates to the reachability of financial services. This has attracted the focus of the Central Banking community. The chances are apt for it to get to the roots. It will be for public use till the end of 2024. All over the world, there are 40 countries that are down the path of CBDC.

Firms Shooting Up for CBDC Registrations

The initiative coordinator, Fabio Arajuo claims to move towards the betterment of the Brazilian payment system. Looking back at the till now payment system in Brazil. Seeing the records in Brazil, the instant payment used PIX whose creation and management all rests in the hands of BCB.

The Brazilian Payment System(SPB) consists of the entities, plans and strategies that will be the piece of cake here. SPB for wholesale payments are the play of the use of sorting the bank and financial markets. On the other hand the retail payment system here rests in the hands of BCB. The overall well being is from the soundness, efficiency and innovation within to the outside lastings, say competition in the market.

The official website of BCB clearly defines the Payment system and components of the SPB. The regulations and operations of these payments are managed by Central Counterpart (CCP). The gist of it lies:

- Hardcore Adequacy: In the acceptability of extra in-parts to sublime both the end parties involved in financial subjections (Credit risk).

- Liquidity Adequacy: So as to maintain it the liquidity risks and obligation need on time levelling of liabilities of both the end users involved, in case of high standard financial obligations, indeed.

Araujo projected this CBDC as a non-replacement for the initial payment system of Brazil. It won’t bifurcate the native fiat currency or already undertaken digital payment system . It’s just an option towards simplification. Inclining to his narratives it seems to slaughter the hurdles that could resist the grounds of payments and could ease out the execution of payment phenomenon.

Noted that, the inception of CBDCs with this approach would not sponsor complications to the older payment system. The fiat currencies will be acceptable in the eyes of banks, also an option of CBDC will be taken into consideration.

CBDCs have covered a long line of track in financial payment systems. Other than Brazil, there are countries like Australia, China, Nigeria and more involved here.

Stats of Atlantic Council elaborate the still exploring and establishing CBDC counts within the countries. It stands 114 covering 95% in Global GDP and 11 in establishment cadres. China’s pilot population exceeds 260 million natives considering 2023. Including 20 countries in 2023 will be piloting for CBDC programs.

The Central Bank of the United Arab Emirates (CBUAE), Oct 2022 vocalizes about it completing world’s largest pilot of CBDC transactions accompanied by the People’s Bank of China’s Digital Currency Institute.

However, a fully fledged regime is the elementary motive and premise to make a firm and secure financial payment system.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News