- 1 The Ordinal craze has pushed Bitcoin transaction costs to multi-year highs.

- 2 The increase in Ordinal activity in Dogecoin and Litecoin caused a decrease in activity in the Blockchain network.

- 3 One more surge of Ordinals is possible before the Bitcoin halving season.

Ordinals created a huge hype in the crypto market ever since they’ve been introduced. They were first launched in the Bitcoin ecosystem and offer similar qualities to NFTs. Although the hype around individual satoshi (smallest unit of bitcoin) has begun to die as users evaluate the actual value that Ordinals offer.

Higher Transaction Fees in the Bitcoin Chain

Introductions of Ordinals to the Bitcoin chain have brought back a few nightmares for Bitcoin users. Ever since Ordinals’ introduction, users have faced low scalability. One of the major reasons for that is the Ordinals and BRC-20-related transaction spike, high transaction cost, and clogging in the Bitcoin network.

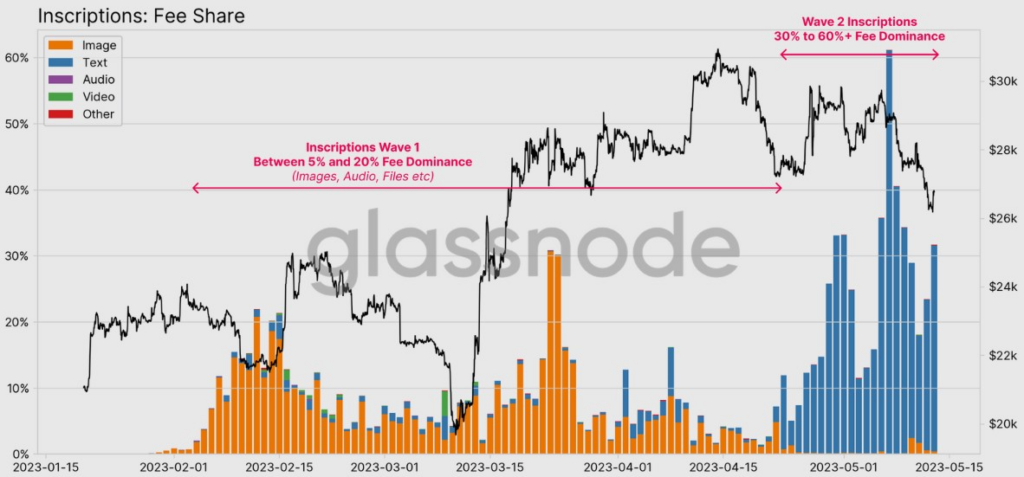

The above chart by Glassnode shows the extraordinarily high fees for Ordinals inscribed on the Bitcoin chain. According to the data, for any kind of data inscribed on the Bitcoin blockchain directly, the fee was 62%.

Glassnode revealed one more data which indicated that during the peak of inscription activity, the amount of the fees paid per day by users was $17.8 million. The surge in the BTC fees for the first time after several years created a bit of friction in the Bitcoin community.

Glassnode further added that due to the Ordinal frenzy, the cost of sending a normal Bitcoin also became extremely high. The avg fees required to get a transaction included in the block hit reached between $20.17 to $30.80.

The community has recently felt relieved as the Bitcoin charges have reduced to 26% which is considerably still high but manageable than before.

Introduction of Ordinals in Dogecoin and Litecoin

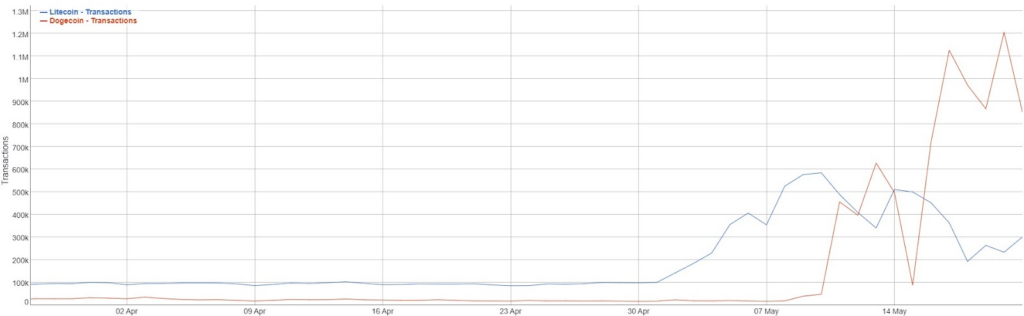

One of the major reasons why Ordinals and BRC-20 are dying on the Bitcoin network is because of Ordinals’ introduction to Dogecoin and Litecoin. Ever since the Ordinals’ introduction in April in both networks, the transaction counts have spiked in both chains.

Due to this rise in the Ordinal craze on Litecoin and Dogecoin, both have hit their highest-ever daily transaction recently. Litecoin recorded 584,000 transactions on May 10, whereas, Dogecoin set a transaction volume record of 1.2 million in 24 hours on May 18.

The launch of LRC-20 AND DRC-20 has allowed and given access to any user to create new meme coins on the network but it has come with a cost. The access has also resulted in a diluted field of offerings which in return has caused a loss of value on the newly launched protocols and products.

With the halving season coming ahead and especially Bitcoin halving, traders are expecting the next bull run. Before the start of the next bull market, there’s a good chance that we can see Ordinals surging across Litecoin, Bitcoin, and Dogecoin networks for one last time.

With rumors running around of a possible airdrop that can be beneficial for Ordinal users, the transaction cost and activities are likely to surge once more in the Bitcoin network.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News