- 1 Amazon’s stock price is up by around 42% YTD.

- 2 The recent surge in AI stocks helped create a buzz, assisting Amazon’s rally.

Amazon Inc. (AMZN Stock) soared 4.44% on May 26, trying to grab the AI rally. Can the company continue its stride? AMZN’s share price grew by 41.28% year to date (YTD). Recently the rise in the AI industry has been mirrored on Wall Street. Microsoft increased ChatGPT investment by 39%, and Alphabet and Amazon.com added over 35%.

Amazon Inc. (AMZN Stock) – Analysis of its Hike Through AI & Finances

Amazon Web Services (AWS) is working extensively with Artificial Intelligence (AI) & Machine Learning (ML). Through Amazon Connect, AWS offers exposure to AI for its users. Hence the development in the industry affects the AMZN share price.

At press time, AMZN stock is trading at $120.11, with a 4.44% hike in the last 24 hours. Previous close and open were at $115.00 and 116.04, respectively. The 52-week change is a slight drop of 0.08%, meaning the price action will soon cross the yearly high.

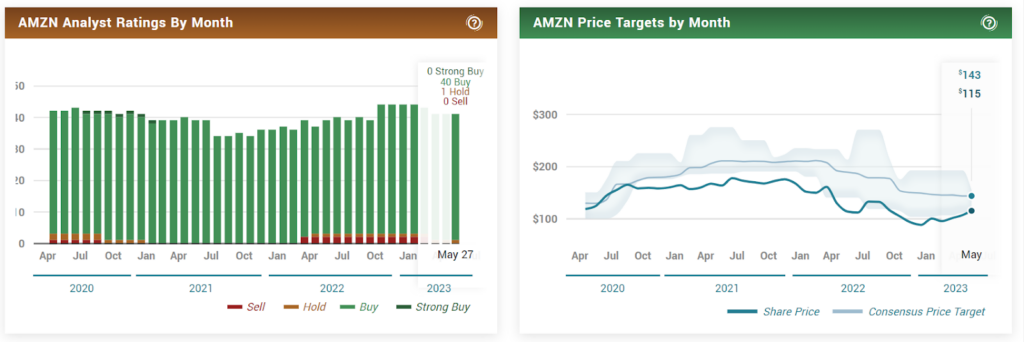

With an average volume of 66.90 Million shares, the market cap stays strong at $1.232 trillion. The earnings are projected to grow by 50.96%, from $1.57 to $2.37 per share. Analysts have given a 2.95 rating for moderate buy, placing the price target at $143.12 with a 19.2% upside.

Concerning March 2023, data revenue jumped by 9.37% to $127.36 billion, while the trailing twelve-month (ttm) revenue is reported to be $524.9 billion. Also, revenue per share is $51.42, and the quarterly revenue growth is 9.40%. Similarly, operating expenses gained 18.50% to $54.61 billion, and net income gained 182.50% to $3.17 billion.

Returns on Assets gained 1.91% while on Equity returns were up by 2.98%. The net profit margin has increased by 175.45% to 2.49, while gross profit remained at $225.15 billion. Basic EPS is $0.42, and EBITDA is $57.19 billion. The total cash in hand is $64.41 billion, and the debt on Amazon is $178.55 billion.

The last earnings were reported on April 27, 2023, with a reported revenue of $127.358 billion. However, it was estimated to be $124.603 billion, with a surprise of $2.755 billion and a hike of 2.21%. The subsequent earnings are scheduled on July 27, 2023, with estimated revenue of $131.091 billion.

Washington Trust Advisor Inc. shed its holdings in Amazon by 5.5% in Q4 2022. The institutional investor now owns 14,148 shares; the last number was 241,025. Bridgefront Capital LLC bought new stakes in Q1 2023 worth $228,000. Krane Funds Advisors LLC increased its position by 239.1%, and Range Financial Group LLC raised its stake by $258,000. My Personal CFO LLC also acquired new stakes worth $261,000, while Worth Asset Management LLC purchased AMZN shares worth $191,000.

Amazon.com Inc. (NASDAQ: AMZN) – Candle Exploration

AMZN’s share price is above the breakout level of $110.16, and it can be assumed to maintain its upward trajectory. Although breaking into a supply zone would be tedious, the price could retrace and bounce off the level at least once. Signs are positive as long as the stock price is above the level.

If due to some reason, the price falls below the $110 level, it could enter the demand zone. If so, another rally would be dependent on certain variables.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News